Region:Asia

Author(s):Rebecca

Product Code:KRAA6881

Pages:98

Published On:January 2026

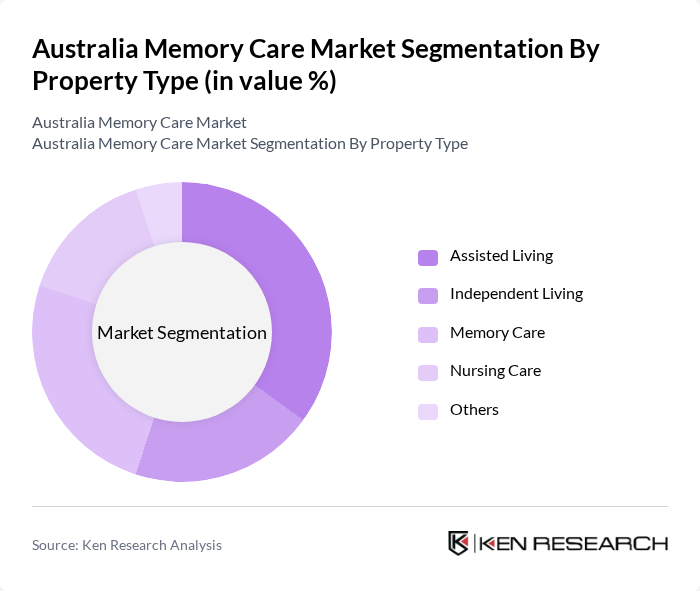

By Property Type:The property type segmentation includes various living arrangements tailored to meet the needs of individuals with memory-related issues. The subsegments are Assisted Living, Independent Living, Memory Care, Nursing Care, and Others. Assisted Living facilities are particularly popular due to their balance of independence and support, while Memory Care facilities are specifically designed for those with cognitive impairments, providing specialized care and environments.

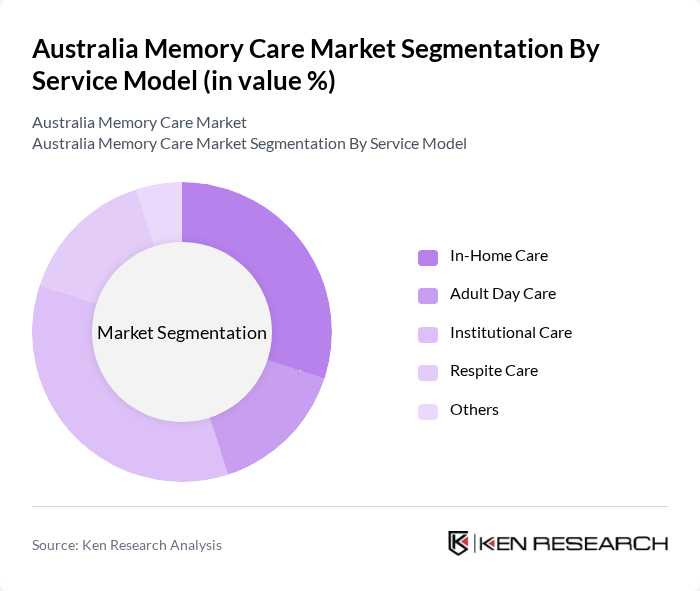

By Service Model:The service model segmentation encompasses various care delivery methods, including In-Home Care, Adult Day Care, Institutional Care, Respite Care, and Others. In-Home Care is gaining traction as families prefer to keep their loved ones in familiar environments, while Institutional Care remains a significant option for those requiring comprehensive support. The demand for Adult Day Care services is also increasing as caregivers seek temporary relief.

The Australia Memory Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Estia Health, Regis Healthcare, Japara Healthcare, Bupa Aged Care, Aveo Group, Southern Cross Care, Allity Aged Care, Opal Aged Care, Blue Care, Anglicare, Uniting Care, Bolton Clarke, Arcare, Life Care, Masonic Care Queensland contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia memory care market appears promising, driven by demographic trends and increasing demand for specialized services. As the aging population continues to grow, the integration of technology in care solutions, such as telehealth and AI, is expected to enhance service delivery. Additionally, the focus on personalized care plans will likely lead to improved patient outcomes, fostering a more supportive environment for individuals with memory-related conditions and their families.

| Segment | Sub-Segments |

|---|---|

| By Property Type | Assisted Living Independent Living Memory Care Nursing Care Others |

| By Service Model | In-Home Care Adult Day Care Institutional Care Respite Care Others |

| By Age Group | 74 Years (Early Care) 84 Years (Mid-to-Heavy Care) Years and Above (Intensive Care) Others |

| By Business Model | Outright Sale (Freehold) Long-Lease / Rental Hybrid (Sale + Lease) Others |

| By Geographic Distribution | New South Wales Victoria Queensland Western Australia Others |

| By Funding Source | Private Pay Government Funding Insurance Coverage Others |

| By Caregiver Type | Professional Caregivers Family Caregivers Volunteer Caregivers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Memory Care Facilities | 100 | Facility Managers, Care Coordinators |

| In-home Memory Care Services | 80 | Caregivers, Home Health Aides |

| Support Groups for Families | 60 | Family Members, Support Group Leaders |

| Healthcare Professionals in Aged Care | 90 | Geriatricians, Nurses, Social Workers |

| Policy Makers in Aged Care | 50 | Government Officials, Policy Analysts |

The Australia Memory Care Market is valued at approximately USD 3 billion, driven by the increasing prevalence of dementia and cognitive disorders, alongside a growing aging population that requires specialized care services.