Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7310

Pages:99

Published On:December 2025

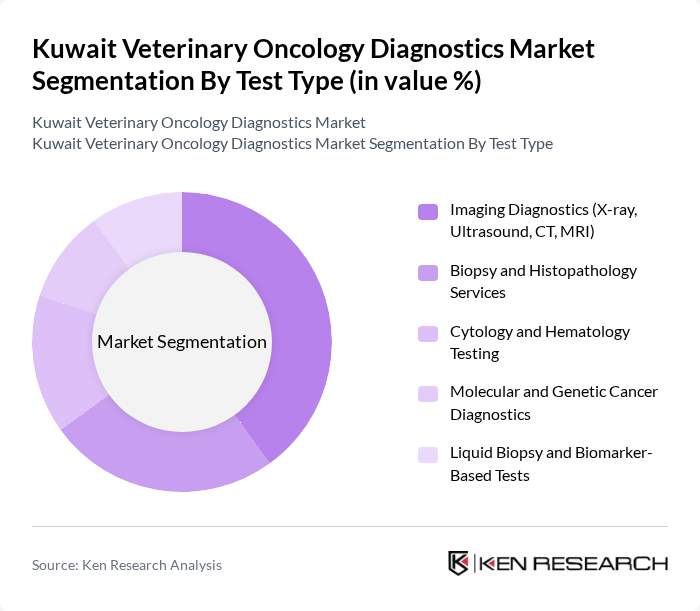

By Test Type:The test type segmentation includes various diagnostic methods utilized in veterinary oncology. The subsegments are Imaging Diagnostics (X-ray, Ultrasound, CT, MRI), Biopsy and Histopathology Services, Cytology and Hematology Testing, Molecular and Genetic Cancer Diagnostics, and Liquid Biopsy and Biomarker-Based Tests. Among these, Imaging Diagnostics is currently the leading subsegment due to its critical role in the early detection and monitoring of tumors in animals. The increasing adoption of advanced imaging technologies and the growing demand for precise diagnostics are driving this trend.

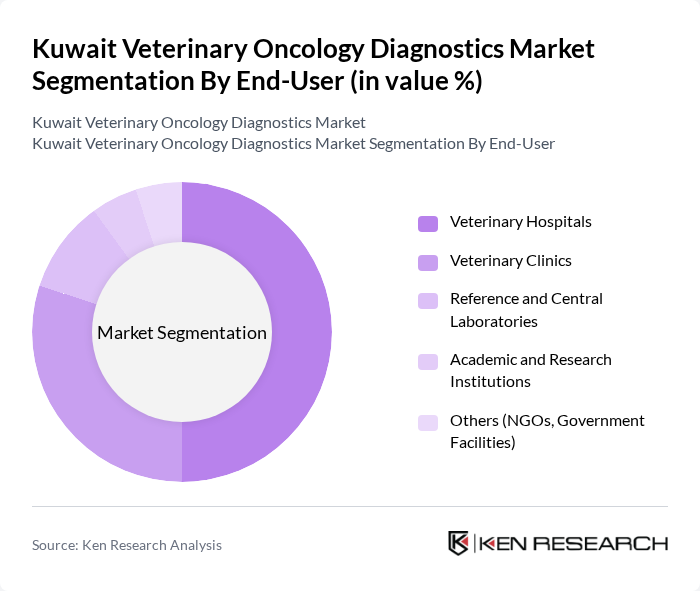

By End-User:The end-user segmentation encompasses various entities that utilize veterinary oncology diagnostics. This includes Veterinary Hospitals, Veterinary Clinics, Reference and Central Laboratories, Academic and Research Institutions, and Others (NGOs, Government Facilities). Veterinary Hospitals are the leading end-user segment, primarily due to their comprehensive services and advanced diagnostic capabilities. The increasing number of pet owners seeking specialized care and the growing trend of pet insurance are contributing to the expansion of this segment.

The Kuwait Veterinary Oncology Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as IDEXX Laboratories Inc., Zoetis Inc., Antech Diagnostics (Mars, Inc.), AbbVie Inc. (including Telix / Elanco oncology diagnostics collaborations where applicable), Elanco Animal Health Incorporated, Boehringer Ingelheim Vetmedica GmbH, Virbac SA, FUJIFILM Holdings Corporation (Veterinary Imaging), Esaote SpA (Veterinary Imaging Solutions), Thermo Fisher Scientific Inc., PetDx Inc., Oncotect Inc., Embark Veterinary Inc. (Genetic Testing), Local Veterinary Diagnostic Centers in Kuwait (e.g., Kuwait Veterinary Hospital Laboratory Services), Regional Reference Laboratories Serving Kuwait (e.g., Dubai-based and GCC Veterinary Labs) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the veterinary oncology diagnostics market in Kuwait appears promising, driven by increasing pet ownership and advancements in diagnostic technologies. As pet owners become more aware of cancer's prevalence, demand for specialized services is expected to rise. Additionally, the integration of telemedicine and the growth of pet insurance covering oncology treatments will likely enhance access to care. These trends indicate a shift towards more comprehensive and personalized veterinary services, fostering a supportive environment for market expansion.

| Segment | Sub-Segments |

|---|---|

| By Test Type | Imaging Diagnostics (X?ray, Ultrasound, CT, MRI) Biopsy and Histopathology Services Cytology and Hematology Testing Molecular and Genetic Cancer Diagnostics Liquid Biopsy and Biomarker-Based Tests |

| By End-User | Veterinary Hospitals Veterinary Clinics Reference and Central Laboratories Academic and Research Institutions Others (NGOs, Government Facilities) |

| By Animal Type | Canine (Dogs) Feline (Cats) Equine (Horses) Small Mammals and Exotic Pets Livestock and Production Animals |

| By Diagnostic Method | Histopathology and Immunohistochemistry Cytology and Fine-Needle Aspiration Imaging Techniques (Radiography, Ultrasound, Advanced Imaging) Blood-Based and Serum Biomarker Tests Molecular Assays (PCR, NGS, Genomic Panels) |

| By Region | Capital Governorate (Kuwait City) Hawalli Governorate Al Ahmadi Governorate Al Jahra Governorate Farwaniya & Mubarak Al-Kabeer Governorates |

| By Service Type | Diagnostic Testing Services Oncology Consultation and Case Review Treatment Planning and Monitoring Support Teleconsultation and Teleradiology / Telepathology Training, Reporting, and Second-Opinion Services |

| By Technology | Conventional Microscopy and Staining Techniques Digital Pathology and Advanced Imaging Technologies Molecular and Genomic Testing Platforms Point-of-Care and In-Clinic Diagnostic Systems Telemedicine-Enabled Diagnostic Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics Offering Oncology Services | 100 | Veterinarians, Clinic Owners |

| Diagnostic Laboratories Specializing in Veterinary Oncology | 75 | Laboratory Managers, Pathologists |

| Pet Owners with Oncology Diagnosed Pets | 50 | Pet Owners, Caregivers |

| Veterinary Hospitals with Oncology Departments | 60 | Oncologists, Hospital Administrators |

| Industry Experts and Consultants in Veterinary Medicine | 40 | Veterinary Consultants, Academic Researchers |

The Kuwait Veterinary Oncology Diagnostics Market is valued at approximately USD 3 million, reflecting a growing demand driven by the increasing prevalence of cancer in pets and advancements in veterinary diagnostic technologies.