Region:Middle East

Author(s):Rebecca

Product Code:KRAE0876

Pages:81

Published On:December 2025

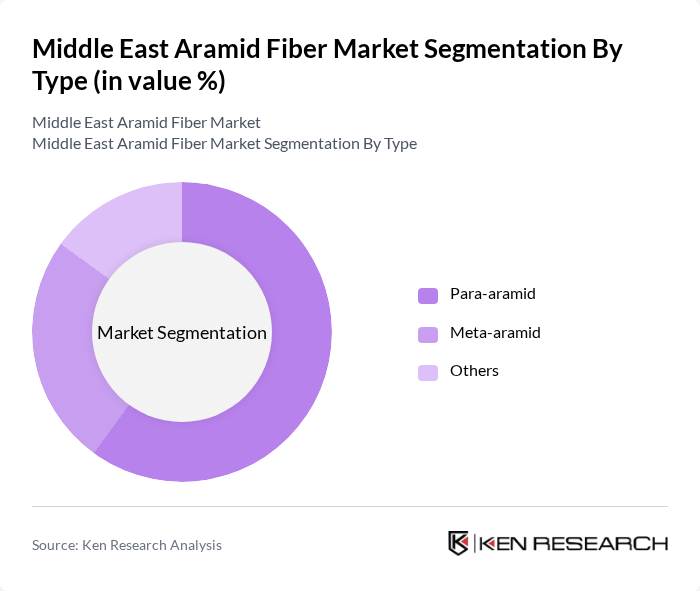

By Type:The aramid fiber market is segmented into three main types: Para-aramid, Meta-aramid, and Others. Para-aramid fibers dominate the market due to their superior strength and thermal stability, making them ideal for applications in aerospace and defense. Meta-aramid fibers, while also important, are primarily used in applications requiring heat resistance, such as electrical insulation. The "Others" category includes specialty fibers that cater to niche markets.

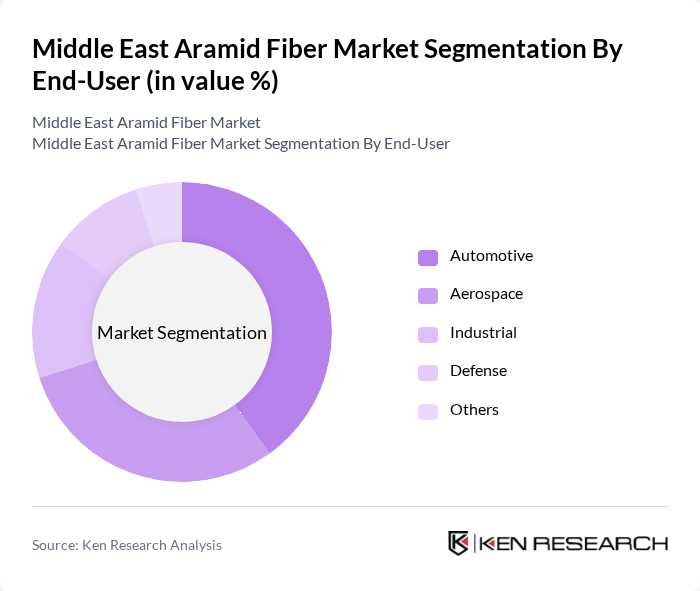

By End-User:The end-user segmentation includes Automotive, Aerospace, Industrial, Defense, and Others. The automotive sector is the largest consumer of aramid fibers, driven by the need for lightweight materials that enhance fuel efficiency. The aerospace and defense sectors also significantly contribute to demand due to stringent safety and performance requirements. Industrial applications are growing, particularly in protective clothing and equipment.

The Middle East Aramid Fiber Market is characterized by a dynamic mix of regional and international players. Leading participants such as DuPont, Teijin Limited, Kermel, Hyosung Corporation, Solvay, Toray Industries, SGL Carbon, Mitsubishi Chemical Corporation, Aramid HPM, Jiangsu Daguangming, Yantai Tayho Advanced Materials, Hubei Huitian New Material, Zhaofeng New Material, Kordsa Teknik Tekstil, Teijin Aramid contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East aramid fiber market appears promising, driven by technological advancements and increasing demand across various sectors. As industries prioritize sustainability, the shift towards eco-friendly materials will likely accelerate the adoption of aramid fibers. Additionally, the ongoing expansion of infrastructure projects will create new opportunities for aramid applications, particularly in construction and automotive sectors, fostering innovation and collaboration among manufacturers and end-users to meet evolving market needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Para-aramid Meta-aramid Others |

| By End-User | Automotive Aerospace Industrial Defense Others |

| By Application | Protective Clothing Composites Electrical Insulation Reinforcement Materials Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Manufacturing Process | Spinning Weaving Coating Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 100 | Product Engineers, Procurement Managers |

| Aerospace Sector Usage | 80 | Design Engineers, Quality Assurance Managers |

| Personal Protective Equipment | 90 | Safety Officers, Compliance Managers |

| Construction and Infrastructure | 70 | Project Managers, Material Specialists |

| Textile and Fashion Industry | 60 | Fashion Designers, Product Development Managers |

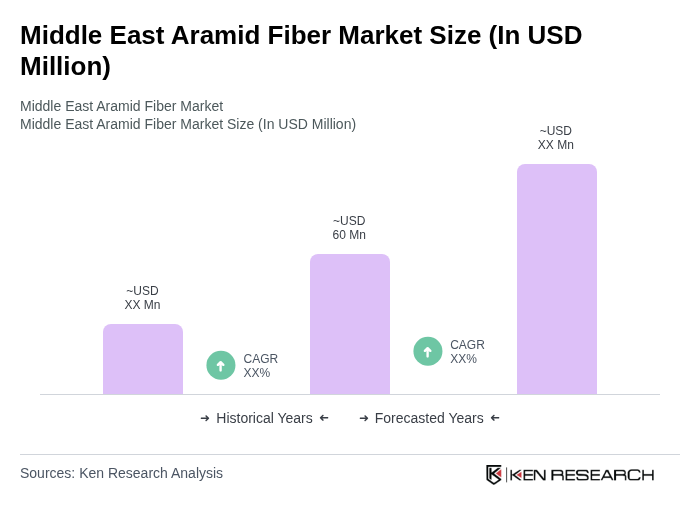

The Middle East Aramid Fiber Market is currently valued at approximately USD 60 million. This valuation reflects the growing demand for lightweight, high-strength materials across various sectors, including aerospace, automotive, and defense.