Region:Middle East

Author(s):Shubham

Product Code:KRAA8571

Pages:86

Published On:November 2025

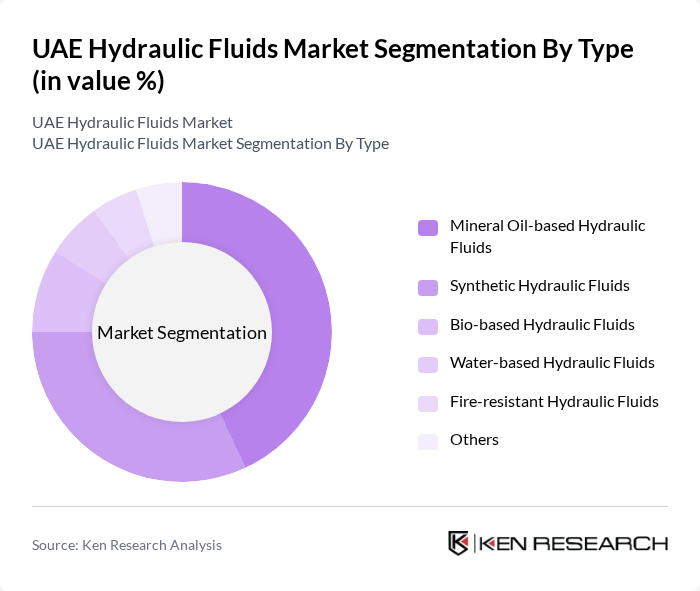

By Type:The hydraulic fluids market in the UAE is segmented into Mineral Oil-based Hydraulic Fluids, Synthetic Hydraulic Fluids, Bio-based Hydraulic Fluids, Water-based Hydraulic Fluids, Fire-resistant Hydraulic Fluids, and Others. Mineral Oil-based Hydraulic Fluids hold the largest share, attributed to their cost-effectiveness and widespread use in industrial and mobile equipment. Synthetic Hydraulic Fluids are gaining popularity for their superior performance under extreme temperatures and longer service life, while Bio-based Hydraulic Fluids are increasingly adopted in sectors prioritizing environmental compliance and sustainability.

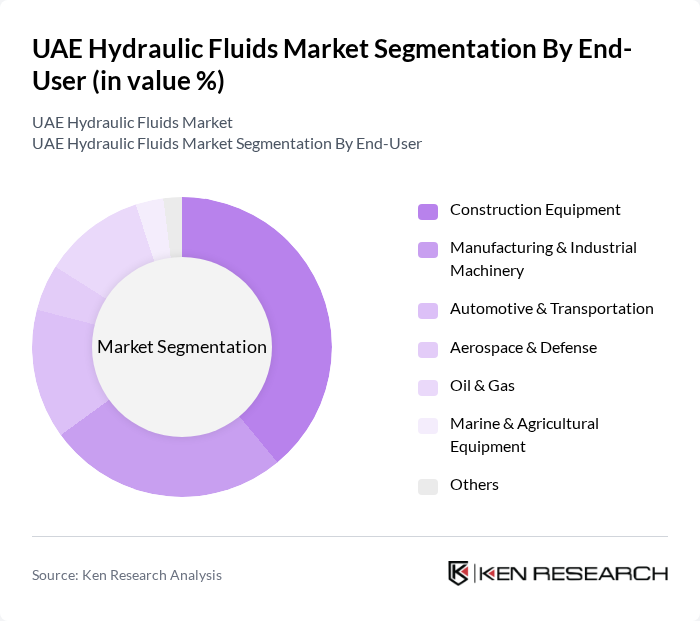

By End-User:The main end-user segments in the UAE hydraulic fluids market are Construction Equipment, Manufacturing & Industrial Machinery, Automotive & Transportation, Aerospace & Defense, Oil & Gas, Marine & Agricultural Equipment, and Others. Construction Equipment leads due to the country’s ongoing infrastructure expansion, while Manufacturing & Industrial Machinery follows, driven by increased automation and investment in advanced production facilities. Automotive & Transportation and Oil & Gas also represent significant demand centers, reflecting the UAE’s diversified industrial landscape.

The UAE Hydraulic Fluids Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil, Shell, TotalEnergies, Chevron, Fuchs Petrolub SE, Castrol (BP), BP, Lukoil, Gulf Oil International, Klüber Lubrication, ENOC (Emirates National Oil Company), ADNOC (Abu Dhabi National Oil Company), Valvoline, Chevron Phillips Chemical, Afton Chemical, BASF, Petromin Corporation, and Repsol contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE hydraulic fluids market appears promising, driven by ongoing investments in infrastructure and technological advancements. As the construction and manufacturing sectors continue to expand, the demand for high-performance and eco-friendly hydraulic fluids is expected to rise. Additionally, the integration of smart technologies in hydraulic systems will likely enhance operational efficiency, creating new opportunities for innovation and product development in the market. Companies that adapt to these trends will be well-positioned for growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Mineral Oil-based Hydraulic Fluids Synthetic Hydraulic Fluids Bio-based Hydraulic Fluids Water-based Hydraulic Fluids Fire-resistant Hydraulic Fluids Others |

| By End-User | Construction Equipment Manufacturing & Industrial Machinery Automotive & Transportation Aerospace & Defense Oil & Gas Marine & Agricultural Equipment Others |

| By Application | Mobile Hydraulic Systems Stationary Hydraulic Systems Industrial Machinery Mining Equipment Marine Applications Agricultural Equipment Others |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Sales Retail Outlets Gasoline Stations Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Performance Characteristics | High-Temperature Fluids Low-Temperature Fluids High-Pressure Fluids Multi-Functional Fluids Biodegradable/Environmentally Friendly Fluids Others |

| By Packaging Type | Bulk Packaging Drums Containers Pails Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Hydraulic Fluids | 100 | Product Managers, Automotive Engineers |

| Industrial Hydraulic Applications | 80 | Operations Managers, Plant Engineers |

| Construction Equipment Fluids | 60 | Procurement Managers, Equipment Operators |

| Aerospace Hydraulic Systems | 40 | Quality Assurance Managers, Aerospace Engineers |

| Marine Hydraulic Fluids | 50 | Marine Engineers, Fleet Managers |

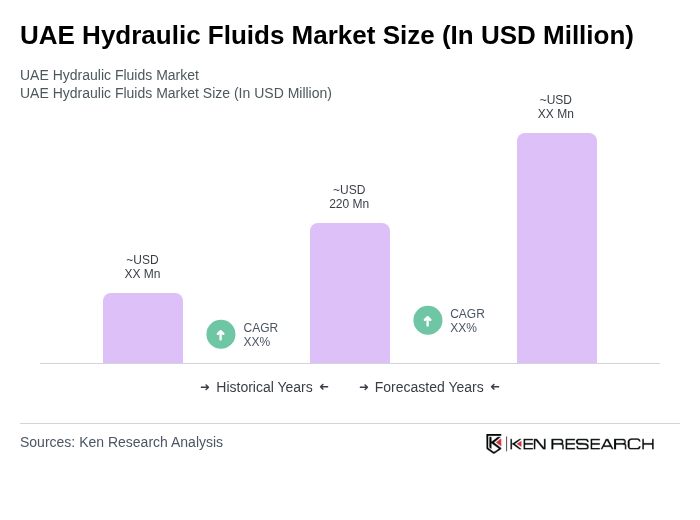

The UAE Hydraulic Fluids Market is valued at approximately USD 220 million, reflecting robust growth driven by industrial automation, construction, and manufacturing demands, as well as advancements in hydraulic fluid formulations to meet performance and environmental standards.