Region:Middle East

Author(s):Dev

Product Code:KRAA9682

Pages:92

Published On:November 2025

Composites Market.png)

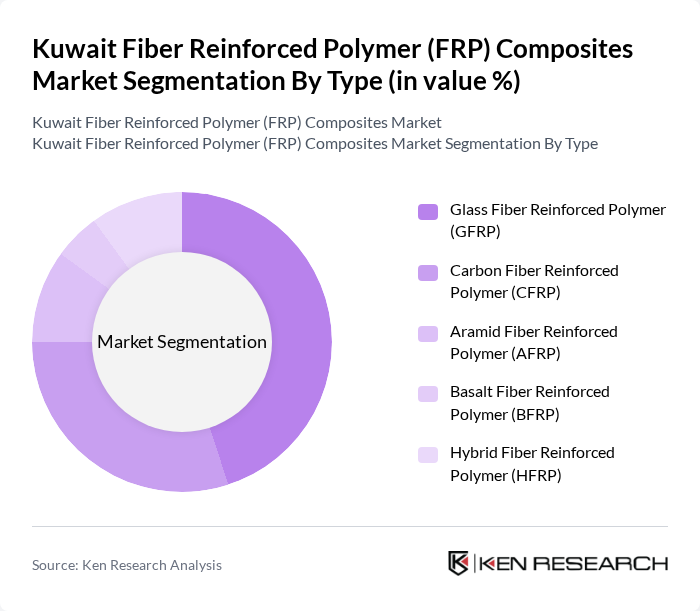

By Type:The market is segmented into various types of fiber reinforced polymers, including Glass Fiber Reinforced Polymer (GFRP), Carbon Fiber Reinforced Polymer (CFRP), Aramid Fiber Reinforced Polymer (AFRP), Basalt Fiber Reinforced Polymer (BFRP), and Hybrid Fiber Reinforced Polymer (HFRP). Among these, GFRP is the most widely used due to its cost-effectiveness, mechanical versatility, and suitability for a broad range of construction and industrial applications. CFRP is gaining traction in high-performance and specialized sectors, such as aerospace and advanced infrastructure, while AFRP and BFRP are emerging for their unique strength and chemical resistance properties. The demand for hybrid solutions is also increasing as industries seek to combine the advantages of multiple fiber types for optimized performance .

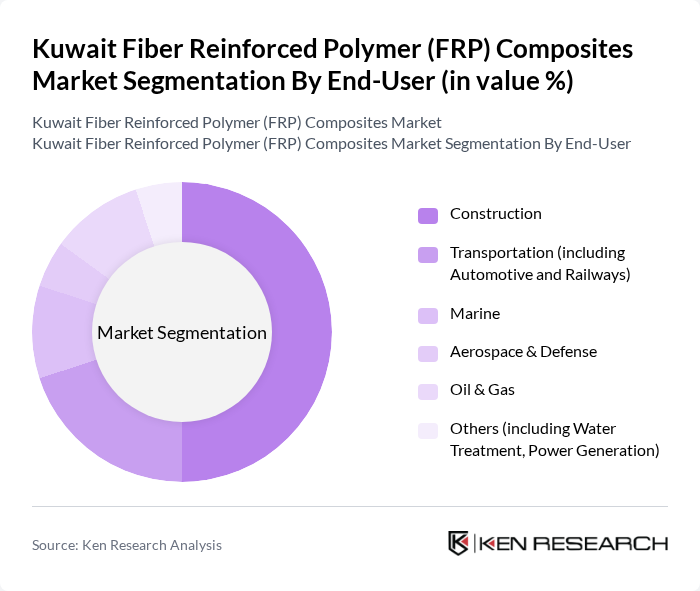

By End-User:The end-user segments include Construction, Transportation (including Automotive and Railways), Marine, Aerospace & Defense, Oil & Gas, and Others (including Water Treatment and Power Generation). The construction sector is the largest consumer of FRP composites, driven by the need for lightweight, corrosion-resistant, and durable materials in buildings, bridges, and civil infrastructure. The transportation sector is also significant, with growing applications in automotive and rail systems for vehicle lightweighting and improved fuel efficiency. The oil and gas industry is adopting FRP for its superior resistance to chemicals and harsh environments, while aerospace and defense sectors leverage FRP’s high strength-to-weight ratio for critical components. Demand from marine, water treatment, and power generation is also rising due to the material’s longevity and low maintenance requirements .

The Kuwait Fiber Reinforced Polymer (FRP) Composites Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Fiber Reinforced Plastics Co., Gulf Composite Materials Co., Alghanim Industries, KCC Engineering & Contracting Company, Al-Futtaim Engineering (Kuwait Branch), National Industries Group (NIG), Al-Mansoori Specialized Engineering, Kuwait Cement Company (KCC), Al-Bahar Group, Al-Khaldiya Group, Al-Mazaya Holding Company, Al-Qatami Global for General Trading & Contracting Co., Al-Sayer Group Holding, Al-Muhalab Group, Al-Mansour Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the FRP composites market in Kuwait appears promising, driven by increasing investments in infrastructure and a growing emphasis on sustainable construction practices. As the government continues to promote the use of innovative materials, the adoption of FRP composites is expected to rise. Additionally, advancements in manufacturing technologies will likely enhance the performance and reduce the costs of these materials, making them more accessible to a broader range of applications across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Glass Fiber Reinforced Polymer (GFRP) Carbon Fiber Reinforced Polymer (CFRP) Aramid Fiber Reinforced Polymer (AFRP) Basalt Fiber Reinforced Polymer (BFRP) Hybrid Fiber Reinforced Polymer (HFRP) |

| By End-User | Construction Transportation (including Automotive and Railways) Marine Aerospace & Defense Oil & Gas Others (including Water Treatment, Power Generation) |

| By Application | Structural Components (e.g., beams, columns, bridges) Non-Structural Components (e.g., panels, facades) Electrical Insulation Chemical Storage & Piping Protective Components Others |

| By Manufacturing Process | Hand Lay-Up Resin Transfer Molding (RTM) Pultrusion Filament Winding Compression Molding Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Others |

| By Market Channel | Direct Sales Distributors Online Sales Others |

| By Product Form | Sheets Rods Tubes Pipes Rebars Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Utilization of FRP | 100 | Project Managers, Structural Engineers |

| Automotive Applications of FRP Composites | 70 | Product Development Engineers, Procurement Managers |

| Marine Industry Adoption of FRP | 50 | Marine Engineers, Operations Managers |

| Infrastructure Projects Using FRP | 60 | Urban Planners, Civil Engineers |

| Research Institutions Focused on FRP Technology | 40 | Research Scientists, Academic Professors |

The Kuwait Fiber Reinforced Polymer (FRP) Composites Market is valued at approximately USD 160 million, reflecting a five-year historical analysis that highlights the increasing demand for lightweight and durable materials across various sectors, including construction and transportation.