Region:Middle East

Author(s):Dev

Product Code:KRAD5075

Pages:80

Published On:December 2025

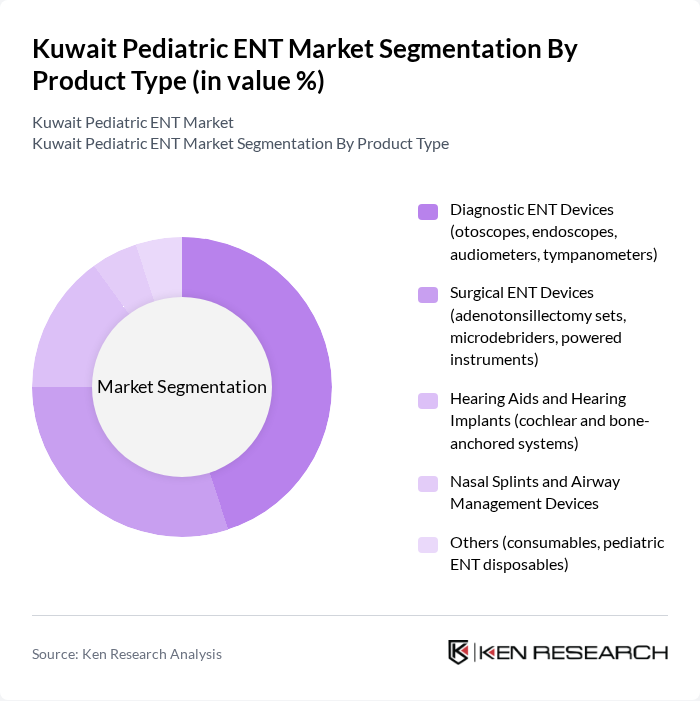

By Product Type:The Pediatric ENT market is segmented into various product types, including diagnostic ENT devices, surgical ENT devices, hearing aids and hearing implants, nasal splints and airway management devices, and others. This structure is consistent with broader ENT and audiology device categorizations used in Kuwait and the wider Middle East. Among these, diagnostic ENT devices are currently leading the market due to their essential role in early detection and management of pediatric ENT disorders, and diagnostic ENT devices represent the largest revenue share within Kuwait’s ENT devices market overall. The increasing prevalence and recognition of conditions such as otitis media, adenoid and tonsillar hypertrophy, allergic rhinitis, and hearing loss among children drive the demand for these devices, together with school and newborn hearing screening initiatives. Surgical ENT devices also hold significant market share, reflecting the growing need for surgical interventions in pediatric populations for procedures such as adenotonsillectomy, tympanostomy tube insertion, and endoscopic sinus surgery, supported by the availability of powered instruments and endoscopic systems in major Kuwaiti hospitals.

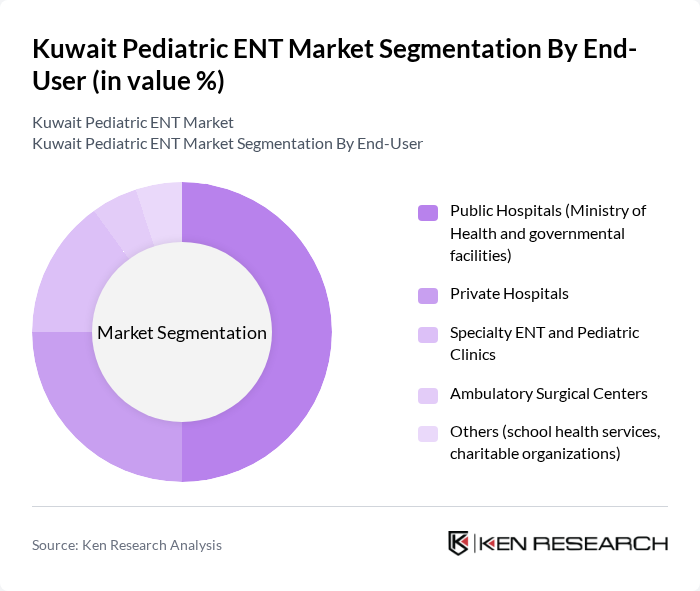

By End-User:The end-user segmentation of the Pediatric ENT market includes public hospitals, private hospitals, specialty ENT and pediatric clinics, ambulatory surgical centers, and others. Public hospitals dominate this segment due to their extensive reach, the central role of the Ministry of Health in financing and operating most acute-care facilities, and accessibility to a larger population. The increasing number of pediatric patients seeking ENT services in public healthcare facilities, where most complex surgeries and cochlear implant programs are concentrated, drives the demand for specialized services and devices. Private hospitals and specialty clinics are also significant contributors, offering advanced care, shorter waiting times, and specialized treatments, particularly in Kuwait City and major urban centers, while ambulatory surgical centers and school health services support day?case ENT procedures and screening activities.

The Kuwait Pediatric ENT Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ministry of Health – Kuwait (MOH) Hospitals and ENT Departments, Al Salam International Hospital, Dar Al Shifa Hospital, Royale Hayat Hospital, Al Razi Orthopedic and Rehabilitation Hospital (ENT and audiology services), Jaber Al Ahmad Al Jaber Al Sabah Hospital, Jahra Medical City (New Jahra Hospital), Kuwait University – Faculty of Medicine and affiliated pediatric ENT units, Medtronic plc (pediatric ENT and airway surgical devices), Karl Storz SE & Co. KG (pediatric ENT endoscopy systems), Stryker Corporation (ENT powered instruments and navigation), Cochlear Limited (pediatric cochlear implant solutions), GN Hearing A/S (ReSound) – pediatric hearing aids, Siemens Healthineers / Sivantos (Signia) – pediatric audiology and hearing aids, Local and Regional Medical Device Distributors (e.g., Gulf Medical Company Kuwait, Al Bahar Medical Services) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait Pediatric ENT market appears promising, driven by technological advancements and increased healthcare investments. As the government continues to prioritize pediatric health, initiatives aimed at enhancing access to specialized care are expected to gain momentum. Additionally, the integration of telemedicine is likely to improve access for families in remote areas, while ongoing collaborations with international healthcare providers will foster knowledge exchange and innovation in treatment methodologies.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Diagnostic ENT Devices (otoscopes, endoscopes, audiometers, tympanometers) Surgical ENT Devices (adenotonsillectomy sets, microdebriders, powered instruments) Hearing Aids and Hearing Implants (cochlear and bone-anchored systems) Nasal Splints and Airway Management Devices Others (consumables, pediatric ENT disposables) |

| By End-User | Public Hospitals (Ministry of Health and governmental facilities) Private Hospitals Specialty ENT and Pediatric Clinics Ambulatory Surgical Centers Others (school health services, charitable organizations) |

| By Age Group | Neonates (0–28 days) Infants (1–12 months) Toddlers (1–3 years) Preschoolers (3–5 years) School-age Children and Adolescents (6–18 years) |

| By Indication | Otitis Media and Other Ear Infections Hearing Loss and Auditory Disorders Tonsillitis, Adenoid Hypertrophy, and Sleep-disordered Breathing Sinusitis and Nasal Obstruction Airway Disorders (laryngotracheal conditions, foreign body) Others (allergic rhinitis, voice and swallowing disorders) |

| By Treatment Modality | Pharmacological and Medical Management Surgical Interventions (adenotonsillectomy, ear and sinus surgery) Hearing Rehabilitation (hearing aids, cochlear implants, speech therapy) Minimally Invasive and Endoscopic Procedures Others (follow-up and supportive care) |

| By Distribution Channel | Direct Tender and Institutional Sales (MOH and public sector) Private Hospital and Clinic Procurement Local Medical Device Distributors Online and E-procurement Platforms Others |

| By Geographic Distribution | Capital Region (Kuwait City and suburbs) Hawalli and Farwaniya Governorates Ahmadi and Mubarak Al-Kabeer Governorates Jahra Governorate and Peripheral Areas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pediatric ENT Specialist Insights | 50 | Pediatric ENT Surgeons, Audiologists |

| Parental Perspectives on Treatment | 120 | Parents of children with ENT conditions |

| Healthcare Provider Feedback | 80 | General Practitioners, Pediatricians |

| Hospital Administration Views | 40 | Hospital Administrators, Health Service Managers |

| Insurance Provider Insights | 40 | Health Insurance Analysts, Policy Makers |

The Kuwait Pediatric ENT market is valued at approximately USD 15 million, reflecting a significant growth driven by increased healthcare expenditure, awareness of pediatric ENT disorders, and advancements in medical technology.