Region:Middle East

Author(s):Dev

Product Code:KRAC1447

Pages:93

Published On:December 2025

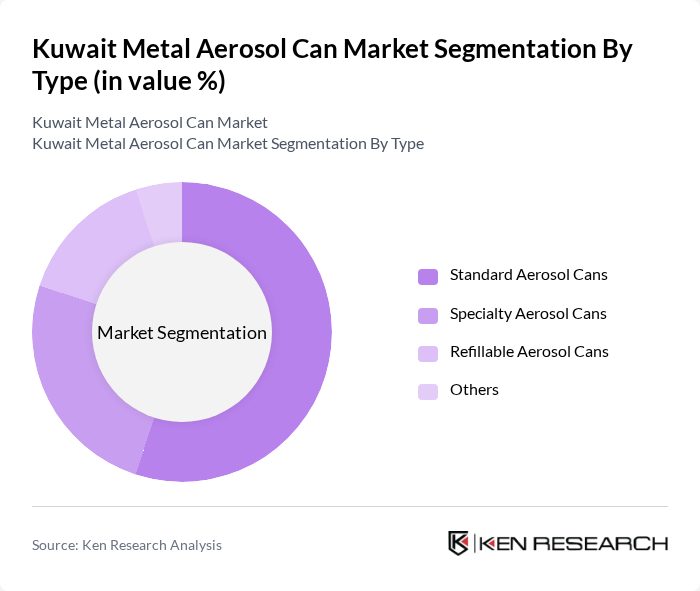

By Type:The market is segmented into four main types of aerosol cans: Standard Aerosol Cans, Specialty Aerosol Cans, Refillable Aerosol Cans, and Others. Standard Aerosol Cans dominate the market due to their widespread use in personal care and household products, driven by consumer preference for convenience and ease of use. Specialty Aerosol Cans are gaining traction in niche markets, while Refillable Aerosol Cans are emerging as a sustainable alternative, appealing to environmentally conscious consumers.

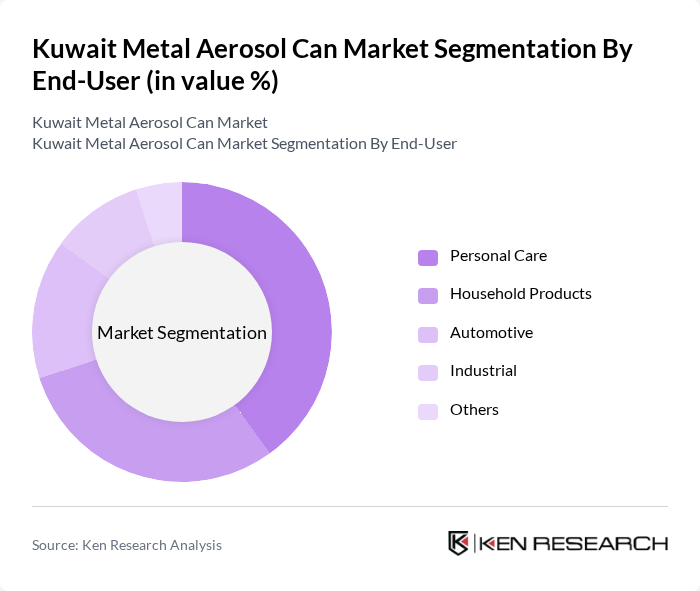

By End-User:The end-user segmentation includes Personal Care, Household Products, Automotive, Industrial, and Others. The Personal Care segment leads the market, driven by the increasing demand for beauty and grooming products packaged in aerosol cans. Household Products follow closely, as consumers prefer aerosol formats for cleaning and maintenance items. The Automotive and Industrial segments are also significant, with aerosol cans being used for lubricants and paints.

The Kuwait Metal Aerosol Can Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Metal Can Company, Gulf Can Manufacturing Company, Al-Ahlia Metal Industries, Al-Mansour Group, Al-Fahad Group, Al-Khalij Can Manufacturing, Al-Sabah Can Company, Al-Mutawa Can Factory, Al-Jazeera Can Manufacturing, Al-Muhalab Can Company, Al-Masoud Can Industries, Al-Qabas Can Manufacturing, Al-Saeed Can Company, Al-Hamra Can Factory, Al-Nasr Can Manufacturing contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait metal aerosol can market appears promising, driven by digital transformation and sustainability trends. With full internet access, e-commerce is expected to flourish, providing new sales channels for aerosol products. Additionally, the increasing emphasis on eco-friendly packaging solutions aligns with global sustainability initiatives, likely influencing consumer preferences and regulatory frameworks. As the non-oil sector diversifies, opportunities for growth in aerosol can applications will expand, fostering innovation and market resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Aerosol Cans Specialty Aerosol Cans Refillable Aerosol Cans Others |

| By End-User | Personal Care Household Products Automotive Industrial Others |

| By Material | Aluminum Steel Others |

| By Application | Paints and Coatings Food and Beverage Pharmaceuticals Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Others |

| By Policy Support | Subsidies for Eco-Friendly Products Tax Incentives for Manufacturers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Care Products | 100 | Brand Managers, Product Development Leads |

| Household Cleaning Products | 80 | Category Managers, Retail Buyers |

| Industrial Applications | 70 | Procurement Managers, Operations Directors |

| Food and Beverage Sector | 60 | Quality Assurance Managers, Supply Chain Coordinators |

| Automotive Products | 50 | Product Managers, Technical Sales Representatives |

The Kuwait Metal Aerosol Can Market is valued at approximately USD 5 billion, reflecting a significant growth trend driven by increasing consumer demand for sustainable and durable packaging solutions across various sectors, including beverages and personal care.