Region:Global

Author(s):Rebecca

Product Code:KRAA5699

Pages:86

Published On:January 2026

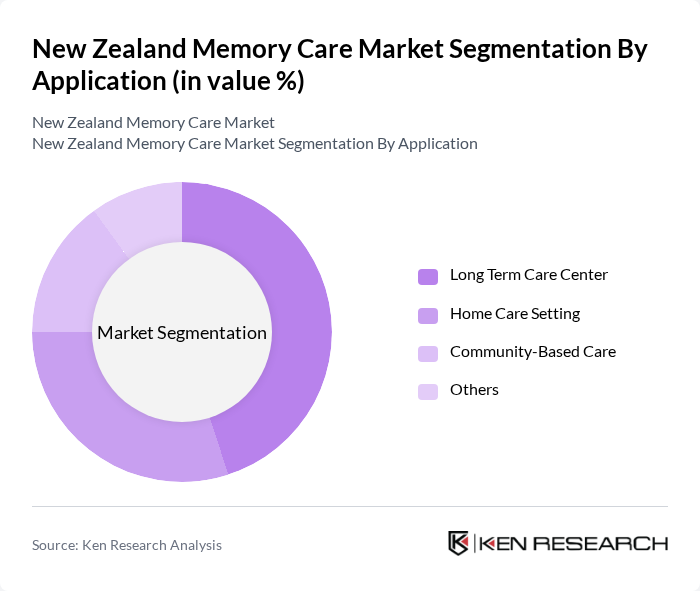

By Application:The market is segmented into four main applications: Long Term Care Center, Home Care Setting, Community-Based Care, and Others. Among these, Long Term Care Centers are the most prominent, as they provide comprehensive care and support for individuals with severe memory impairments. The increasing demand for specialized facilities that cater to the unique needs of dementia patients drives this segment's growth. Home Care Settings are also gaining traction as families seek personalized care solutions for their loved ones in familiar environments.(source)

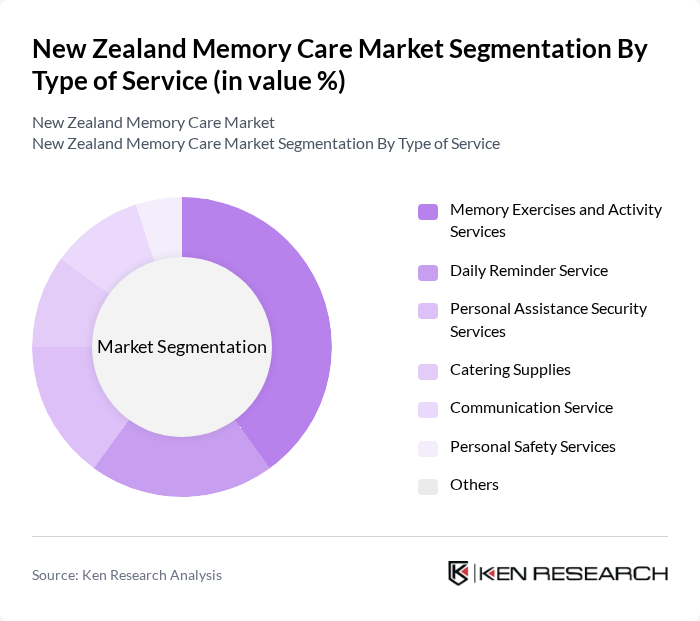

By Type of Service:The services offered in the memory care market include Memory Exercises and Activity Services, Daily Reminder Service, Personal Assistance Security Services, Catering Supplies, Communication Service, Personal Safety Services, and Others. Memory Exercises and Activity Services dominate this segment, as they are essential for maintaining cognitive function and enhancing the quality of life for individuals with memory impairments. The increasing focus on therapeutic activities and engagement strategies drives the demand for these services.

The New Zealand Memory Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ryman Healthcare, Summerset Group, Oceania Healthcare, Metlifecare, Arvida Group, Heritage Lifecare, Radius Residential Care, Bupa New Zealand, Enliven, The Selwyn Foundation, Presbyterian Support, Aged Care Association New Zealand, CareNZ, ElderCare, Dementia Care New Zealand contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand memory care market is poised for transformative growth, driven by technological advancements and an increasing focus on personalized care. The integration of telehealth services and artificial intelligence is expected to enhance patient monitoring and care delivery. Additionally, community-based support programs are gaining traction, fostering a more inclusive approach to memory care. As these trends evolve, they will likely reshape the landscape of memory care, improving accessibility and quality of services for patients and families alike.

| Segment | Sub-Segments |

|---|---|

| By Application | Long Term Care Center Home Care Setting Community-Based Care Others |

| By Type of Service | Memory Exercises and Activity Services Daily Reminder Service Personal Assistance Security Services Catering Supplies Communication Service Personal Safety Services Others |

| By Region | North Island South Island Urban Areas Rural Areas |

| By Care Level | Specialist Dementia Care Psychogeriatric Care Rest Home Care Hospital Level Care Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Memory Care Facilities | 50 | Facility Managers, Care Coordinators |

| Healthcare Professionals | 40 | Geriatricians, Neurologists, Nurses |

| Family Caregivers | 60 | Primary Caregivers, Family Members |

| Support Organizations | 30 | Non-profit Directors, Program Managers |

| Policy Makers | 25 | Health Department Officials, Aging Policy Advisors |

The New Zealand Memory Care Market is valued at approximately USD 4.6 billion, reflecting a significant growth driven by the increasing prevalence of dementia and cognitive disorders, as well as advancements in memory care technologies.