Region:Asia

Author(s):Geetanshi

Product Code:KRAC9439

Pages:99

Published On:November 2025

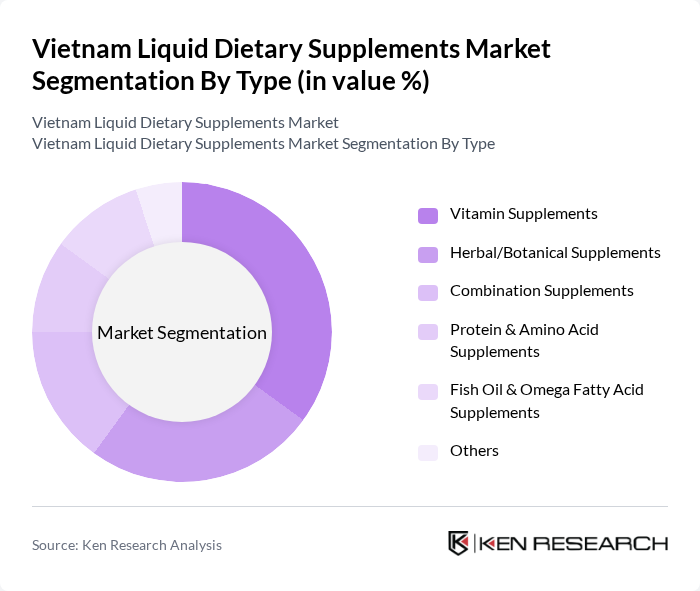

By Type:The liquid dietary supplements market in Vietnam is segmented into Vitamin Supplements, Herbal/Botanical Supplements, Combination Supplements, Protein & Amino Acid Supplements, Fish Oil & Omega Fatty Acid Supplements, and Others.Vitamin Supplementsremain the leading segment, driven by widespread consumer awareness of essential nutrients and their role in supporting immunity and general wellness.Herbal/Botanical Supplementsare gaining momentum, reflecting a shift toward natural and plant-based health solutions. The market also sees rapid growth inProtein & Amino Acid Supplements, fueled by fitness trends and the popularity of muscle recovery products among younger consumers.

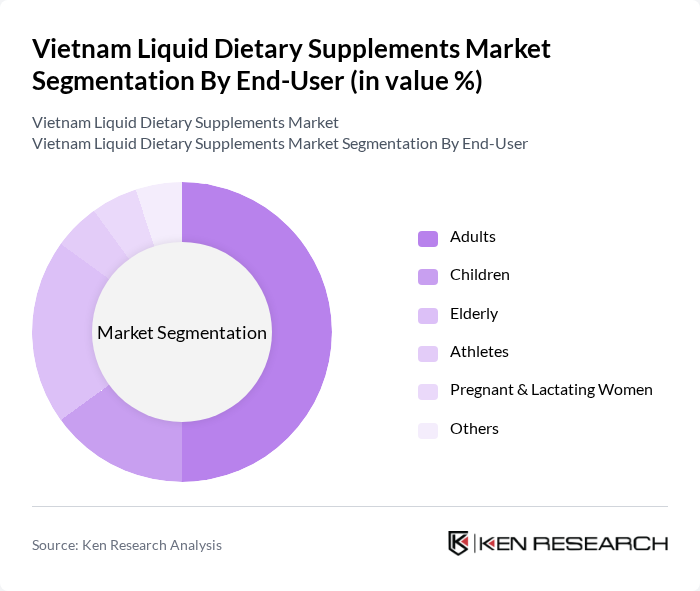

By End-User:The market is segmented by end-user categories: Adults, Children, Elderly, Athletes, Pregnant & Lactating Women, and Others.Adultsrepresent the largest segment, accounting for the majority of consumption due to heightened health awareness, preventive healthcare practices, and lifestyle-related nutritional needs. TheElderlysegment is also significant, reflecting the aging population's focus on supplements for age-related health support.

The Vietnam Liquid Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Vietnam Ltd., Nutrilite (Amway), Blackmores Limited, GNC Holdings, LLC, Nature's Way (Pharmavite LLC), USANA Health Sciences, Inc., Abbott Laboratories Vietnam, DSM Nutritional Products AG, Herbalife Vietnam Co., Ltd., Mega Lifesciences Public Company Limited (Mega We Care), Swisse Wellness Pty Ltd, Blackmores Vietnam Co., Ltd., DHG Pharmaceutical Joint Stock Company (DHG Pharma), Traphaco Joint Stock Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam liquid dietary supplements market appears promising, driven by increasing health awareness and the demand for convenient health solutions. As e-commerce continues to expand, brands will have greater opportunities to reach consumers directly. Additionally, the trend towards personalization in health products is expected to gain traction, allowing companies to tailor offerings to individual needs. This evolving landscape will likely foster innovation and collaboration within the industry, enhancing overall market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamin Supplements Herbal/Botanical Supplements Combination Supplements Protein & Amino Acid Supplements Fish Oil & Omega Fatty Acid Supplements Others |

| By End-User | Adults Children Elderly Athletes Pregnant & Lactating Women Others |

| By Distribution Channel | Pharmacies & Drug Stores Supermarkets/Hypermarkets Online Retail Health & Specialty Stores Others |

| By Ingredient Source | Natural Ingredients Synthetic Ingredients Organic Ingredients Others |

| By Packaging Type | Bottles Sachets Tetra Packs Ampoules Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Consumer Demographics | Gender Age Group Income Level Urban vs Rural Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 100 | Store Managers, Retail Buyers |

| Consumer Preferences | 120 | Health-Conscious Consumers, Fitness Enthusiasts |

| Distribution Channel Analysis | 80 | Wholesalers, Distributors |

| Regulatory Impact Assessment | 60 | Regulatory Affairs Specialists, Compliance Officers |

| Market Trend Evaluation | 70 | Market Analysts, Industry Experts |

The Vietnam Liquid Dietary Supplements Market is valued at approximately USD 50 million, reflecting a robust growth trend driven by increasing health consciousness and rising disposable incomes among consumers.