Region:Middle East

Author(s):Rebecca

Product Code:KRAC3969

Pages:99

Published On:October 2025

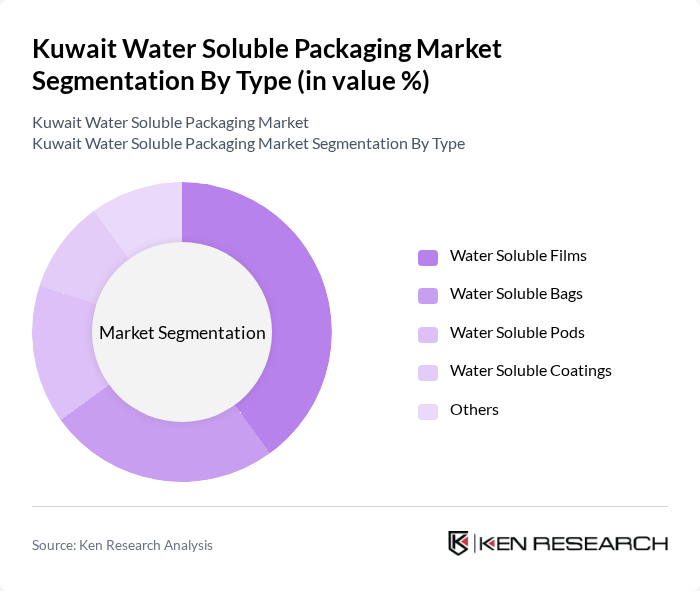

By Type:The market is segmented into various types of water-soluble packaging, including Water Soluble Films, Water Soluble Bags, Water Soluble Pods, Water Soluble Coatings, and Others. Among these, Water Soluble Films are gaining significant traction due to their versatility and wide application in various sectors. Globally, polyvinyl alcohol (PVA)-based films are the dominant product type, favored for their dissolution performance and compatibility with high-speed filling operations in consumer goods production.

Water Soluble Films dominate the market due to their extensive use in packaging applications, particularly in the food and beverage industry. Their ability to dissolve in water makes them an ideal choice for single-use packaging, which aligns with the growing consumer preference for sustainable and eco-friendly products. Additionally, advancements in film technology have improved their strength and barrier properties, further driving their adoption across various sectors. Recent innovations include the development of cold-water soluble films and multi-chamber pod designs, which are gaining traction in both household and industrial applications.

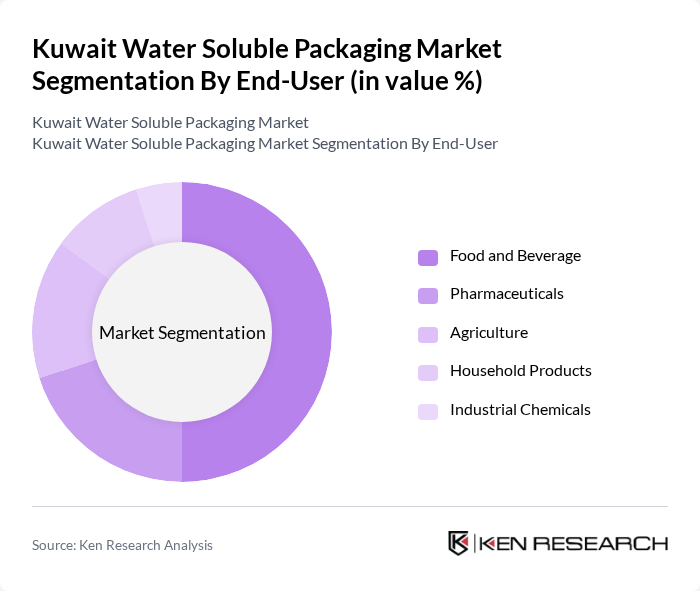

By End-User:The end-user segmentation includes Food and Beverage, Pharmaceuticals, Agriculture, Household Products, Industrial Chemicals, and Others. The Food and Beverage sector is the largest consumer of water-soluble packaging due to the increasing demand for convenient and sustainable packaging solutions. Globally, detergents and cleaning products account for the largest application share, but in Kuwait, the food and beverage segment is particularly prominent, driven by consumer demand for single-dose, mess-free formats.

The Food and Beverage sector leads the market due to the rising consumer preference for single-use, environmentally friendly packaging options. The convenience of water-soluble packaging for products like instant beverages and ready-to-eat meals has significantly contributed to its popularity. Additionally, the pharmaceutical industry is also witnessing growth in the adoption of water-soluble packaging for its ability to enhance product safety and shelf life. The household products segment is expanding as well, with increasing use of water-soluble pods for laundry and dishwasher applications, reflecting global trends toward unit-dose convenience and sustainability.

The Kuwait Water Soluble Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mondi Group, BASF SE, Kuraray Co., Ltd., Aquapak Polymers Ltd., Amcor plc, Innovia Films, BioBag International AS, NatureWorks LLC, Soltec International, TIPA Corp, Ahlstrom-Munksjö, Huhtamaki Group, DuPont de Nemours, Inc., Berry Global, Inc., Sealed Air Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the water-soluble packaging market in Kuwait appears promising, driven by ongoing technological advancements and increasing regulatory support for sustainable practices. As consumer preferences shift towards eco-friendly solutions, manufacturers are likely to invest in innovative materials and production techniques. Additionally, the government's commitment to reducing plastic waste will further enhance market dynamics, fostering a competitive landscape that prioritizes sustainability and environmental responsibility in packaging solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Water Soluble Films Water Soluble Bags Water Soluble Pods Water Soluble Coatings Others |

| By End-User | Food and Beverage Pharmaceuticals Agriculture Household Products Industrial Chemicals Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales B2B Distributors Others |

| By Application | Packaging for Liquids Packaging for Powders Packaging for Granules Packaging for Solid Products Agrochemical Delivery Detergent Pods Others |

| By Material Type | Polyvinyl Alcohol (PVA) Starch-Based Materials Polyethylene Glycol (PEG) Polyvinyl Acetate Derivatives Others |

| By Region | Kuwait Middle East (Ex-Kuwait) Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 100 | Packaging Managers, Product Development Leads |

| Pharmaceutical Packaging Solutions | 80 | Regulatory Affairs Specialists, Quality Assurance Managers |

| Agricultural Film Applications | 70 | Agronomists, Supply Chain Coordinators |

| Personal Care Product Packaging | 50 | Brand Managers, Sustainability Officers |

| Retail Sector Insights | 60 | Retail Buyers, Sustainability Consultants |

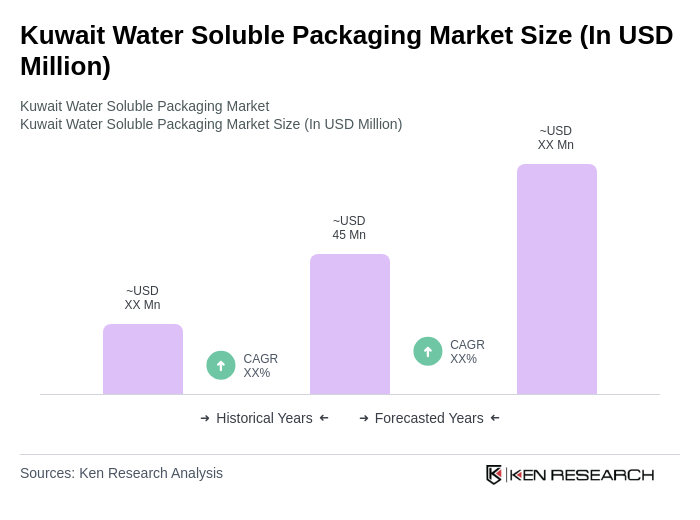

The Kuwait Water Soluble Packaging Market is valued at approximately USD 45 million, reflecting a significant growth trend driven by increasing environmental awareness and the demand for sustainable packaging solutions across various sectors, particularly food and beverage and pharmaceuticals.