Region:Asia

Author(s):Rebecca

Product Code:KRAA5680

Pages:86

Published On:January 2026

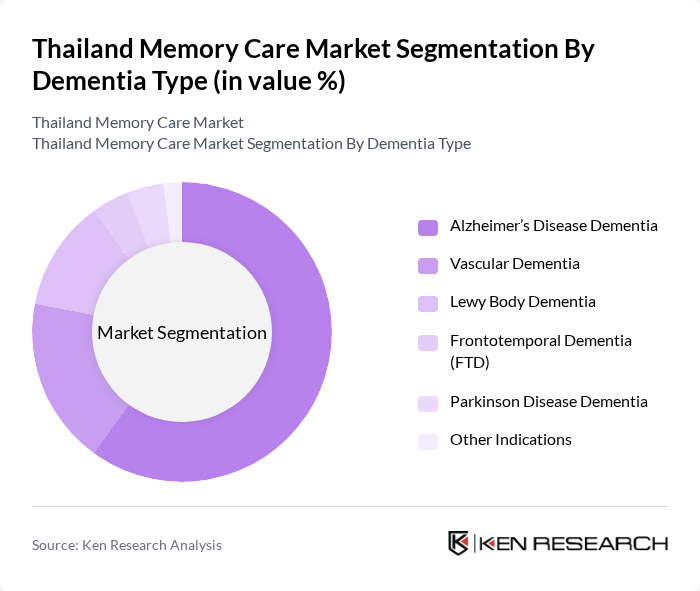

By Dementia Type:The market is segmented into various dementia types, including Alzheimer’s Disease Dementia, Vascular Dementia, Lewy Body Dementia, Frontotemporal Dementia (FTD), Parkinson Disease Dementia, and Other Indications. Among these, Alzheimer’s Disease Dementia is the most prevalent, accounting for a significant portion of the market due to its high incidence rate and the growing awareness of the disease.

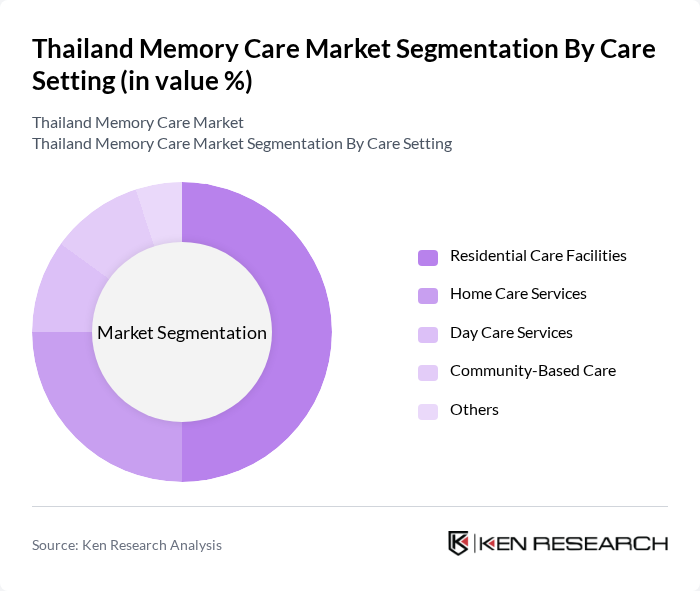

By Care Setting:The market is also segmented by care settings, which include Residential Care Facilities, Home Care Services, Day Care Services, Community-Based Care, and Others. Residential Care Facilities dominate this segment, as they provide comprehensive support and specialized services tailored to individuals with memory-related issues, ensuring a safe and structured environment.

The Thailand Memory Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bangkok Dusit Medical Services, Bumrungrad International Hospital, Samitivej Hospital, Phyathai Hospital, Bangkok Hospital, Vejthani Hospital, BNH Hospital, Theptarin Hospital, Chulalongkorn Hospital, Siriraj Hospital, MedPark Hospital, Piyavate Hospital, Bangkok Nursing Home, Memory Care Center Thailand, Elderly Care Thailand contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand memory care market is poised for significant transformation as the aging population continues to grow and awareness of memory disorders increases. Innovations in telehealth and AI-driven care solutions are expected to enhance service delivery and accessibility. Furthermore, government initiatives aimed at improving care quality and expanding facilities will likely create a more supportive environment for memory care services. As these trends evolve, the market will adapt to meet the changing needs of the elderly population, fostering sustainable growth.

| Segment | Sub-Segments |

|---|---|

| By Dementia Type | Alzheimer’s Disease Dementia Vascular Dementia Lewy Body Dementia Frontotemporal Dementia (FTD) Parkinson Disease Dementia Other Indications |

| By Care Setting | Residential Care Facilities Home Care Services Day Care Services Community-Based Care Others |

| By Service Type | Diagnostic Services Therapeutic Services Assistive Devices Cognitive Training Programs Others |

| By Payer Type | Out-of-Pocket/Private Pay Government Funding Insurance Reimbursement Non-Profit Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Memory Care Facilities | 100 | Facility Managers, Care Coordinators |

| Healthcare Professionals | 80 | Geriatricians, Neurologists, Nurses |

| Family Caregivers | 120 | Primary Caregivers, Family Members of Patients |

| Policy Makers | 50 | Health Ministry Officials, NGO Representatives |

| Market Analysts | 30 | Healthcare Market Researchers, Industry Analysts |

The Thailand Memory Care Market is valued at approximately USD 65 million, reflecting a significant increase driven by the rising prevalence of dementia and cognitive disorders, as well as an aging population seeking specialized care services.