Region:Middle East

Author(s):Shubham

Product Code:KRAC4251

Pages:93

Published On:October 2025

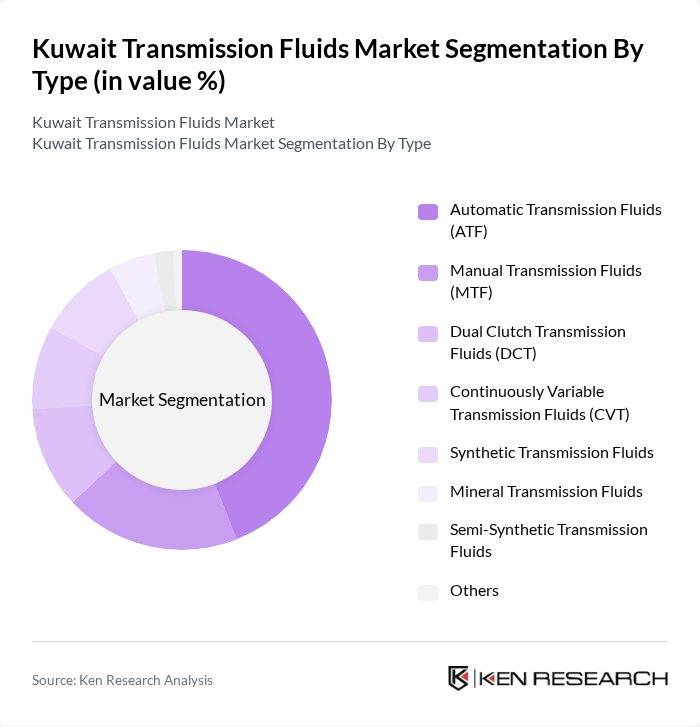

By Type:The transmission fluids market can be segmented into various types, including Automatic Transmission Fluids (ATF), Manual Transmission Fluids (MTF), Dual Clutch Transmission Fluids (DCT), Continuously Variable Transmission Fluids (CVT), Synthetic Transmission Fluids, Mineral Transmission Fluids, Semi-Synthetic Transmission Fluids, and Others. Among these, Automatic Transmission Fluids (ATF) dominate the market due to their widespread use in modern vehicles, which increasingly feature automatic transmissions. The growing preference for convenience and ease of driving has led to a surge in demand for ATF, making it the leading subsegment in the market. The adoption of synthetic and semi-synthetic formulations is also increasing, driven by the need for higher thermal stability and longer service intervals.

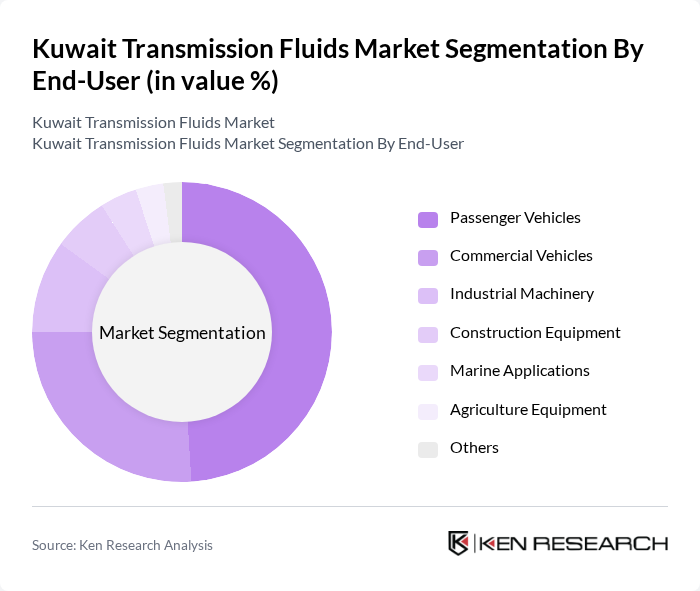

By End-User:The end-user segmentation of the transmission fluids market includes Passenger Vehicles, Commercial Vehicles, Industrial Machinery, Construction Equipment, Marine Applications, Agriculture Equipment, and Others. The Passenger Vehicles segment holds the largest share, driven by the increasing number of personal vehicles and the growing trend of vehicle ownership in Kuwait. The rise in disposable income and urbanization has led to a higher demand for passenger vehicles, thereby boosting the consumption of transmission fluids in this segment. Demand from commercial vehicles and construction equipment is also growing due to ongoing infrastructure projects and expansion in logistics and fleet operations.

The Kuwait Transmission Fluids Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Corporation, Shell PLC, TotalEnergies SE, Chevron Corporation, Fuchs Petrolub SE, BP Castrol, Valvoline Inc., Gulf Oil International, LUKOIL, PETRONAS Lubricants International, Mobil 1 (ExxonMobil Brand), Amsoil Inc., Red Line Synthetic Oil, Liqui Moly GmbH, and Motul S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait transmission fluids market is poised for significant transformation driven by technological advancements and evolving consumer preferences. As the automotive industry increasingly embraces electric vehicles, the demand for specialized transmission fluids will rise. Additionally, the focus on sustainability will encourage the development of bio-based fluids, aligning with global environmental goals. Manufacturers are expected to invest heavily in research and development, fostering innovation and enhancing product offerings to meet the changing landscape of the automotive sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Automatic Transmission Fluids (ATF) Manual Transmission Fluids (MTF) Dual Clutch Transmission Fluids (DCT) Continuously Variable Transmission Fluids (CVT) Synthetic Transmission Fluids Mineral Transmission Fluids Semi-Synthetic Transmission Fluids Others |

| By End-User | Passenger Vehicles Commercial Vehicles Industrial Machinery Construction Equipment Marine Applications Agriculture Equipment Others |

| By Application | Factory Fill Aftermarket/Service Fill Off-Road Vehicles Performance Vehicles Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Platforms Distributors/Dealers Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Others |

| By Price Range | Economy Mid-Range Premium |

| By Brand | Established Brands Emerging Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive OEMs | 50 | Product Development Managers, Procurement Officers |

| Aftermarket Suppliers | 40 | Sales Managers, Distribution Heads |

| Automotive Service Centers | 60 | Workshop Managers, Service Advisors |

| Fluid Manufacturers | 40 | R&D Managers, Quality Control Specialists |

| Industry Experts | 40 | Consultants, Market Analysts |

The Kuwait Transmission Fluids Market is valued at approximately USD 120 million, reflecting a five-year historical analysis and normalization against regional lubricant consumption trends in the Middle East.