Region:Middle East

Author(s):Rebecca

Product Code:KRAA5687

Pages:83

Published On:January 2026

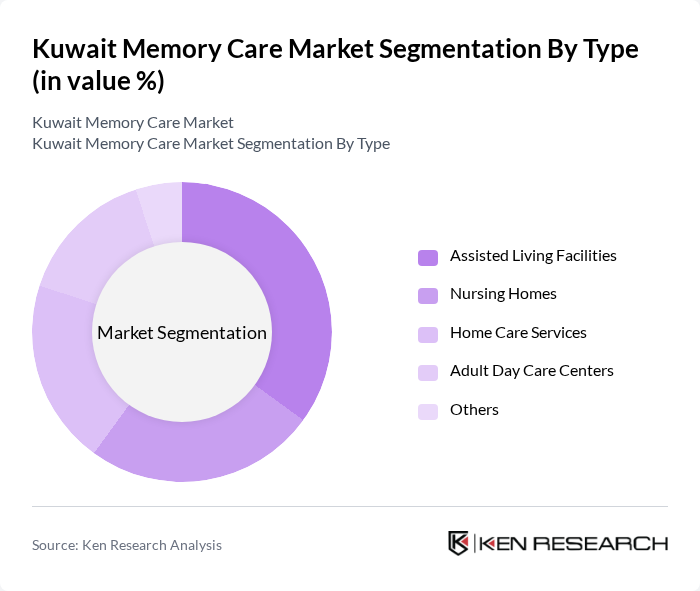

By Type:The market is segmented into various types, including Assisted Living Facilities, Nursing Homes, Home Care Services, Adult Day Care Centers, and Others. Each of these segments caters to different needs and preferences of individuals requiring memory care. Assisted Living Facilities are particularly popular due to their combination of independence and support, while Home Care Services are favored for their personalized approach and cost-effectiveness.

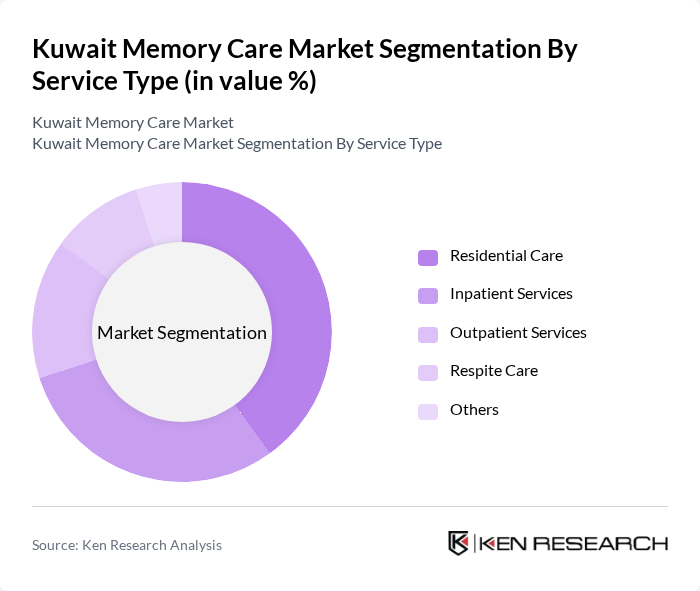

By Service Type:The service type segmentation includes Residential Care, Inpatient Services, Outpatient Services, Respite Care, and Others. Residential Care is the leading service type, as it provides comprehensive support for individuals with memory-related issues, ensuring a safe and structured environment. Inpatient Services are also significant, catering to those requiring intensive care and specialized therapeutic programming designed to manage behavioral symptoms and ensure resident safety.

The Kuwait Memory Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aster DM Healthcare, Al Noor Hospital, Gulf Healthcare International, Kuwait Medical Center, Al Seef Hospital, Dar Al Shifa Hospital, Life Care Hospital, Al Razi Hospital, Royal Hayat Hospital, Kuwait University Health Center, Al Sabah Hospital, Al Adan Hospital, Ibn Sina Hospital, Al Farwaniyah Hospital, Kuwait City Health Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the memory care market in Kuwait appears promising, driven by demographic changes and increased awareness of memory disorders. As the elderly population continues to grow, the demand for specialized care services is expected to rise significantly. Innovations in telehealth and AI technologies are likely to enhance service delivery, making care more accessible. Additionally, government support and funding initiatives will play a crucial role in expanding facilities and improving training programs for caregivers, ultimately leading to better care outcomes for patients.

| Segment | Sub-Segments |

|---|---|

| By Type | Assisted Living Facilities Nursing Homes Home Care Services Adult Day Care Centers Others |

| By Service Type | Residential Care Inpatient Services Outpatient Services Respite Care Others |

| By End-User | Individuals and Families Healthcare Institutions Government Agencies Non-profit Organizations Others |

| By Payment Model | Private Pay Insurance-Based Government-Funded Hybrid Models Others |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas Others |

| By Age Group | 70 Years 80 Years Years and Above Others |

| By Care Intensity Level | Basic Memory Support Intermediate Care Advanced Specialized Care Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Memory Care Facility Administrators | 100 | Facility Managers, Operations Directors |

| Healthcare Professionals in Geriatric Care | 80 | Doctors, Nurses, Social Workers |

| Family Caregivers of Dementia Patients | 120 | Family Members, Caregivers |

| Policy Makers in Health Sector | 50 | Government Officials, Health Policy Advisors |

| Support Staff in Memory Care Facilities | 70 | Caregivers, Activity Coordinators |

The Kuwait Memory Care Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by the increasing prevalence of dementia and Alzheimer's disease, as well as a rising aging population requiring specialized care services.