Region:Middle East

Author(s):Rebecca

Product Code:KRAD4195

Pages:98

Published On:December 2025

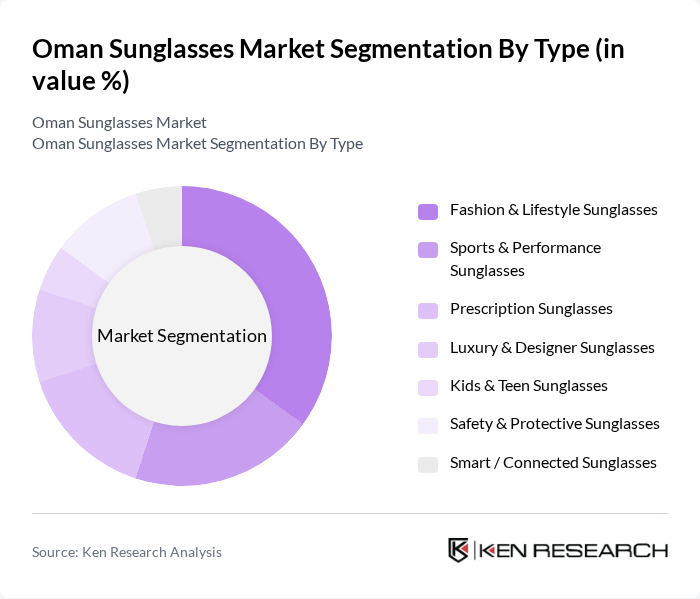

By Type:The sunglasses market can be segmented into various types, including Fashion & Lifestyle Sunglasses, Sports & Performance Sunglasses, Prescription Sunglasses, Luxury & Designer Sunglasses, Kids & Teen Sunglasses, Safety & Protective Sunglasses, and Smart / Connected Sunglasses. Among these, Fashion & Lifestyle Sunglasses dominate the market due to their appeal to a broad consumer base, driven by fashion trends, social media influence, and the presence of global brands in organized retail and online channels. The increasing focus on personal style, brand consciousness among young adults and professionals, and the popularity of polarized and UV-protective lenses in everyday wear have led to a sustained surge in demand for fashionable eyewear in Oman.

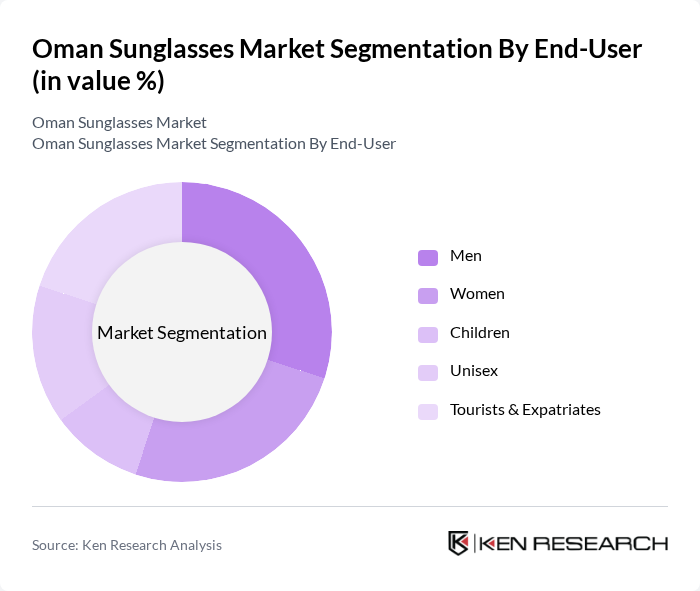

By End-User:The end-user segmentation includes Men, Women, Children, Unisex, and Tourists & Expatriates. The market is primarily driven by men and women, who are increasingly purchasing sunglasses as fashion accessories and for UV-related eye protection in Oman’s high-sunlight climate. The growing trend of outdoor leisure, beach tourism, desert activities, and sports, combined with a sizable tourist and expatriate base shopping in duty-free, malls, and online channels, also contributes significantly to the market as these consumers seek stylish, functional, and often branded eyewear.

The Oman Sunglasses Market is characterized by a dynamic mix of regional and international players. Leading participants such as EssilorLuxottica (Ray-Ban, Oakley, Vogue Eyewear, Persol), Safilo Group (Carrera, Polaroid Eyewear), Kering Eyewear (Gucci, Saint Laurent, Balenciaga), LVMH – Thélios (Dior, Fendi, Celine), De Rigo Vision (Police, Lozza), Marchon Eyewear (Calvin Klein, Nike, Lacoste), Marcolin (Tom Ford, Guess, Michael Kors), MAGRABi Retail Group (MAGRABi, Rivoli Vision partnership), Rivoli Vision (Optics & Sunglasses Retail in Oman), Grand Optics, Vision Express (Middle East), Al Jaber Optical, Solaris (Sunglasses Specialty Retail), Amazon.sa & Noon.com (Online Sunglasses Retail in Oman), Namshi (Online Fashion & Eyewear Retail) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman sunglasses market appears promising, driven by evolving consumer preferences and technological advancements. The increasing integration of smart technology in eyewear is expected to attract tech-savvy consumers, while the rise of e-commerce platforms will facilitate broader market access. Additionally, the focus on sustainability will likely shape product offerings, as consumers increasingly seek eco-friendly options. These trends indicate a dynamic market landscape poised for growth and innovation in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Fashion & Lifestyle Sunglasses Sports & Performance Sunglasses Prescription Sunglasses Luxury & Designer Sunglasses Kids & Teen Sunglasses Safety & Protective Sunglasses Smart / Connected Sunglasses |

| By End-User | Men Women Children Unisex Tourists & Expatriates |

| By Distribution Channel | Optical Retail Chains Department Stores & Fashion Boutiques Supermarkets/Hypermarkets Travel Retail (Airports & Duty-Free) Online Channels (E-commerce & Brand Websites) |

| By Material | Plastic & Acetate Metal & Alloy Mixed / Combination Frames Polycarbonate & Other Performance Materials Sustainable / Bio-based Materials |

| By Price Range | Mass / Value (Entry Level) Mid-Range Premium Luxury Ultra-Luxury |

| By Brand Type | International Licensed Brands Regional Middle East Brands Local Optical Private Labels Sports & Outdoor Brands |

| By Occasion / Usage | Everyday Casual Wear Beach, Travel & Tourism Sports & Outdoor Activities Work & Occupational Protection Special Events & Fashion Occasions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Insights | 100 | Store Managers, Retail Buyers |

| Consumer Preferences Survey | 150 | General Consumers, Fashion Enthusiasts |

| Distribution Channel Analysis | 80 | Wholesalers, Distributors |

| Market Trend Evaluation | 60 | Fashion Influencers, Optometrists |

| Tourism Impact Assessment | 50 | Travel Agencies, Tour Operators |

The Oman sunglasses market is valued at approximately USD 12 million, reflecting a five-year historical analysis of domestic consumption and eyewear spending patterns. This growth is driven by increased consumer awareness and fashion trends.