Region:Middle East

Author(s):Rebecca

Product Code:KRAC9763

Pages:93

Published On:November 2025

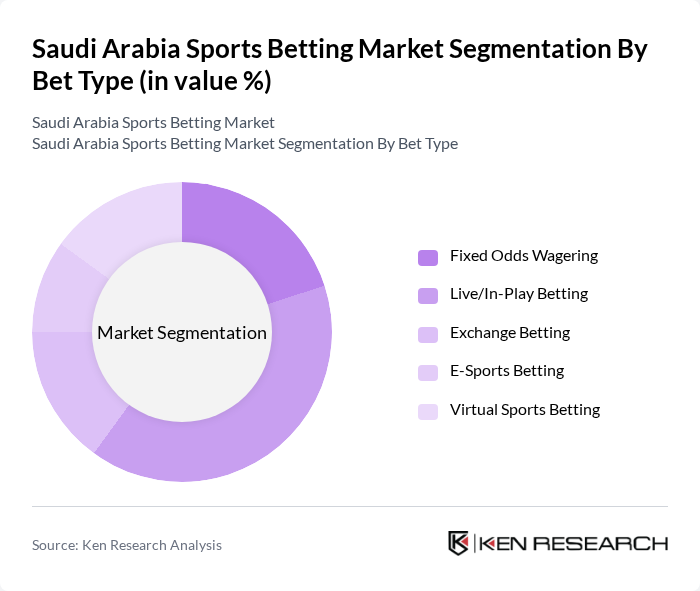

By Bet Type:

The sports betting market is segmented by bet type into Fixed Odds Wagering, Live/In-Play Betting, Exchange Betting, E-Sports Betting, and Virtual Sports Betting. Among these, Live/In-Play Betting is the most dominant segment, driven by the increasing demand for real-time betting experiences. Consumers are increasingly favoring the excitement of placing bets during live events, which enhances engagement and offers a more interactive experience. This trend is supported by advancements in technology, allowing bettors to access live data and make informed decisions quickly.

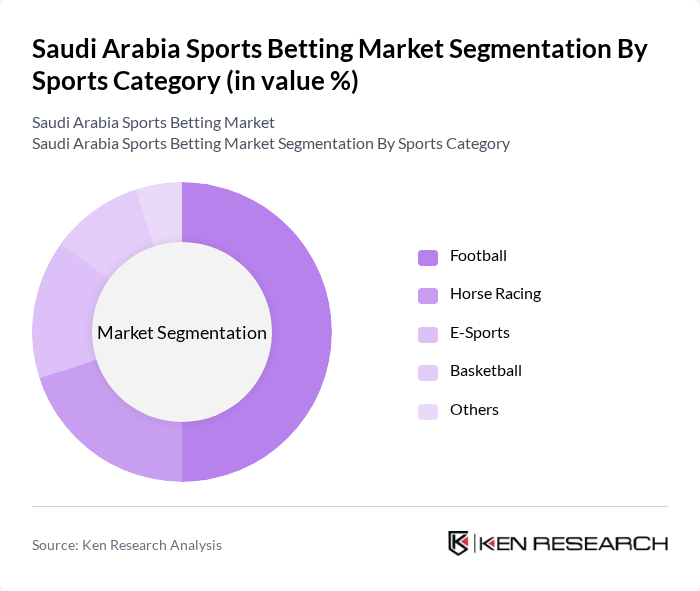

By Sports Category:

The market is also segmented by sports category, including Football, Horse Racing, E-Sports, Basketball, and Others. Football is the leading category, capturing the largest share of the market due to its immense popularity in Saudi Arabia and the Middle East. The country's investment in football infrastructure and hosting international events has further fueled interest. Additionally, the rise of E-Sports is notable, particularly among younger audiences, as it offers a new avenue for engagement and betting opportunities.

The Saudi Arabia Sports Betting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Betfinal, Bet365, Betway, William Hill, 888 Holdings, Unibet, Pinnacle Sports, Betfair, DraftKings, FanDuel, PointsBet, LeoVegas, Kambi Group, BetMakers Technology Group, EveryMatrix contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia sports betting market appears promising, driven by increasing government support and technological advancements. As the regulatory framework stabilizes, more operators are likely to enter the market, enhancing competition and innovation. Additionally, the growing popularity of e-sports and mobile applications will attract younger demographics, further expanding the consumer base. With a focus on responsible gambling and consumer protection, the market is poised for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Bet Type | Fixed Odds Wagering Live/In-Play Betting Exchange Betting E-Sports Betting Virtual Sports Betting |

| By Sports Category | Football Horse Racing E-Sports Basketball Others |

| By Betting Platform | Online Betting Mobile Betting Applications Retail Betting Shops Others |

| By Demographics | Gen X (11.58% CAGR) Millennials Gen Z Others |

| By Payment Method | Credit/Debit Cards E-wallets Bank Transfers Digital Wallets |

| By Geographic Distribution | Urban Areas Semi-Urban Areas Others |

| By Channel | Online Channels Offline Channels Virtual Reality (VR) Channels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Potential Sports Bettors | 120 | Individuals aged 18-45, interested in sports |

| Industry Experts | 40 | Regulatory officials, market analysts, and consultants |

| Sports Enthusiasts | 100 | Fans of major sports leagues and events in Saudi Arabia |

| Online Betting Platform Users | 60 | Current users of online betting services |

| Retail Betting Outlets | 40 | Managers and staff of physical betting locations |

The Saudi Arabia Sports Betting Market is valued at approximately USD 805 million, reflecting significant growth driven by the increasing popularity of sports, particularly football, and the expansion of digital platforms for online betting.