Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7247

Pages:91

Published On:December 2025

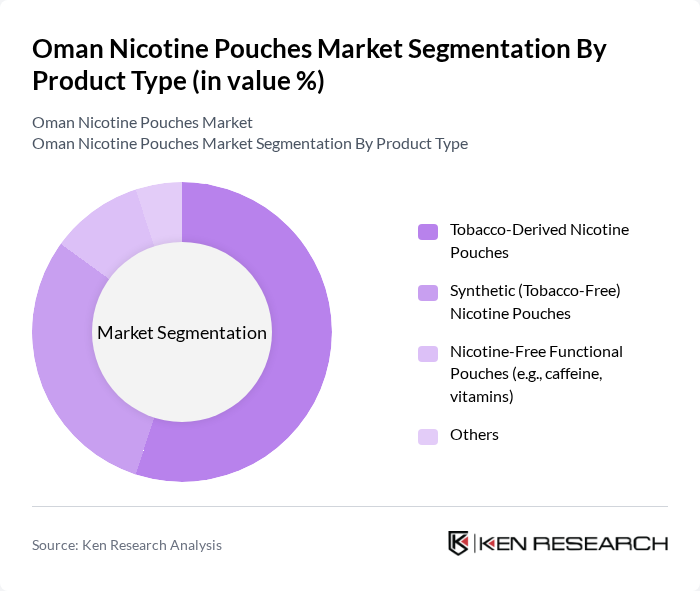

By Product Type:The market is segmented into various product types, including Tobacco-Derived Nicotine Pouches, Synthetic (Tobacco-Free) Nicotine Pouches, Nicotine-Free Functional Pouches (e.g., caffeine, vitamins), and Others. Among these, Tobacco-Derived Nicotine Pouches are currently leading the market due to their familiarity among consumers and the traditional appeal of tobacco-derived products. However, the rise of health-conscious consumers is gradually increasing the popularity of Synthetic Nicotine Pouches, which are perceived as a safer alternative. The demand for Nicotine-Free Functional Pouches is also growing, particularly among younger demographics seeking non-nicotine options for social use.

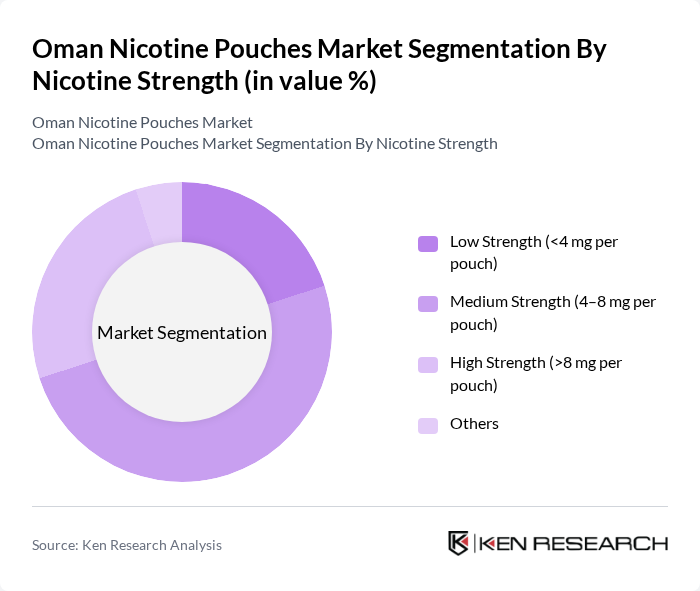

By Nicotine Strength:The segmentation by nicotine strength includes Low Strength (<4 mg per pouch), Medium Strength (4–8 mg per pouch), High Strength (>8 mg per pouch), and Others. The Medium Strength segment is currently the most popular among consumers, as it offers a balanced experience that appeals to both new users and those transitioning from traditional tobacco products. Low Strength pouches are gaining traction among health-conscious consumers, while High Strength options cater to experienced users seeking a more intense nicotine experience. The diversity in nicotine strength allows manufacturers to target a broader audience.

The Oman Nicotine Pouches Market is characterized by a dynamic mix of regional and international players. Leading participants such as Swedish Match AB (ZYN), Philip Morris International Inc. (Shiro, Veev Now, VELO in selected markets), British American Tobacco p.l.c. (VELO, Lyft), Altria Group, Inc. (On!), Imperial Brands PLC (Zone X, Skruf), Japan Tobacco International SA (Nordic Spirit, Logic), Reynolds American Inc. (part of British American Tobacco group), Hayati Group, White Fox (GN Tobacco Sweden AB), XQS International AB, V&YOU, Fedrs (FEDRS Nicotine Pouches), Skruf Snus AB, LOCAL OMANI & REGIONAL PRIVATE LABEL BRANDS (Travel Retail & E?commerce), Other Emerging Middle East & GCC Brands contribute to innovation, geographic expansion, and service delivery in this space.

The future of the nicotine pouches market in Oman appears promising, driven by evolving consumer preferences and increasing health awareness. As more individuals seek alternatives to traditional tobacco products, the demand for nicotine pouches is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate easier access to these products, further enhancing market growth. Companies that focus on product innovation and effective marketing strategies will likely capture a larger share of this emerging market segment in the future.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Tobacco-Derived Nicotine Pouches Synthetic (Tobacco-Free) Nicotine Pouches Nicotine-Free Functional Pouches (e.g., caffeine, vitamins) Others |

| By Nicotine Strength | Low Strength (<4 mg per pouch) Medium Strength (4–8 mg per pouch) High Strength (>8 mg per pouch) Others |

| By Flavor Category | Mint & Menthol Fruit & Citrus Coffee & Dessert Tobacco-Like Unflavoured / Original Others |

| By Sales Channel | Convenience Stores & Petrol Stations Supermarkets / Hypermarkets Specialty Vape & Tobacco Shops Cross-Border & Travel Retail (Duty Free) Online Retail & Marketplaces (Domestic & Cross-Border) Others |

| By Price Tier | Economy Mid-Range Premium & Imported Brands Others |

| By Consumer Profile | Adult Smokers Seeking Harm Reduction Dual Users (Cigarettes / Vapes & Pouches) Former Smokers Expatriates Others |

| By Gender and Age Group | Male (18–24, 25–34, 35–44, 45+) Female (18–24, 25–34, 35–44, 45+) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Distribution of Nicotine Pouches | 100 | Store Managers, Retail Buyers |

| Consumer Usage Patterns | 120 | Regular Users, Occasional Users |

| Market Entry Insights | 80 | Industry Analysts, Market Strategists |

| Regulatory Impact Assessment | 60 | Policy Makers, Health Officials |

| Distribution Channel Effectiveness | 90 | Wholesalers, Distributors |

The Oman Nicotine Pouches Market is valued at approximately USD 45 million, reflecting a significant growth trend driven by consumer preferences for smokeless alternatives and increasing health awareness regarding traditional tobacco products.