Region:Middle East

Author(s):Dev

Product Code:KRAC3464

Pages:80

Published On:October 2025

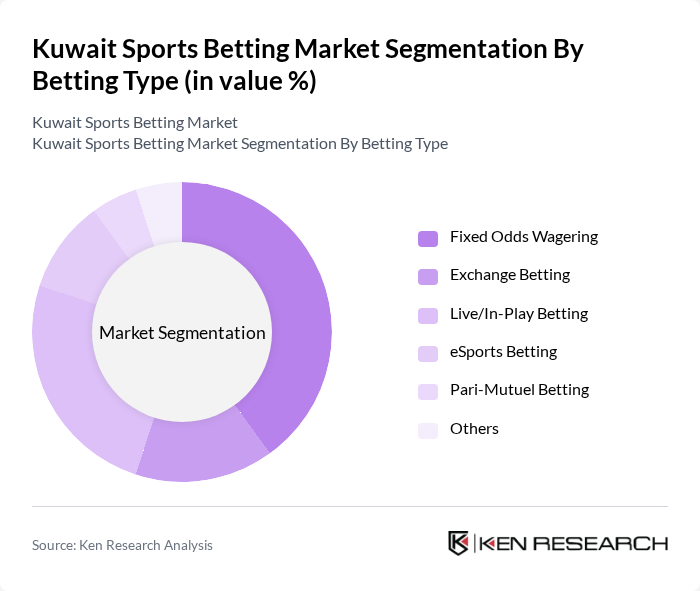

By Betting Type:The betting type segmentation includes various methods through which consumers engage in sports betting. The primary subsegments are Fixed Odds Wagering, Exchange Betting, Live/In-Play Betting, eSports Betting, Pari-Mutuel Betting, and Others. Among these, Fixed Odds Wagering is the most popular due to its straightforward nature, allowing bettors to place wagers on specific outcomes at predetermined odds. This simplicity appeals to both novice and experienced bettors, driving its dominance in the market.

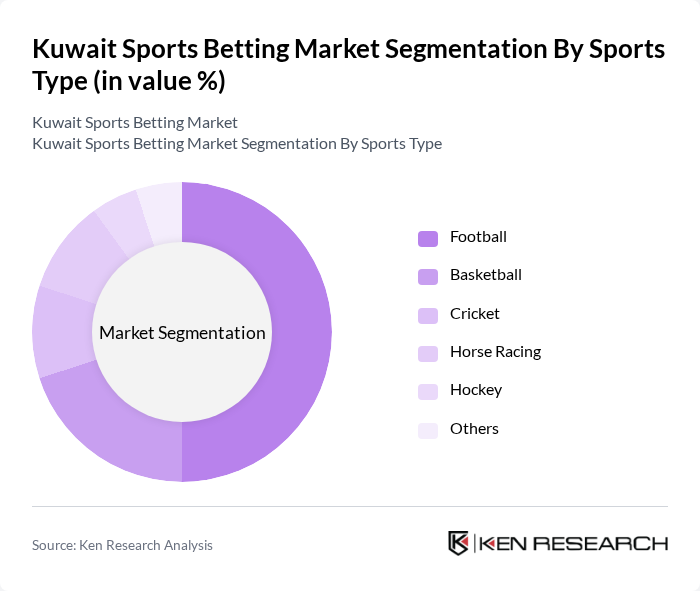

By Sports Type:The sports type segmentation encompasses various sports on which betting occurs. Key subsegments include Football, Basketball, Cricket, Horse Racing, Hockey, and Others. Football dominates this segment, driven by its immense popularity in the region and the global appeal of major leagues. The high frequency of matches and events provides ample opportunities for betting, making it the preferred choice among bettors.

The Kuwait Sports Betting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bet365, William Hill, Pinnacle Sports, 888 Holdings, Betfair, Unibet, Betway, DraftKings, FanDuel, BetMGM, LeoVegas, Bwin, Sportingbet, Interwetten, Casumo contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait sports betting market appears promising, driven by technological advancements and changing consumer behaviors. As smartphone usage continues to rise, more individuals are likely to engage in online betting. Additionally, the integration of innovative features such as live betting and data analytics will enhance user experiences. However, addressing regulatory challenges and cultural perceptions will be crucial for sustainable growth. The market is poised for transformation as operators adapt to these dynamics and explore new opportunities.

| Segment | Sub-Segments |

|---|---|

| By Betting Type | Fixed Odds Wagering Exchange Betting Live/In-Play Betting eSports Betting Pari-Mutuel Betting Others |

| By Sports Type | Football Basketball Cricket Horse Racing Hockey Others |

| By Platform | Online Platforms Mobile Applications Retail Betting Shops |

| By Payment Method | Credit/Debit Cards E-Wallets Bank Transfers Cryptocurrency |

| By Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender (Male, Female) Income Level (Low, Medium, High) |

| By Geographic Distribution | Urban Areas Rural Areas |

| By Regulatory Compliance | Licensed Operators Unlicensed Operators International Operators |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Sports Betting Users | 100 | Active bettors, ages 18-45 |

| Retail Sports Betting Outlets | 60 | Managers and staff of betting shops |

| Regulatory Authorities | 40 | Officials from the Ministry of Commerce and Industry |

| Market Analysts and Consultants | 50 | Industry analysts and market research professionals |

| Esports Betting Enthusiasts | 80 | Gamers and esports fans, ages 16-35 |

The Kuwait Sports Betting Market is valued at approximately USD 1.15 billion, reflecting a significant growth trend driven by the increasing popularity of sports, particularly football, and the rise of online betting platforms that enhance consumer accessibility.