Region:Middle East

Author(s):Dev

Product Code:KRAD7812

Pages:82

Published On:December 2025

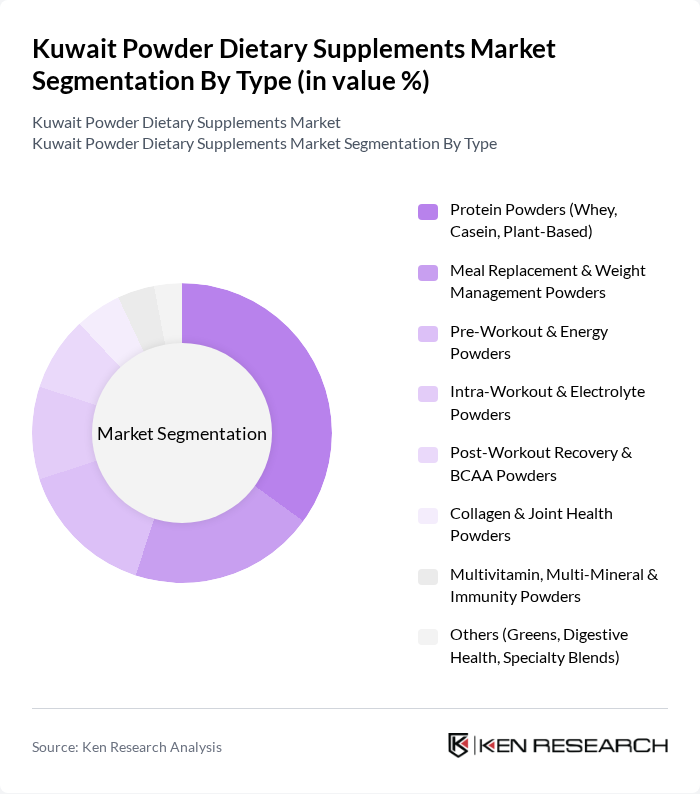

By Type:The market is segmented into various types of powder dietary supplements, including Protein Powders (Whey, Casein, Plant-Based), Meal Replacement & Weight Management Powders, Pre-Workout & Energy Powders, Intra-Workout & Electrolyte Powders, Post-Workout Recovery & BCAA Powders, Collagen & Joint Health Powders, Multivitamin, Multi-Mineral & Immunity Powders, and Others (Greens, Digestive Health, Specialty Blends). Each of these sub-segments caters to specific consumer needs and preferences, reflecting the diverse applications of powder supplements in health and fitness.

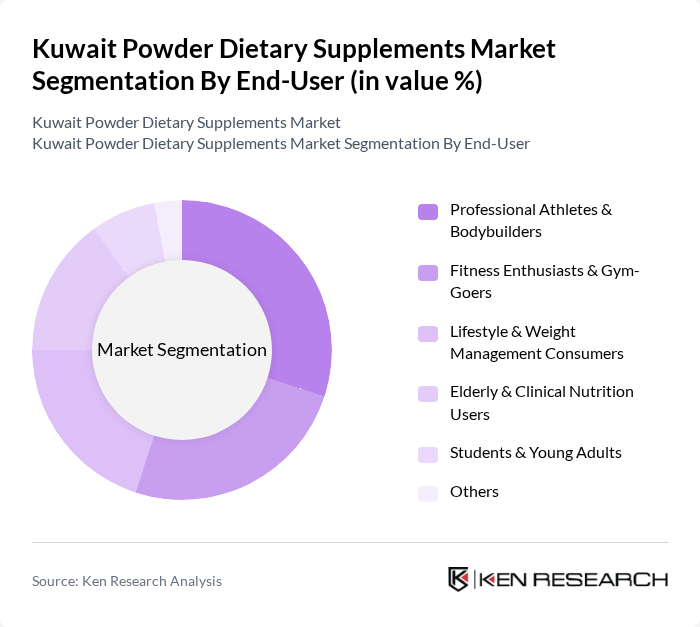

By End-User:The end-user segmentation includes Professional Athletes & Bodybuilders, Fitness Enthusiasts & Gym-Goers, Lifestyle & Weight Management Consumers, Elderly & Clinical Nutrition Users, Students & Young Adults, and Others. This segmentation highlights the diverse demographics that utilize powder dietary supplements, each with unique motivations and consumption patterns.

The Kuwait Powder Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Optimum Nutrition (Glanbia Performance Nutrition), BSN (Bio-Engineered Supplements and Nutrition, Inc.), MuscleTech (Iovate Health Sciences International Inc.), Dymatize Enterprises LLC, MyProtein (The Hut Group), GNC Holdings, LLC, Herbalife Nutrition Ltd., Isopure Company, LLC, Ultimate Nutrition Inc., Quest Nutrition LLC, Garden of Life LLC, NOW Foods, Vega (Danone SA), Orgain, Inc., Local & Regional Brands Active in Kuwait (e.g., Al Seif Pharmacy Private Labels, Sports Nutrition House Brands) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait powder dietary supplements market appears promising, driven by evolving consumer preferences and technological advancements. As personalized nutrition solutions gain traction, companies are expected to invest in tailored products that cater to individual health needs. Additionally, the integration of technology in product development, such as app-based tracking and AI-driven recommendations, will likely enhance consumer engagement and satisfaction, fostering market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Protein Powders (Whey, Casein, Plant-Based) Meal Replacement & Weight Management Powders Pre-Workout & Energy Powders Intra-Workout & Electrolyte Powders Post-Workout Recovery & BCAA Powders Collagen & Joint Health Powders Multivitamin, Multi-Mineral & Immunity Powders Others (Greens, Digestive Health, Specialty Blends) |

| By End-User | Professional Athletes & Bodybuilders Fitness Enthusiasts & Gym-Goers Lifestyle & Weight Management Consumers Elderly & Clinical Nutrition Users Students & Young Adults Others |

| By Distribution Channel | Online Retail & Marketplaces Supermarkets/Hypermarkets Specialty Nutrition & Health Food Stores Pharmacies & Drug Stores Gyms, Fitness Centers & Sports Clubs Direct Sales & Others |

| By Ingredient Source | Plant-Based & Vegan Powders Animal-Based Powders Synthetic & Fortified Blends Organic & Clean-Label Formulations |

| By Packaging Type | Rigid Tubs & Canisters Stand-Up Pouches & Bags Single-Serve Sachets & Stick Packs Others (Bulk Packs, Refill Packs) |

| By Price Range | Economy Mass-Market/Mid-Range Premium & Imported Ultra-Premium & Niche |

| By Consumer Demographics | Age Group (15–24, 25–34, 35–44, 45–54, 55+) Gender Income Level (Low, Middle, High) Nationality (Kuwaiti, Expatriate) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 100 | Store Managers, Product Buyers |

| Consumer Preferences | 150 | Health-Conscious Consumers, Fitness Enthusiasts |

| Industry Expert Opinions | 60 | Nutritionists, Health Coaches |

| Distribution Channel Analysis | 80 | Wholesalers, Distributors |

| Regulatory Impact Assessment | 40 | Regulatory Affairs Specialists, Compliance Officers |

The Kuwait Powder Dietary Supplements Market is valued at approximately USD 140 million, reflecting a significant growth trend driven by increasing health consciousness, fitness activities, and demand for sports nutrition products among consumers.