Region:Middle East

Author(s):Rebecca

Product Code:KRAC1922

Pages:95

Published On:October 2025

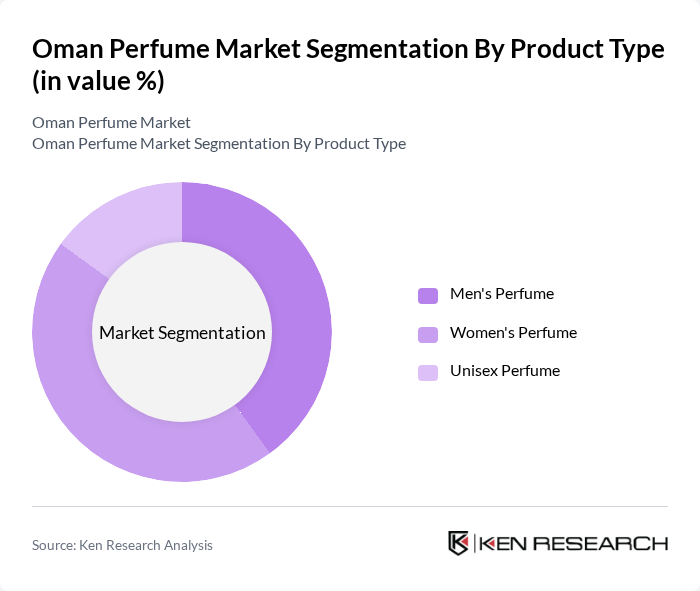

By Product Type:The product type segmentation includes Men's Perfume, Women's Perfume, and Unisex Perfume. Men's Perfume has been gaining traction due to changing perceptions of masculinity and grooming, while Women's Perfume remains a staple in the market, driven by a wide variety of fragrance options. Unisex Perfume is also emerging as a popular choice among consumers seeking versatility and inclusivity in their fragrance selections .

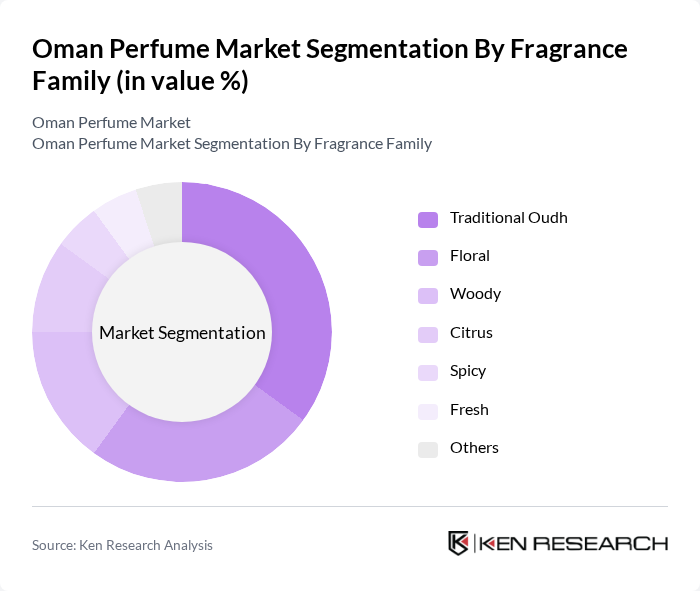

By Fragrance Family:The fragrance family segmentation includes Traditional Oudh, Floral, Woody, Citrus, Spicy, Fresh, and Others. Traditional Oudh is particularly significant in Oman due to its cultural roots and luxurious appeal. Floral fragrances are popular among women, while Woody and Spicy scents are favored by both genders. The Fresh and Citrus families are gaining popularity for their refreshing qualities, especially in warmer climates .

The Oman Perfume Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amouage, Oman Perfumes LLC, Arabian Oud, Ajmal Perfumes, Rasasi Perfumes, Al Haramain Perfumes, Swiss Arabian Perfumes, Oud Elite Group, Abdul Samad Al Qurashi, LVMH Moët Hennessy Louis Vuitton, The Estée Lauder Companies Inc., Coty Inc., Chanel S.A., Inter Parfums Inc., Wipro Limited, Gruppo Sodalis Srl, L'Oréal S.A. contribute to innovation, geographic expansion, and service delivery in this space .

The Oman perfume market is poised for continued growth, driven by evolving consumer preferences towards personalized and sustainable products. As the demand for organic and natural fragrances rises, local brands are likely to innovate, creating unique offerings that resonate with environmentally conscious consumers. Additionally, the expansion of e-commerce will facilitate greater market access, allowing both local and international brands to reach a broader audience, enhancing competition and variety in the market.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Men's Perfume Women's Perfume Unisex Perfume |

| By Fragrance Family | Traditional Oudh Floral Woody Citrus Spicy Fresh Others |

| By End-User | Individual Consumers Retailers Wholesalers Corporate Clients |

| By Distribution Channel | Supermarkets and Hypermarkets Grocery Stores Department Stores Health and Beauty Stores E-commerce Duty-Free Shops Others |

| By Price Range | Mass Premium |

| By Packaging Type | Glass Bottles Plastic Bottles Others (Crystal, Metal, etc.) |

| By Occasion | Daily Wear Special Occasions Gifting |

| By Brand Loyalty | Brand Loyal Customers Brand Switchers New Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Perfume Outlets | 100 | Store Managers, Sales Representatives |

| Online Perfume Retailers | 60 | E-commerce Managers, Digital Marketing Specialists |

| Fragrance Manufacturers | 40 | Production Managers, Product Development Heads |

| Consumer Focus Groups | 50 | Fragrance Enthusiasts, Regular Buyers |

| Industry Experts and Analysts | 30 | Market Analysts, Industry Consultants |

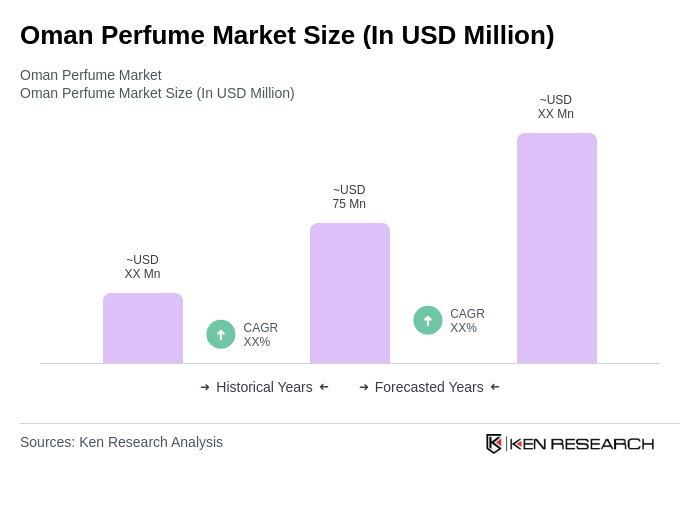

The Oman Perfume Market is valued at approximately USD 75 million, reflecting a significant growth driven by increasing demand for luxury and niche fragrances, cultural significance, and a growing tourism sector.