Region:Africa

Author(s):Geetanshi

Product Code:KRAA1283

Pages:92

Published On:August 2025

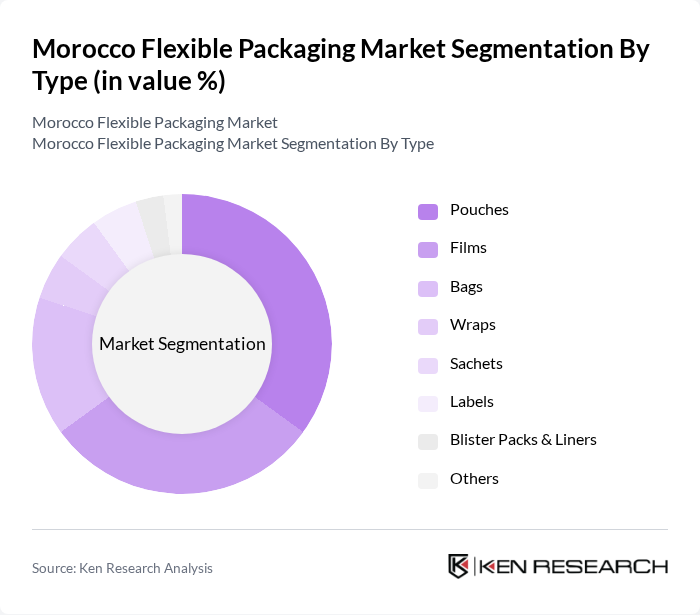

By Type:The flexible packaging market can be segmented into various types, including pouches, films, bags, wraps, sachets, labels, blister packs & liners, and others. Among these, pouches and films are the most widely used due to their versatility and ability to preserve product freshness. The demand for pouches has surged, particularly in the food and beverage sector, as they offer convenience and ease of use.

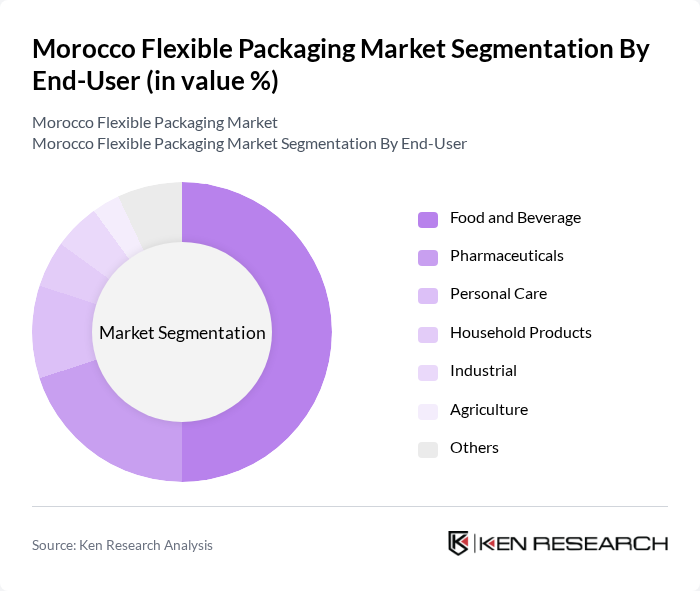

By End-User:The end-user segmentation includes food and beverage, pharmaceuticals, personal care, household products, industrial, agriculture, and others. The food and beverage sector is the largest consumer of flexible packaging, driven by the growing demand for ready-to-eat meals and snacks. This trend is further supported by the increasing health consciousness among consumers, leading to a preference for packaged and portion-controlled products.

The Morocco Flexible Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Huhtamaki Oyj, Mondi Group, Constantia Flexibles, Smurfit Kappa Group, Berry Global, Inc., Sonoco Products Company, Winpak Ltd., Hotpack Packaging Industries LLC, Afrimag Glue, Unibag Maghreb, Compagnie Industrielle Des Fibres, Mondi Pap Sac Maghreb SA, Alpla Werke Alwin Lehner GmbH & Co KG, and Coveris Holdings S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Moroccan flexible packaging market appears promising, driven by increasing consumer awareness of sustainability and the need for innovative packaging solutions. As the food and beverage sector continues to expand, manufacturers are likely to invest in advanced technologies to enhance product offerings. Additionally, the growing e-commerce sector will further stimulate demand for customized packaging solutions, creating opportunities for businesses to differentiate themselves in a competitive landscape while adhering to environmental standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Pouches Films Bags Wraps Sachets Labels Blister Packs & Liners Others |

| By End-User | Food and Beverage Pharmaceuticals Personal Care Household Products Industrial Agriculture Others |

| By Material | Plastic (PE, BOPP, CPP, PVC, EVOH, etc.) Paper Aluminum Foil Composites Others |

| By Application | Food Packaging Beverage Packaging Medical & Pharmaceutical Packaging Retail Packaging Industrial Packaging Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Supermarkets/Hypermarkets Others |

| By Price Range | Economy Mid-Range Premium |

| By Sustainability Level | Conventional Packaging Recyclable Packaging Biodegradable Packaging Compostable Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Packaging Sector | 120 | Packaging Managers, Product Development Heads |

| Pharmaceutical Packaging | 60 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Consumer Goods Packaging | 80 | Brand Managers, Supply Chain Coordinators |

| Industrial Packaging Solutions | 50 | Operations Managers, Procurement Specialists |

| Sustainability Initiatives in Packaging | 40 | Sustainability Officers, Environmental Compliance Managers |

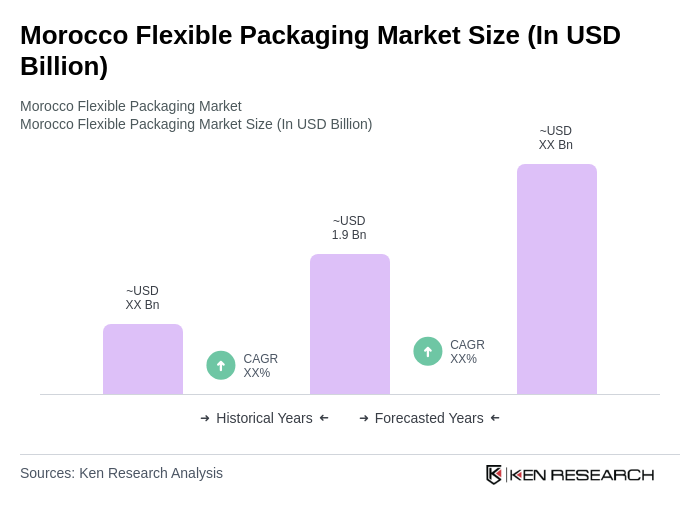

The Morocco Flexible Packaging Market is valued at approximately USD 1.9 billion, reflecting significant growth driven by increasing demand for packaged food products, consumer preferences for convenience, and the expansion of the e-commerce sector.