Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2401

Pages:100

Published On:October 2025

By Material:

The material segmentation of the market includes Plastics, Paper, Metal (Aluminum Foil), Bioplastics, and Laminates. Plastics remain the dominant material, accounting for the majority share due to their versatility, lightweight nature, and cost-effectiveness. The increasing demand for flexible packaging in food and beverage applications drives the consumption of plastic materials, as they provide excellent barrier properties and extend shelf life. Recent trends show a growing shift toward recyclable plastics and bioplastics, driven by sustainability mandates and consumer awareness. Paper-based formats are also gaining traction, supported by investments in recyclable grades and government policies encouraging eco-friendly packaging .

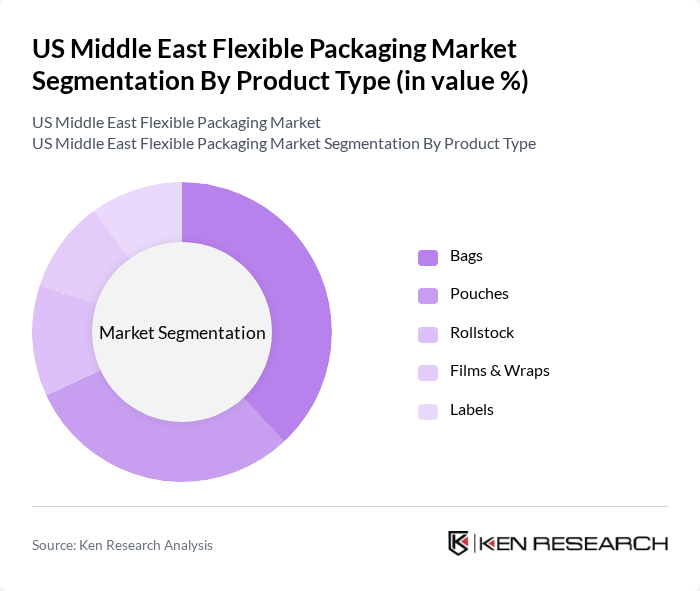

By Product Type:

The product type segmentation includes Bags, Pouches, Rollstock, Films & Wraps, and Labels. Bags lead the market, driven by their widespread use in retail and food service applications. The convenience of bags for packaging various products, coupled with consumer preferences for lightweight and portable options, contributes to their dominance. Pouches are rapidly gaining market share, favored for their ability to preserve freshness, extend shelf life, and support unit-dose pharmaceutical formats. Rollstock and films are increasingly used in e-commerce and logistics, while labels benefit from regulatory requirements for serialization and traceability .

The US Middle East Flexible Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Huhtamaki Oyj, Mondi Group, Napco National, ENPI Group, Flex Films UAE, Hotpack Packaging Industries LLC, Silver Corner Packaging, Bony Packaging, ZamZam Packaging Mat. Ind. LLC, Universal Carton Industries LLC, RAK Packaging Company Ltd, Takamul Industrial Company, Amcor plc, Berry Global, Inc., Constantia Flexibles contribute to innovation, geographic expansion, and service delivery in this space.

The US Middle East flexible packaging market is poised for transformative growth, driven by the increasing emphasis on sustainability and technological advancements. As consumer preferences shift towards eco-friendly products, manufacturers are likely to invest in innovative materials and processes. Additionally, the rise of e-commerce will continue to shape packaging solutions, necessitating adaptability and efficiency. Companies that embrace these trends will be well-positioned to capitalize on emerging opportunities and navigate the evolving regulatory landscape effectively.

| Segment | Sub-Segments |

|---|---|

| By Material | Plastics Paper Metal (Aluminum Foil) Bioplastics Laminates |

| By Product Type | Bags Pouches Rollstock Films & Wraps Labels |

| By Application | Food & Beverage Pharmaceuticals & Healthcare Personal Care & Cosmetics Household Products Industrial |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Israel Turkey |

| By Distribution Channel | Direct Sales Distributors & Wholesalers E-commerce Platforms Retail Stores |

| By Sustainability Level | Conventional Recyclable Biodegradable Compostable |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 120 | Packaging Managers, Product Development Leads |

| Pharmaceutical Packaging Solutions | 80 | Regulatory Affairs Specialists, Quality Assurance Managers |

| Consumer Goods Packaging Trends | 100 | Brand Managers, Marketing Directors |

| Sustainability in Packaging | 60 | Sustainability Officers, Environmental Compliance Managers |

| Innovations in Flexible Packaging | 80 | R&D Managers, Innovation Leads |

The US Middle East Flexible Packaging Market is valued at approximately USD 10 billion, driven by increasing demand for convenient packaging solutions across various sectors, including food and beverage, pharmaceuticals, and personal care.