Region:Middle East

Author(s):Shubham

Product Code:KRAD6820

Pages:87

Published On:December 2025

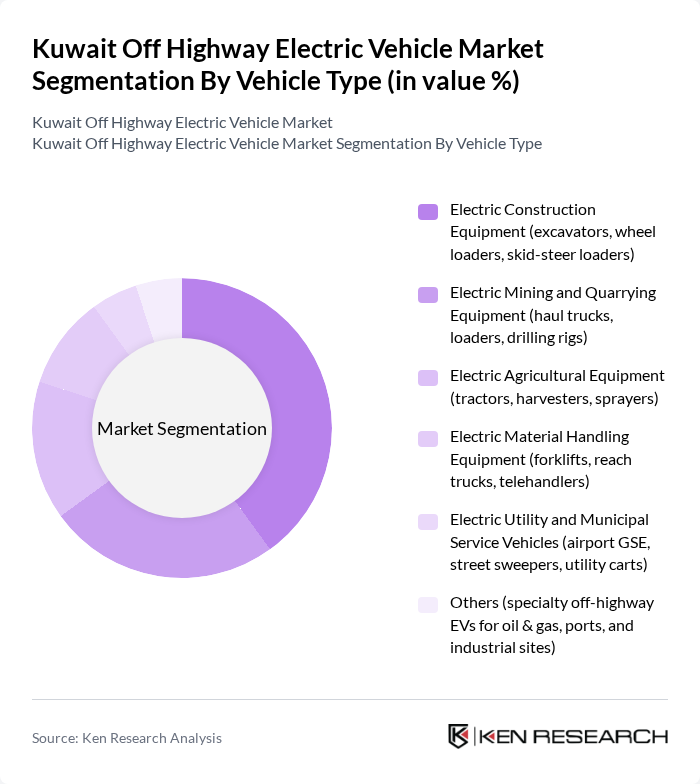

By Vehicle Type:The vehicle type segmentation includes various categories of electric vehicles designed for off-highway and utility applications, aligned with the way the Kuwait electric utility vehicle market is structured into specialized work vehicles used in industrial, commercial, and municipal environments. The subsegments are Electric Construction Equipment, Electric Mining and Quarrying Equipment, Electric Agricultural Equipment, Electric Material Handling Equipment, Electric Utility and Municipal Service Vehicles, and Others. Among these, Electric Construction Equipment is currently leading the market due to rapid urbanization, large-scale infrastructure and real estate projects, and growing interest in low-emission machinery on construction sites in Kuwait.

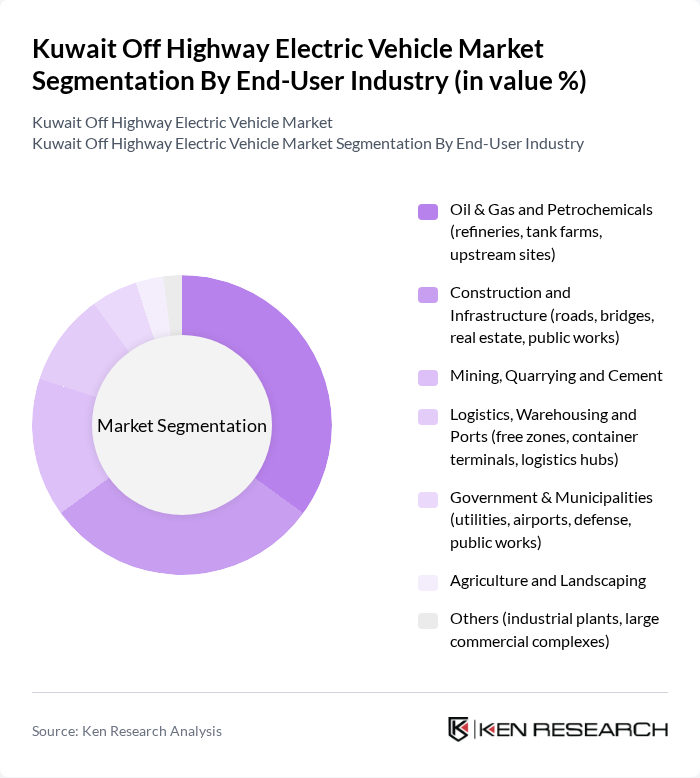

By End-User Industry:The end-user industry segmentation encompasses various sectors utilizing off-highway electric and utility vehicles for on-site transport, material handling, and specialized operations, consistent with sectoral usage patterns observed in Kuwait’s electric utility vehicle market. Key segments include Oil & Gas and Petrochemicals, Construction and Infrastructure, Mining, Quarrying and Cement, Logistics, Warehousing and Ports, Government & Municipalities, Agriculture and Landscaping, and Others. The Oil & Gas and Petrochemicals sector is currently the leading segment, driven by the need for sustainable practices in energy production and distribution, growing emphasis on reducing local emissions at refineries and depots, and adoption of electric utility vehicles for in-plant logistics and maintenance.

The Kuwait Off Highway Electric Vehicle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Volvo Construction Equipment AB, Caterpillar Inc., Komatsu Ltd., JCB Ltd., Hitachi Construction Machinery Co., Ltd., Doosan Bobcat Inc., Liebherr Group, Wacker Neuson SE, CASE Construction Equipment (CNH Industrial N.V.), Bobcat Company, Hyundai Construction Equipment Co., Ltd., Manitou Group, Terex Corporation, SANY Group Co., Ltd., XCMG Group (Xuzhou Construction Machinery Group Co., Ltd.) contribute to innovation, geographic expansion, and service delivery in this space, leveraging advances in battery technology, charging solutions, and compact electric platforms that are increasingly being deployed in global off-highway applications.

The future of the off-highway electric vehicle market in Kuwait appears promising, driven by technological advancements and supportive government policies. As battery technology continues to improve, electric vehicles will become more affordable and efficient, attracting a broader consumer base. Additionally, the expansion of charging infrastructure will alleviate range anxiety, further encouraging adoption. With a focus on sustainability and reduced emissions, the market is poised for significant growth, aligning with Kuwait's long-term environmental goals and economic diversification strategies.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Electric Construction Equipment (excavators, wheel loaders, skid-steer loaders) Electric Mining and Quarrying Equipment (haul trucks, loaders, drilling rigs) Electric Agricultural Equipment (tractors, harvesters, sprayers) Electric Material Handling Equipment (forklifts, reach trucks, telehandlers) Electric Utility and Municipal Service Vehicles (airport GSE, street sweepers, utility carts) Others (specialty off?highway EVs for oil & gas, ports, and industrial sites) |

| By End-User Industry | Oil & Gas and Petrochemicals (refineries, tank farms, upstream sites) Construction and Infrastructure (roads, bridges, real estate, public works) Mining, Quarrying and Cement Logistics, Warehousing and Ports (free zones, container terminals, logistics hubs) Government & Municipalities (utilities, airports, defense, public works) Agriculture and Landscaping Others (industrial plants, large commercial complexes) |

| By Application | Earthmoving and Land Development Road and Urban Infrastructure Construction Material Handling and Yard Operations Mining and Quarry Operations Airport Ground Support and terminal operations Utility, Waste Management and Municipal Services Others |

| By Propulsion & Battery Type | Battery Electric Vehicles (BEV) Hybrid Electric Vehicles (HEV / PHEV) Fuel Cell Electric Vehicles (FCEV) – pilot and demonstration fleets Lithium-ion Batteries (LFP, NMC and other chemistries) Lead-acid Batteries Others (solid-state, nickel-based and emerging chemistries) |

| By Charging & Power Supply | AC Depot and Standard Charging (up to 22 kW) DC Fast and Opportunity Charging (30–350 kW) Battery Swapping and Modular Pack Solutions On-site Renewable and Microgrid-based Charging Others |

| By Ownership & Financing Model | Owned Fleet Leased Fleet (operating and finance lease) Rental and Short-term Hire Services Managed Fleet / Equipment-as-a-Service Others |

| By Region | Kuwait City and Metropolitan Projects Al Ahmadi and Southern Oil & Gas Corridor Hawalli and Farwaniya Industrial & Logistics Clusters Jahra, Mubarak Al-Kabeer and Other Governorates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Electric Vehicle Users | 100 | Farm Managers, Agricultural Equipment Operators |

| Construction Industry Stakeholders | 80 | Project Managers, Equipment Rental Companies |

| Mining Sector Electric Vehicle Operators | 70 | Site Managers, Fleet Supervisors |

| Logistics and Transportation Companies | 90 | Logistics Coordinators, Fleet Managers |

| Government and Regulatory Bodies | 50 | Policy Makers, Environmental Analysts |

The Kuwait Off Highway Electric Vehicle market is valued at approximately USD 420 million, reflecting a significant growth trend driven by investments in sustainable technologies and government initiatives promoting electric vehicles.