Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5904

Pages:81

Published On:December 2025

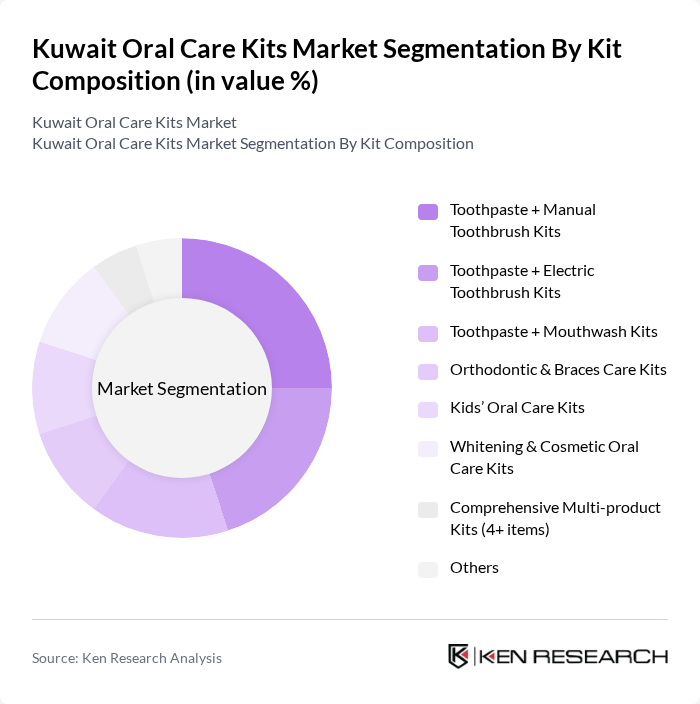

By Kit Composition:The segmentation of oral care kits by composition includes various combinations of products designed to meet diverse consumer needs. The subsegments are as follows:

The segment of Toothpaste + Manual Toothbrush Kits dominates the market due to its affordability, strong consumer habit of purchasing toothpaste and toothbrush together, and widespread acceptance among households across the country. This combination is favored for its simplicity and effectiveness in maintaining daily oral hygiene routines, and is widely available across supermarkets, pharmacies, and cooperative stores. Additionally, the growing trend of eco-conscious consumers has led to an increased demand for manual toothbrushes and bundled kits featuring biodegradable handles or reduced-plastic packaging, which are perceived as more environmentally friendly compared to many electric alternatives. The market for Kids’ Oral Care Kits is also expanding, driven by parents' increasing focus on children's dental health, supported by school-based oral health initiatives and rising availability of child-focused flavored toothpastes, soft-bristle brushes, and character-themed kits.

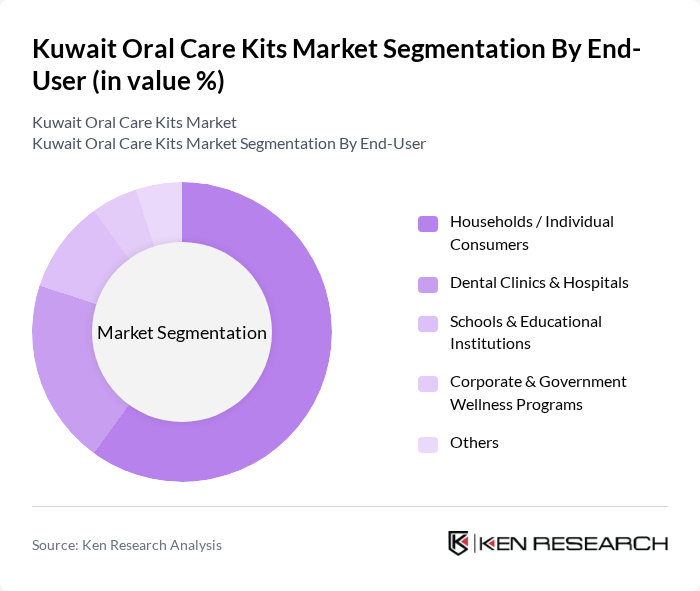

By End-User:The segmentation of oral care kits by end-user includes various categories that utilize these products. The subsegments are as follows:

Households and individual consumers represent the largest segment in the oral care kits market, driven by increasing awareness of oral hygiene, frequent replenishment of basic products such as toothpaste and toothbrushes, and the convenience of having comprehensive kits at home that combine multiple items in one purchase. The demand from dental clinics and hospitals is also significant, as these institutions often purchase kits in bulk for patient care, post-procedure maintenance, orthodontic cases, and preventive packages offered as part of treatment plans. The growing trend of corporate wellness programs and government-led health promotion campaigns is expected to further boost the market, as companies and public entities increasingly invest in employee and citizen health initiatives that include oral hygiene awareness, distribution of oral care starter kits, and collaboration with dental service providers.

The Kuwait Oral Care Kits Market is characterized by a dynamic mix of regional and international players. Leading participants such as Colgate-Palmolive Company (Colgate), Procter & Gamble Company (Oral-B, Crest), Unilever PLC (Signal, Closeup), GlaxoSmithKline plc (Sensodyne, Parodontax), Johnson & Johnson (Listerine), Church & Dwight Co., Inc. (Arm & Hammer), Henkel AG & Co. KGaA, Tom's of Maine, Inc., Hello Products LLC, Dr. Fresh LLC, Jordan Asia Pacific Sdn. Bhd. (Jordan Oral Care), Trisa AG, Curaden AG (Curaprox), Sunstar Suisse S.A. (GUM), Local & Regional Private Label Brands in Kuwait Retail contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait oral care kits market appears promising, driven by evolving consumer preferences and technological advancements. As more consumers seek personalized oral care solutions, brands are likely to invest in innovative product development. Additionally, the trend towards eco-friendly products is expected to gain traction, with consumers increasingly favoring sustainable options. The integration of technology, such as smart toothbrushes and mobile apps, will further enhance consumer engagement and drive market growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Kit Composition | Toothpaste + Manual Toothbrush Kits Toothpaste + Electric Toothbrush Kits Toothpaste + Mouthwash Kits Orthodontic & Braces Care Kits Kids’ Oral Care Kits Whitening & Cosmetic Oral Care Kits Comprehensive Multi-product Kits (4+ items) Others |

| By End-User | Households / Individual Consumers Dental Clinics & Hospitals Schools & Educational Institutions Corporate & Government Wellness Programs Others |

| By Distribution Channel | Pharmacies & Drugstores Supermarkets / Hypermarkets Convenience Stores & Cooperatives Online Retail & Marketplaces Direct Sales via Dental Clinics Others |

| By Price Range | Economy / Value Kits Mid-Range Kits Premium & Professional Kits Luxury & Imported Kits Others |

| By Consumer Profile | Brand-Loyal Consumers Price-Sensitive Consumers Health- & Ingredient-Conscious Consumers Convenience-Driven / Subscription Users Others |

| By Packaging Type | Single-Use / Travel Packaging Family-Size / Bulk Packaging Eco-Friendly / Sustainable Packaging Gift & Promotional Packaging Others |

| By Product Features | Natural & Herbal Ingredient Kits Sensitivity & Therapeutic Care Kits Halal-Certified Oral Care Kits Smart / App-Connected Oral Care Kits Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Oral Care Preferences | 150 | General Consumers, Parents of Young Children |

| Dental Professional Insights | 100 | Dentists, Dental Hygienists |

| Retailer Perspectives on Oral Care Products | 80 | Pharmacy Managers, Supermarket Buyers |

| Market Trends in Oral Care Kits | 70 | Product Managers, Marketing Executives |

| Children's Oral Care Product Usage | 60 | Parents, Pediatric Dentists |

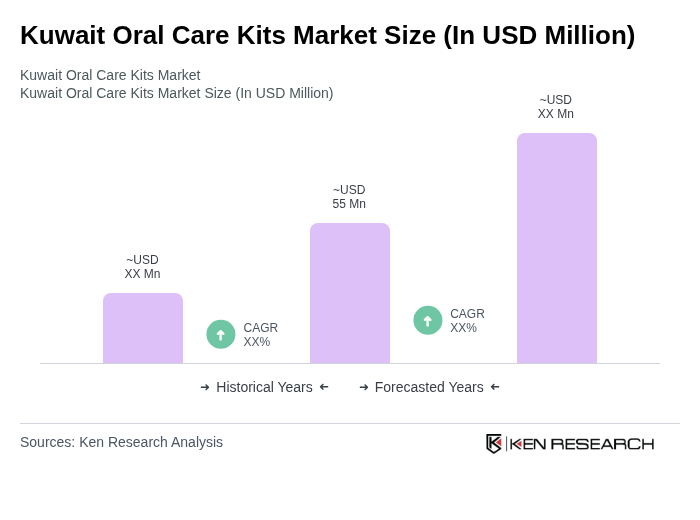

The Kuwait Oral Care Kits Market is valued at approximately USD 55 million, reflecting a significant growth trend driven by increased consumer awareness of oral hygiene and the rising prevalence of dental issues among the population.