Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9501

Pages:80

Published On:November 2025

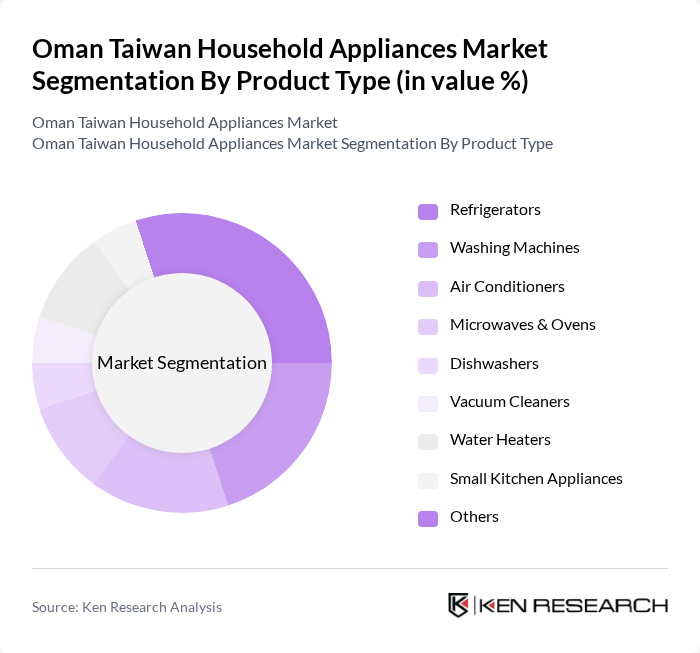

By Product Type:The product type segmentation includes various categories such as refrigerators, washing machines, air conditioners, microwaves & ovens, dishwashers, vacuum cleaners, water heaters, small kitchen appliances, and others. Each of these subsegments caters to specific consumer needs and preferences, with trends indicating a growing demand for energy-efficient and smart appliances. Compact kitchen appliances, such as coffee makers, blenders, and food processors, are experiencing increased adoption due to rising health consciousness and the desire for convenience in meal preparation .

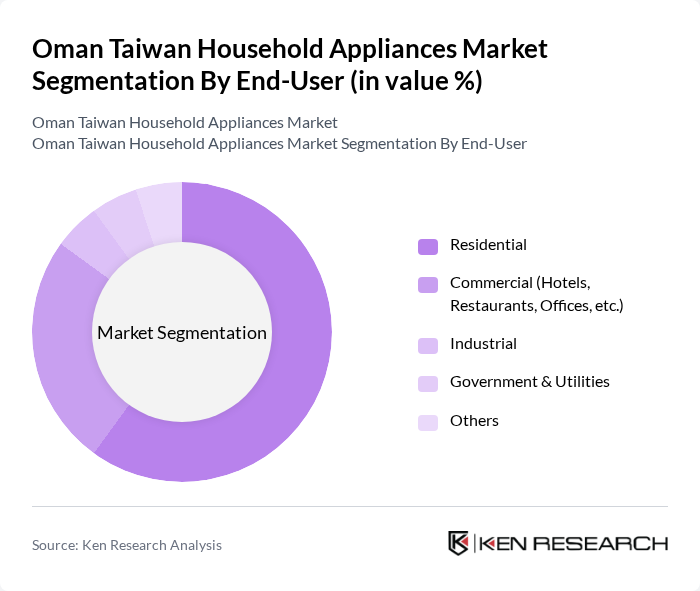

By End-User:The end-user segmentation encompasses residential, commercial, industrial, government & utilities, and others. The residential segment is the largest, driven by increasing household incomes and a growing trend towards modern living, which emphasizes convenience and efficiency in home appliances. The commercial segment, including hotels, restaurants, and offices, is also expanding as hospitality and service sectors grow in urban centers .

The Oman Taiwan Household Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd. (Taiwan & Oman), LG Electronics Inc., Whirlpool Corporation, Panasonic Corporation / Panasonic Taiwan Co., Ltd., Haier Group, Bosch Home Appliances (Robert Bosch Taiwan Co., Ltd. / BSH Hausgeräte GmbH), Midea Group, Sharp Corporation, Gree Electric Appliances Inc., Hisense Group, TCL Technology, Electrolux AB, Arçelik A.?., Smeg S.p.A., Beko (Arçelik A.?.), Hitachi Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Oman Taiwan household appliances market is poised for significant transformation driven by technological advancements and changing consumer preferences. As urbanization continues to rise, the demand for smart appliances and energy-efficient products will likely increase. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products. Companies that adapt to these trends and invest in innovative solutions will be well-positioned to capture market share and meet evolving consumer needs in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Refrigerators Washing Machines Air Conditioners Microwaves & Ovens Dishwashers Vacuum Cleaners Water Heaters Small Kitchen Appliances (Coffee Makers, Toasters, Blenders, Food Processors, etc.) Others |

| By End-User | Residential Commercial (Hotels, Restaurants, Offices, etc.) Industrial Government & Utilities Others |

| By Region | Muscat Salalah Sohar Nizwa Other Regions |

| By Technology | Smart Appliances Energy-efficient Appliances IoT-enabled Appliances Traditional Appliances |

| By Application | Kitchen Appliances Laundry Appliances Climate Control Appliances Cleaning Appliances Water Heating Appliances Others |

| By Distribution Channel | Hypermarkets & Supermarkets Electronic Stores Exclusive Brand Outlets Online Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Household Appliances | 150 | Store Managers, Sales Representatives |

| Consumer Preferences for Appliances | 120 | Homeowners, Renters |

| Distribution Channels Analysis | 100 | Logistics Coordinators, Supply Chain Managers |

| Market Trends and Innovations | 80 | Product Development Managers, Marketing Executives |

| Post-Purchase Consumer Satisfaction | 110 | Recent Buyers, Customer Service Representatives |

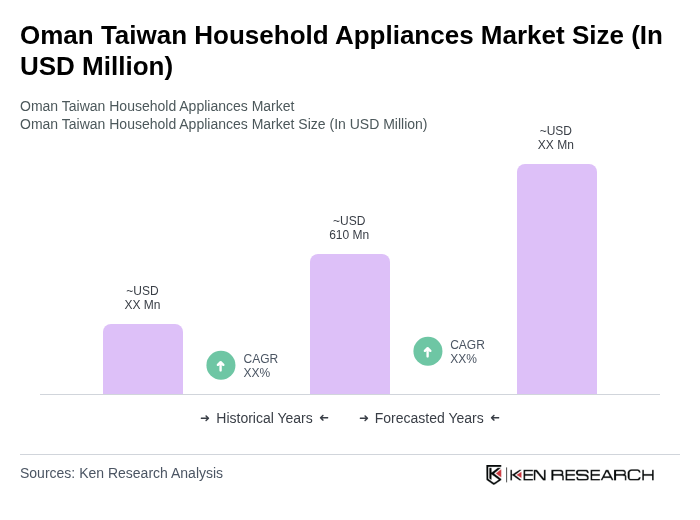

The Oman Taiwan Household Appliances Market is valued at approximately USD 610 million, reflecting a significant growth trend driven by urbanization, rising disposable incomes, and a preference for energy-efficient appliances among consumers.