Region:Middle East

Author(s):Dev

Product Code:KRAC1597

Pages:99

Published On:December 2025

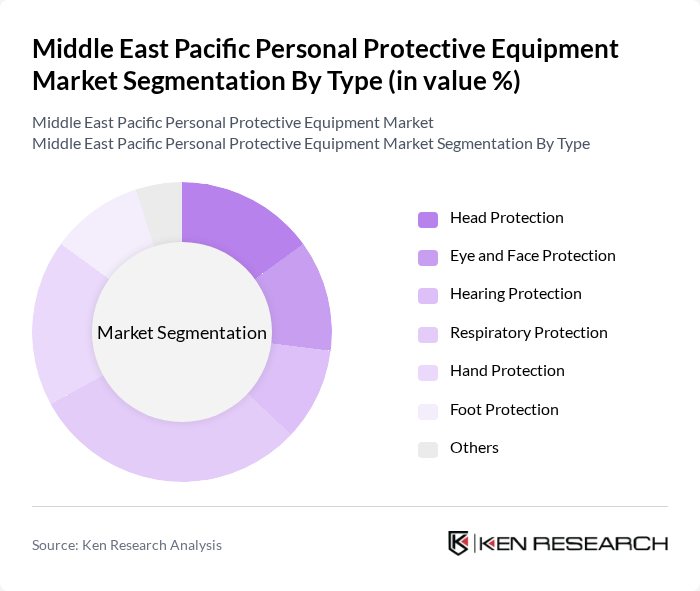

By Type:The market is segmented into various types of personal protective equipment, including head protection, eye and face protection, hearing protection, respiratory protection, hand protection, foot protection, and others. Among these, respiratory protection is currently the leading sub-segment due to the increasing focus on health and safety standards, particularly in industries such as healthcare and manufacturing. The demand for high-quality respiratory PPE has surged, especially in light of recent global health crises.

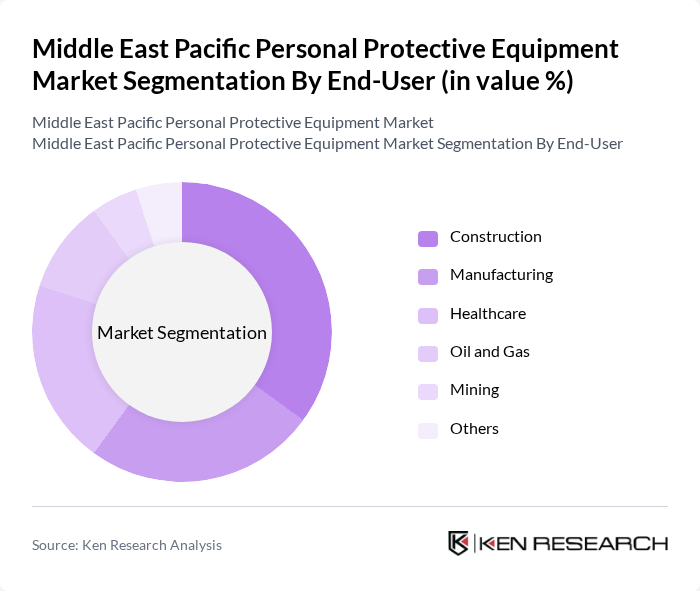

By End-User:The end-user segmentation includes construction, manufacturing, healthcare, oil and gas, mining, and others. The construction sector is the dominant end-user of personal protective equipment, driven by stringent safety regulations and the high incidence of workplace accidents. The increasing number of construction projects in the region, particularly in urban areas, has led to a significant rise in demand for various types of PPE.

The Middle East Pacific Personal Protective Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., 3M Company, DuPont de Nemours, Inc., Ansell Limited, MSA Safety Incorporated, Kimberly-Clark Corporation, Lakeland Industries, Inc., Radians, Inc., Alpha Pro Tech, Ltd., Bullard, JSP Limited, Delta Plus Group, Ergodyne, Uvex Safety Group, Cintas Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the Middle East Pacific personal protective equipment market is promising, driven by ongoing trends in healthcare and industrial safety. The demand for hand protection and healthcare PPE is expected to grow significantly, with innovations focusing on personalized and ergonomic designs. As regulatory frameworks strengthen, companies will likely invest in advanced materials and technologies, enhancing product offerings. This evolution will create a dynamic market landscape, fostering competition and encouraging new entrants to address diverse safety needs across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Head Protection Eye and Face Protection Hearing Protection Respiratory Protection Hand Protection Foot Protection Others |

| By End-User | Construction Manufacturing Healthcare Oil and Gas Mining Others |

| By Industry | Construction Manufacturing Healthcare Oil and Gas Mining Others |

| By Material | Fabric-based PPE Plastic-based PPE Metal-based PPE Composite materials Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Application | Industrial Safety Construction Safety Healthcare Safety Emergency Response Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry PPE Usage | 120 | Site Managers, Safety Coordinators |

| Healthcare Sector Protective Equipment | 100 | Healthcare Administrators, Infection Control Officers |

| Manufacturing Safety Equipment Adoption | 80 | Production Managers, Safety Compliance Officers |

| Retail PPE Distribution Channels | 70 | Retail Managers, Supply Chain Analysts |

| Government Regulations Impact on PPE | 60 | Regulatory Affairs Specialists, Policy Makers |

The Middle East Pacific Personal Protective Equipment Market is valued at approximately USD 8.2 billion, driven by urban and industrial development, increased workplace safety regulations, and heightened awareness of occupational hazards.