Region:Asia

Author(s):Geetanshi

Product Code:KRAE0627

Pages:86

Published On:December 2025

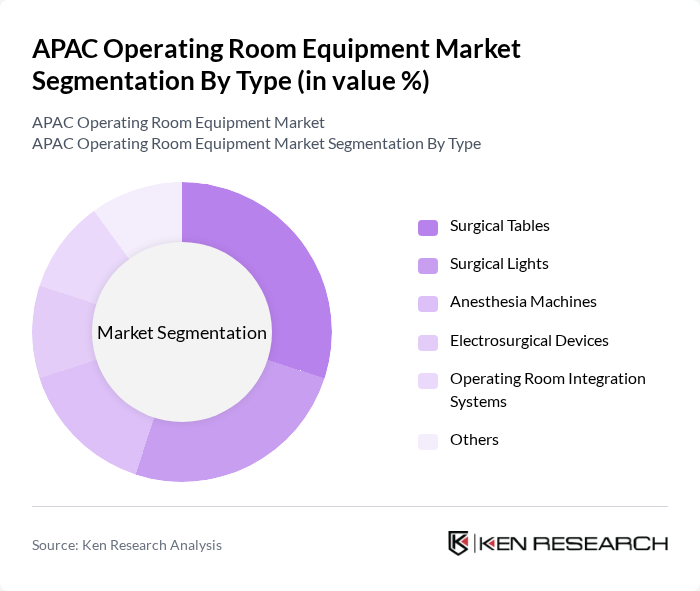

By Type:The market is segmented into various types of operating room equipment, including surgical tables, surgical lights, anesthesia machines, electrosurgical devices, operating room integration systems, and others. Among these, surgical tables and surgical lights are the most prominent due to their essential roles in facilitating surgical procedures. The demand for advanced surgical tables that offer enhanced functionality and ergonomics is particularly high, driven by the increasing complexity of surgeries and the need for improved patient positioning.

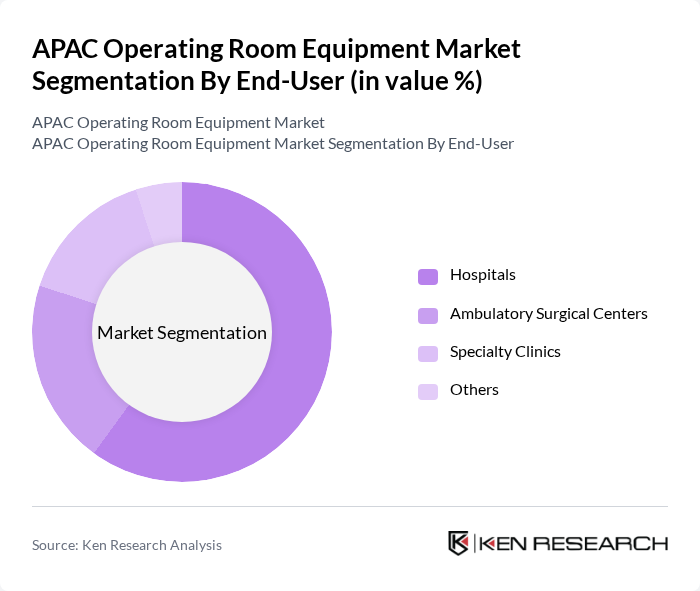

By End-User:The end-user segment includes hospitals, ambulatory surgical centers, specialty clinics, and others. Hospitals dominate this segment due to their comprehensive surgical services and higher patient volumes. The increasing number of surgical procedures performed in hospitals, coupled with the growing trend of outpatient surgeries, is driving the demand for advanced operating room equipment in these facilities.

The APAC Operating Room Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE Healthcare, Philips Healthcare, Stryker Corporation, Medtronic, Johnson & Johnson, Hill-Rom Holdings, Getinge Group, Canon Medical Systems, Fujifilm Holdings Corporation, Olympus Corporation, B. Braun Melsungen AG, Karl Storz SE & Co. KG, Terumo Corporation, Mindray Medical International Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC operating room equipment market is poised for transformative growth, driven by the increasing integration of digital technologies and a focus on patient-centered care. As healthcare providers prioritize safety and efficiency, the adoption of AI and machine learning in surgical procedures is expected to rise. Additionally, the trend towards minimally invasive surgeries will further propel demand for advanced equipment, ensuring that hospitals remain competitive and capable of delivering high-quality surgical outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Surgical Tables Surgical Lights Anesthesia Machines Electrosurgical Devices Operating Room Integration Systems Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Others |

| By Region | North India South India East India West India |

| By Application | General Surgery Orthopedic Surgery Cardiothoracic Surgery Neurosurgery Others |

| By Equipment Class | High-End Equipment Mid-Range Equipment Budget Equipment Others |

| By Technology | Digital Operating Room Technologies Traditional Operating Room Technologies Hybrid Operating Room Technologies Others |

| By Procurement Method | Direct Purchase Leasing Government Tenders Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Surgery Equipment | 150 | Surgeons, Operating Room Managers |

| Orthopedic Surgical Tools | 100 | Orthopedic Surgeons, Procurement Officers |

| Cardiovascular Equipment | 80 | Cardiologists, Medical Device Buyers |

| Minimally Invasive Surgery Tools | 70 | Surgeons, Surgical Technologists |

| Anesthesia Equipment | 90 | Anesthesiologists, Hospital Equipment Managers |

The APAC Operating Room Equipment Market is valued at approximately USD 0.5 billion, driven by increasing surgical procedure volumes, healthcare infrastructure development, and advancements in surgical technologies that enhance patient outcomes.