Region:Middle East

Author(s):Shubham

Product Code:KRAD3585

Pages:84

Published On:November 2025

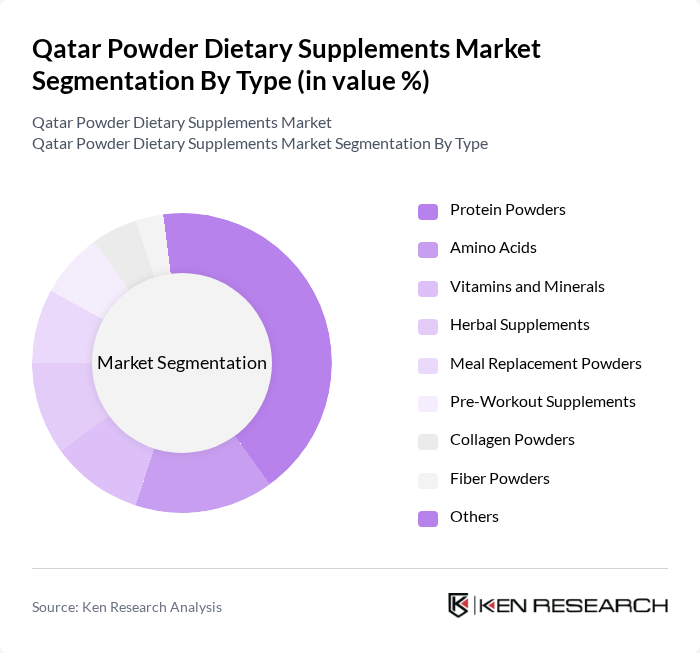

By Type:The market is segmented into various types of powder dietary supplements, including Protein Powders, Amino Acids, Vitamins and Minerals, Herbal Supplements, Meal Replacement Powders, Pre-Workout Supplements, Collagen Powders, Fiber Powders, and Others. Among these, Protein Powders are the most dominant segment, driven by the increasing popularity of fitness and bodybuilding among consumers. The demand for high-protein diets has led to a surge in the consumption of protein powders, particularly whey and plant-based options. Recent trends highlight the growing preference for plant-based and organic protein powders, as well as blends tailored for muscle recovery and weight management.

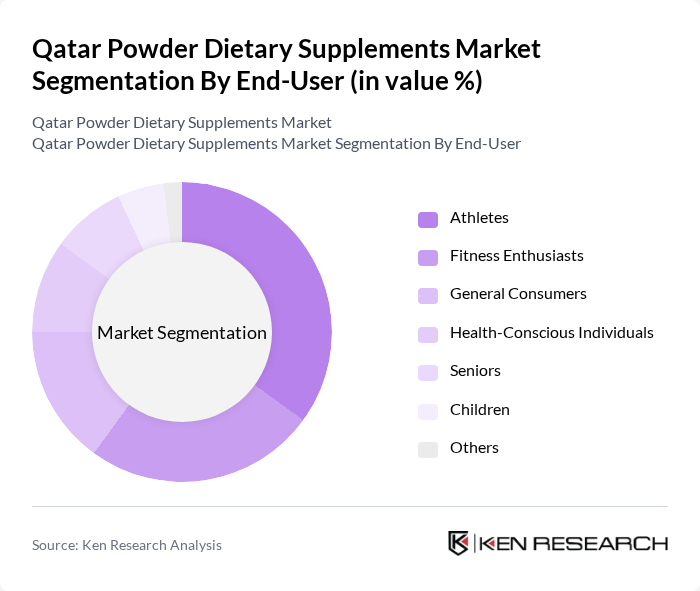

By End-User:The end-user segmentation includes Athletes, Fitness Enthusiasts, General Consumers, Health-Conscious Individuals, Seniors, Children, and Others. Athletes represent the largest segment, as they actively seek supplements to enhance performance and recovery. The growing trend of fitness and wellness has led to increased consumption among fitness enthusiasts and health-conscious individuals, further expanding the market. Hospitality businesses, such as hotels and cafes, are also increasingly offering supplement-based products, reflecting broader adoption across consumer segments.

The Qatar Powder Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Optimum Nutrition (Glanbia Performance Nutrition), BSN (Bio-Engineered Supplements and Nutrition, Inc.), MusclePharm Corporation, Myprotein (The Hut Group), GNC Holdings, LLC, Quest Nutrition (Simply Good Foods Co.), Dymatize Nutrition (BellRing Brands, Inc.), Isagenix International LLC, Garden of Life (Nestlé Health Science), NOW Foods, Vega (Danone S.A.), Health Plus (Qatar), Botanic Supplements (Qatar), BIOVEA Qatar, Abbott Laboratories, Inc., Holland & Barrett, Pfizer, Inc., Natures Aid, Olimp Labs contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar Powder Dietary Supplements Market is poised for significant growth, driven by increasing health awareness and the demand for convenient nutrition solutions. As the fitness and wellness industry expands, innovative product development will play a crucial role in attracting health-conscious consumers. Additionally, the rise of e-commerce platforms will facilitate easier access to dietary supplements, further enhancing market penetration. Companies that adapt to these trends and invest in consumer education will likely thrive in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Protein Powders Amino Acids Vitamins and Minerals Herbal Supplements Meal Replacement Powders Pre-Workout Supplements Collagen Powders Fiber Powders Others |

| By End-User | Athletes Fitness Enthusiasts General Consumers Health-Conscious Individuals Seniors Children Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies and Drug Stores Direct Sales Others |

| By Formulation | Powdered Form Ready-to-Drink Capsules/Tablets Soft Gels Others |

| By Age Group | Children Adults Seniors Others |

| By Health Benefit | Weight Management Muscle Gain Immunity Boosting Digestive Health Bone & Joint Health Energy & Vitality Others |

| By Packaging Type | Single-Serve Packs Bulk Packaging Retail Packs Sachets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 80 | Store Managers, Product Buyers |

| Consumer Preferences | 120 | Health-conscious Consumers, Fitness Enthusiasts |

| Industry Expert Opinions | 40 | Nutritionists, Health Coaches |

| Distribution Channel Analysis | 60 | Distributors, Wholesalers |

| Market Trend Evaluation | 50 | Market Analysts, Research Professionals |

The Qatar Powder Dietary Supplements Market is valued at approximately USD 50 million, reflecting a significant growth trend driven by increasing health consciousness, fitness activities, and preventive healthcare among consumers.