Region:Middle East

Author(s):Shubham

Product Code:KRAA8735

Pages:93

Published On:November 2025

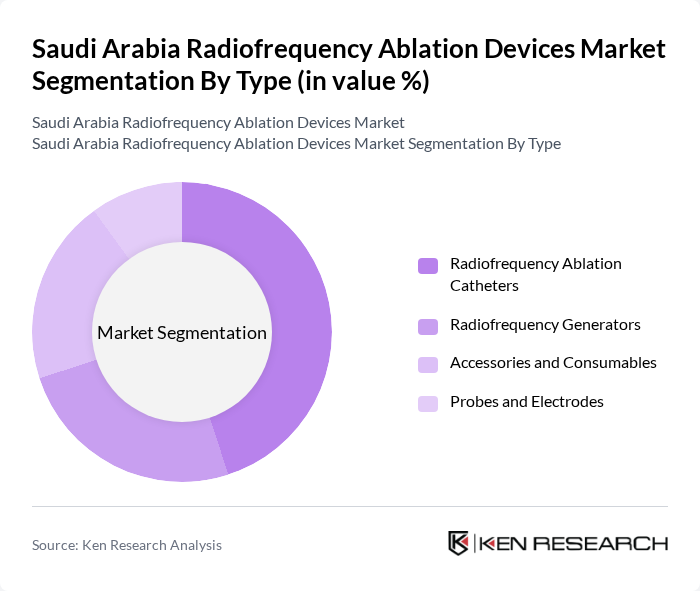

By Type:The market is segmented into Radiofrequency Ablation Catheters, Radiofrequency Generators, Accessories and Consumables, and Probes and Electrodes. Among these, Radiofrequency Ablation Catheters hold the largest share due to their essential role in procedures for cardiology and pain management. The increasing adoption in hospitals and surgical centers is driven by their proven effectiveness, reduced complication rates, and the expanding trend toward minimally invasive surgeries .

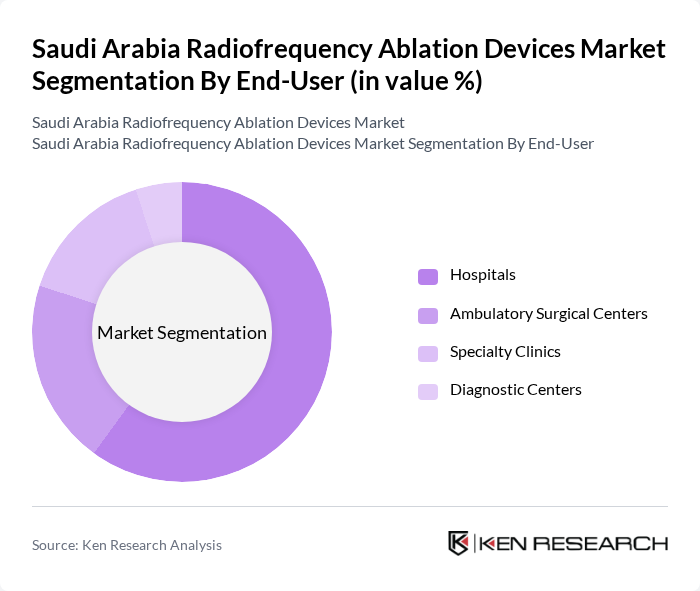

By End-User:The end-user segmentation includes Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Diagnostic Centers. Hospitals are the dominant end-user segment, accounting for the majority share of the market. This is attributed to the high volume of procedures performed, access to advanced medical technologies, and the increasing number of patients seeking treatment for chronic conditions. Ambulatory Surgical Centers and Specialty Clinics are also witnessing growth due to the rising demand for outpatient and pain management procedures .

The Saudi Arabia Radiofrequency Ablation Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Boston Scientific Corporation, Johnson & Johnson (Biosense Webster), Abbott Laboratories, Stryker Corporation, B. Braun Melsungen AG, AngioDynamics, Inc., CONMED Corporation, Merit Medical Systems, Inc., Avanos Medical, Inc., Koninklijke Philips N.V. (Philips Healthcare), Siemens Healthineers AG, GE HealthCare Technologies Inc., Terumo Corporation, Cook Medical LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the radiofrequency ablation devices market in Saudi Arabia appears promising, driven by technological advancements and an increasing focus on patient-centric care. The integration of artificial intelligence in treatment planning is expected to enhance procedural accuracy and outcomes. Additionally, the expansion of healthcare infrastructure, particularly in underserved regions, will likely facilitate greater access to these devices, fostering market growth and improving healthcare delivery across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Radiofrequency Ablation Catheters Radiofrequency Generators Accessories and Consumables Probes and Electrodes |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Diagnostic Centers |

| By Application | Pain Management Cardiology (e.g., Atrial Fibrillation, Arrhythmia) Oncology (e.g., Liver, Kidney, Lung Tumors) Orthopedics and Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Thermal Ablation Pulsed Field Ablation Microwave Ablation Cryoablation |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiology Departments | 60 | Cardiologists, Interventional Radiologists |

| Oncology Clinics | 50 | Oncologists, Medical Directors |

| Pain Management Centers | 40 | Pain Specialists, Anesthesiologists |

| Medical Device Distributors | 40 | Sales Managers, Product Specialists |

| Healthcare Policy Makers | 40 | Health Economists, Regulatory Affairs Managers |

The Saudi Arabia Radiofrequency Ablation Devices Market is valued at approximately USD 90 million, reflecting a significant growth driven by the rising prevalence of chronic diseases and advancements in medical technology.