Region:Middle East

Author(s):Rebecca

Product Code:KRAC9869

Pages:97

Published On:November 2025

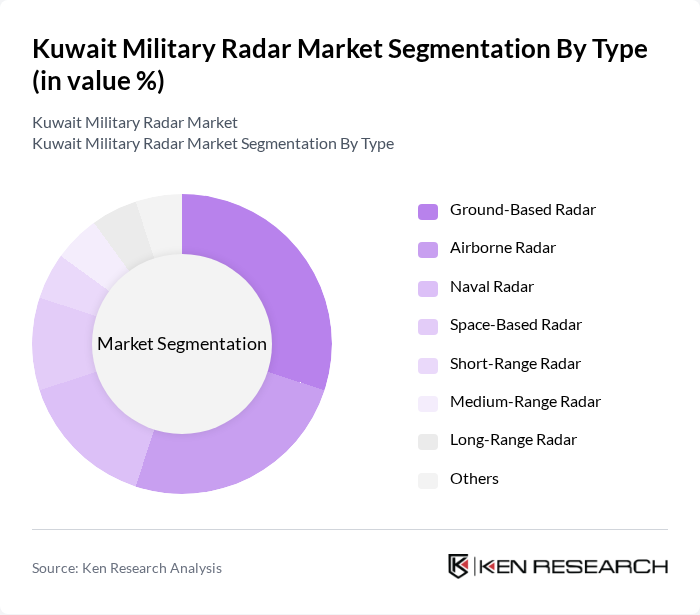

By Type:The market is segmented into various types of radar systems, including Ground-Based Radar, Airborne Radar, Naval Radar, Space-Based Radar, Short-Range Radar, Medium-Range Radar, Long-Range Radar, and Others. Each type serves specific operational needs, with Ground-Based and Airborne Radars being particularly prominent due to their versatility and effectiveness in various military applications.

By End-User:The end-user segmentation includes the Kuwait Armed Forces, Ministry of Interior, Border Security Agencies, Defense Contractors, and Others. The Kuwait Armed Forces are the primary consumers of military radar systems, driven by the need for enhanced defense capabilities and modernization efforts.

The Kuwait Military Radar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Raytheon Technologies, Northrop Grumman, Thales Group, Lockheed Martin, BAE Systems, Leonardo S.p.A., Saab AB, Elbit Systems Ltd., L3Harris Technologies, General Dynamics, Indra Sistemas S.A., Rheinmetall AG, Mitsubishi Electric Corporation, Israel Aerospace Industries (IAI), HENSOLDT AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait military radar market appears promising, driven by ongoing investments in advanced technologies and a heightened focus on national security. As Kuwait continues to modernize its defense capabilities, the integration of artificial intelligence and machine learning into radar systems is expected to enhance operational efficiency. Additionally, the shift towards modular radar systems will allow for greater flexibility and adaptability in addressing emerging threats, ensuring that Kuwait remains prepared for future challenges in the defense landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Ground-Based Radar Airborne Radar Naval Radar Space-Based Radar Short-Range Radar Medium-Range Radar Long-Range Radar Others |

| By End-User | Kuwait Armed Forces Ministry of Interior Border Security Agencies Defense Contractors Others |

| By Application | Air & Missile Defense Intelligence, Surveillance & Reconnaissance Navigation & Weapon Guidance Space Situational Awareness Airspace Monitoring & Traffic Management Maritime Patrolling Search and Rescue Ground Surveillance & Intruder Detection Others |

| By Technology | Phased Array Radar Synthetic Aperture Radar (SAR) Doppler Radar (Conventional & Pulse-Doppler) Frequency-Modulated Continuous Wave (FMCW) Radar Software-Defined Radar (SDR) Quantum Radar Others |

| By Component | Antennas Transmitters Receivers Power Amplifiers Duplexers Digital Signal Processors Stabilization Systems Graphical User Interfaces Others |

| By Deployment Mode | Fixed Radar Systems Mobile Radar Systems Others |

| By Region | Central Kuwait Northern Kuwait Southern Kuwait Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Procurement Officials | 45 | Defense Procurement Managers, Budget Analysts |

| Radar System Manufacturers | 40 | Product Development Managers, Sales Directors |

| Military Operations Personnel | 35 | Radar Technicians, Operations Commanders |

| Defense Analysts and Consultants | 30 | Market Analysts, Defense Policy Experts |

| Regional Defense Cooperation Representatives | 25 | Defense Liaison Officers, Strategic Planners |

The Kuwait Military Radar Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by increased defense budgets, regional security concerns, and advancements in radar technology aimed at enhancing surveillance and reconnaissance capabilities.