Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1191

Pages:89

Published On:November 2025

By Type:The market is segmented into Loose Snus, Portion Snus, Nicotine Pouches, Flavored Snus, and Others. Portion Snus is the leading sub-segment, favored for its convenience and ease of use, particularly among younger consumers who prefer discreet consumption. The demand for Flavored Snus continues to rise, driven by consumer interest in diverse flavors such as mint, berries, and dry fruit, which enhance the overall experience. Nicotine pouches, including tobacco-free options, are also gaining market share due to their appeal among health-conscious users .

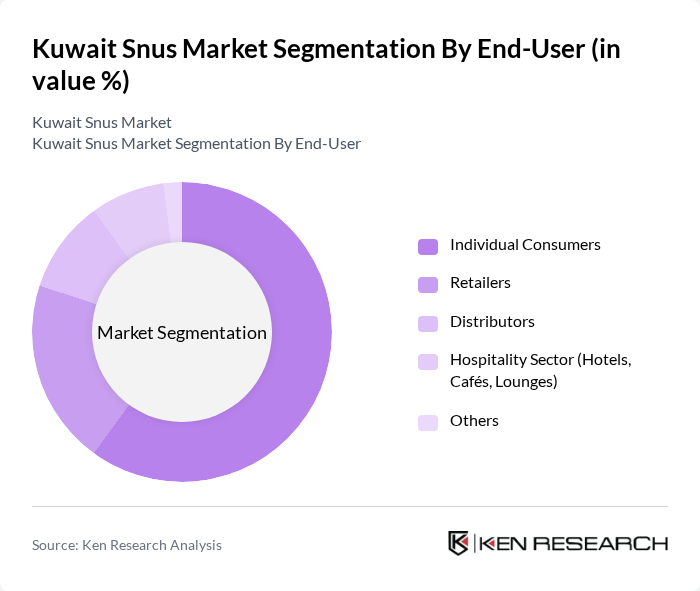

By End-User:The end-user segmentation includes Individual Consumers, Retailers, Distributors, the Hospitality Sector (Hotels, Cafés, Lounges), and Others. Individual Consumers dominate the market, reflecting a growing trend toward personal use of smokeless tobacco products. The hospitality sector is also significant, with establishments increasingly offering snus and nicotine pouches as part of their tobacco product range to cater to both local and expatriate customers. Retailers and distributors play a key role in expanding market access through both physical outlets and online channels .

The Kuwait Snus Market is characterized by a dynamic mix of regional and international players. Leading participants such as Swedish Match AB, Altria Group, Inc., British American Tobacco plc, Imperial Brands plc, Japan Tobacco International (JTI), Scandinavian Tobacco Group A/S, Reynolds American Inc., Philip Morris International Inc., GN Tobacco Sweden AB (Oden's Snus), Nordic Snus AB, Skruf Snus AB, Gotlandssnus AB (Jakobsson's Snus), Fiedler & Lundgren AB (General Snus, Catch Snus, Lundgrens), AG Snus, V2 Tobacco (Thunder Snus) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait snus market appears promising, driven by evolving consumer preferences and increasing health awareness. As disposable incomes rise, consumers are likely to seek premium and innovative snus products. Additionally, the expansion of e-commerce platforms will facilitate easier access to snus, enhancing market penetration. The focus on sustainability and organic ingredients is expected to resonate with health-conscious consumers, further driving demand for snus products in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Loose Snus Portion Snus Nicotine Pouches Flavored Snus Others |

| By End-User | Individual Consumers Retailers Distributors Hospitality Sector (Hotels, Cafés, Lounges) Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Convenience Stores Tobacco Specialty Stores Pharmacies Others |

| By Packaging Type | Cans Pouches Bulk Packaging Single-Serve Packs Others |

| By Flavor Profile | Mint Fruit (e.g., Berries, Citrus) Herbal/Spice Coffee/Chocolate Tobacco/Traditional Others |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Nationality (Kuwaiti, Expatriate) Others |

| By Market Maturity | Emerging Market Established Market Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Snus | 120 | Regular Snus Users, Occasional Smokers |

| Retail Insights on Snus Sales | 85 | Store Managers, Tobacco Product Retailers |

| Health Perspectives on Snus | 65 | Healthcare Professionals, Public Health Officials |

| Market Trends in Tobacco Alternatives | 55 | Industry Analysts, Market Researchers |

| Regulatory Impact Assessment | 50 | Regulatory Affairs Managers, Legal Advisors in Tobacco Regulation |

The Kuwait Snus Market is valued at approximately USD 120 million, reflecting a significant consumer shift towards smokeless tobacco products, particularly among younger demographics, and an increasing awareness of the health risks associated with traditional smoking.