Region:Middle East

Author(s):Rebecca

Product Code:KRAC3295

Pages:94

Published On:October 2025

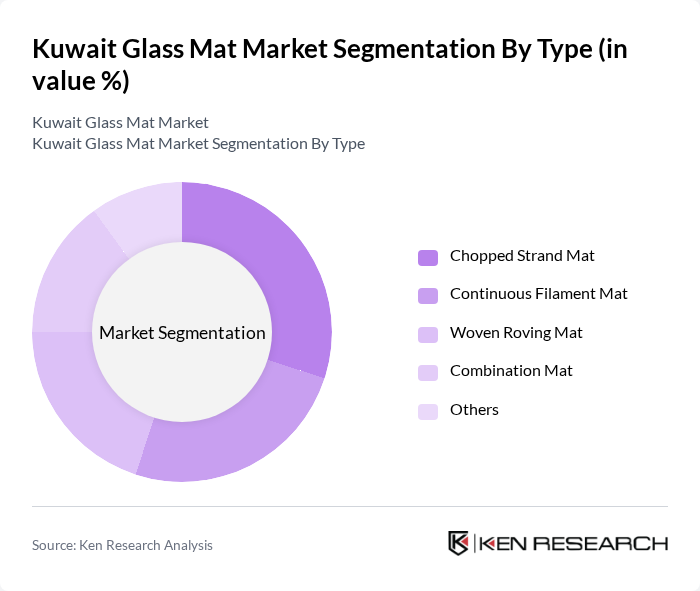

By Type:The market is segmented into various types of glass mats, including Chopped Strand Mat, Continuous Filament Mat, Woven Roving Mat, Combination Mat, and Others. Each type serves different applications and industries, catering to specific consumer needs and preferences. Chopped Strand Mats are widely used in construction and automotive applications for their versatility and ease of molding, while Continuous Filament Mats are preferred for high-performance and structural uses. Woven Roving Mats and Combination Mats address specialized requirements in marine, industrial, and infrastructure sectors.

The Chopped Strand Mat segment dominates the market due to its versatility and ease of use in various applications, particularly in the construction and automotive sectors. Its lightweight nature and excellent mechanical properties make it a preferred choice for manufacturers. Continuous Filament Mats are also gaining traction, especially in high-performance applications, but the Chopped Strand Mat remains the leading sub-segment due to its widespread adoption and cost-effectiveness.

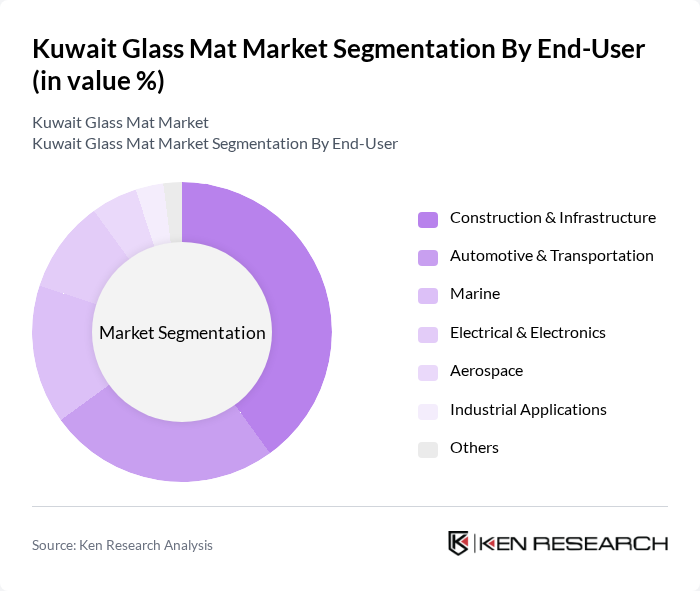

By End-User:The market is segmented based on end-users, including Construction & Infrastructure, Automotive & Transportation, Marine, Electrical & Electronics, Aerospace, Industrial Applications, and Others. Each end-user segment has unique requirements and contributes differently to the overall market dynamics. The construction sector’s demand is driven by the need for lightweight, durable, and energy-efficient materials, while automotive manufacturers focus on weight reduction and improved fuel efficiency. Marine and industrial applications benefit from the corrosion resistance and mechanical strength of glass mats.

The Construction & Infrastructure segment is the largest end-user of glass mats, driven by the robust construction industry in Kuwait and the adoption of sustainable building materials. The Automotive & Transportation sector follows, as manufacturers seek to reduce vehicle weight and improve fuel efficiency, further propelling the growth of glass mat usage in this industry.

The Kuwait Glass Mat Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Glass Manufacturing Company K.S.C., Gulf Glass Manufacturing Company K.S.C., Al-Ahlia Glass Manufacturing Company, National Industries Company (Glass Reinforced Products Division), Al-Fahad Glass Factory, Al-Mansour Glass Company, Glass Technology Company, Kuwait Insulating Material Manufacturing Company, Al-Jazeera Glass Company, Al-Muhalab Glass Company, Al-Salam Glass Company, Al-Masoud Glass Company, Al-Qurain Glass Company, Al-Kuwait Glass Company, and Al-Mahfouz Glass Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait glass mat market appears promising, driven by ongoing investments in infrastructure and a growing emphasis on sustainable construction practices. As the government continues to prioritize eco-friendly initiatives, the demand for glass mats is expected to rise. Additionally, technological advancements in production processes will likely enhance efficiency and reduce costs, making glass mats more competitive. The integration of smart technologies in construction will further open avenues for innovative applications, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Chopped Strand Mat Continuous Filament Mat Woven Roving Mat Combination Mat Others |

| By End-User | Construction & Infrastructure Automotive & Transportation Marine Electrical & Electronics Aerospace Industrial Applications Others |

| By Application | Insulation Reinforcement Roofing & Waterproofing Soundproofing Pipe & Tank Manufacturing Others |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Sales Others |

| By Price Range | Economy Mid-Range Premium |

| By Material Composition | E-Glass Fiber C-Glass Fiber S-Glass Fiber Resin (Polyester, Epoxy, Vinyl Ester, etc.) Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Glass Applications | 50 | Home Builders, Interior Designers |

| Commercial Glass Solutions | 45 | Facility Managers, Architects |

| Automotive Glass Market | 40 | Automotive Manufacturers, Repair Shop Owners |

| Glass Packaging Sector | 45 | Packaging Engineers, Brand Managers |

| Specialty Glass Products | 50 | Product Development Managers, R&D Specialists |

The Kuwait Glass Mat Market is valued at approximately USD 110 million, reflecting a robust growth trajectory driven by increasing demand for lightweight and durable materials across various industries, including construction, automotive, and marine.