Region:Middle East

Author(s):Rebecca

Product Code:KRAC8427

Pages:97

Published On:November 2025

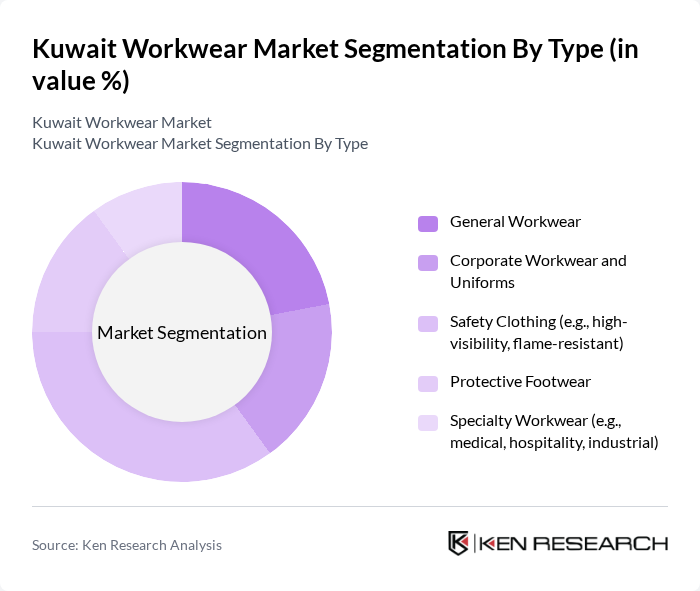

By Type:The workwear market is segmented into General Workwear, Corporate Workwear and Uniforms, Safety Clothing, Protective Footwear, and Specialty Workwear. Each segment addresses distinct industry requirements and consumer preferences, with a growing trend toward functional, fashionable, and gender-specific designs to enhance comfort and safety .

TheSafety Clothingsegment leads the market, reflecting the impact of stricter safety regulations and increased employer awareness of workplace hazards. High-visibility and flame-resistant apparel are especially in demand in construction and oil and gas, where risk mitigation is a priority. The segment’s growth is reinforced by ongoing infrastructure projects and the adoption of international safety standards .

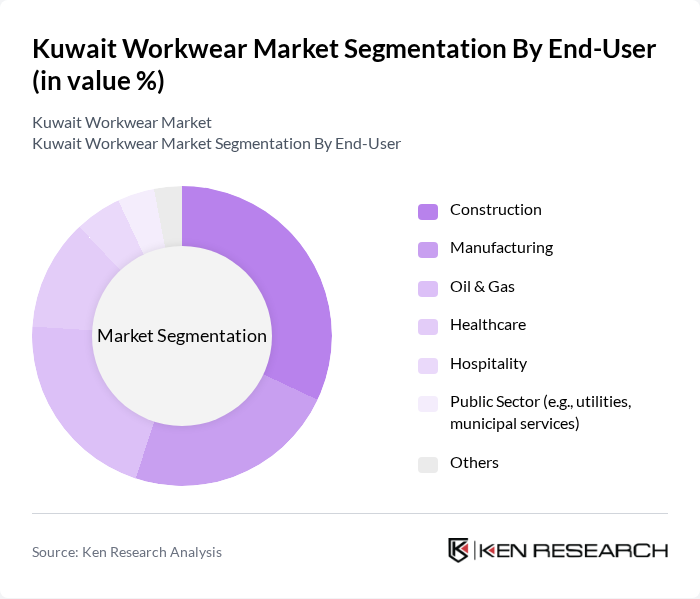

By End-User:The workwear market is segmented by end-user industries, including Construction, Manufacturing, Oil & Gas, Healthcare, Hospitality, Public Sector, and Others. Each segment reflects unique safety, durability, and branding requirements, with a notable shift toward customized and sector-specific solutions .

TheConstructionsector is the largest end-user, fueled by large-scale infrastructure projects and strict enforcement of safety standards. The Oil & Gas and Manufacturing sectors also represent significant demand, driven by hazardous work environments and the need for specialized protective apparel. Healthcare and hospitality are emerging segments, reflecting broader adoption of uniforms and infection-control garments .

The Kuwait Workwear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Mufeed Workwear, Gulf Safety Equips Trading Co., Al Khatib Group, Alshaya Group, Al Mulla Group, KWD Uniforms, Al Jazeera Safety & Security Co., Al Fawaz Group, Al Sayer Group, Al Kharafi Group, United Workwear Co., Al Muthanna Group, Al Zayani Group, Industrial Uniforms Co., and Al Safat Safety & Security contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait workwear market appears promising, driven by ongoing investments in infrastructure and heightened safety regulations. As the government continues to prioritize workplace safety, the demand for compliant workwear is expected to rise. Additionally, the integration of smart technology and sustainable materials into workwear design will likely attract a new customer base, enhancing market growth. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | General Workwear Corporate Workwear and Uniforms Safety Clothing (e.g., high-visibility, flame-resistant) Protective Footwear Specialty Workwear (e.g., medical, hospitality, industrial) |

| By End-User | Construction Manufacturing Oil & Gas Healthcare Hospitality Public Sector (e.g., utilities, municipal services) Others |

| By Distribution Channel | Direct Sales Retail Stores E-Commerce Rental Services Others |

| By Material | Cotton Polyester Blends (e.g., poly-cotton) Specialty Fabrics (e.g., flame-retardant, antimicrobial) Others |

| By Region | Kuwait City Al Ahmadi Hawalli Jahra Farwaniya Mubarak Al-Kabeer Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Brand | Local Brands International Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Workwear | 100 | Site Managers, Safety Officers |

| Healthcare Sector Uniforms | 80 | Nursing Supervisors, Procurement Managers |

| Manufacturing Safety Gear | 70 | Production Managers, Quality Control Inspectors |

| Corporate Workwear Solutions | 50 | HR Managers, Office Administrators |

| Retail Workwear Preferences | 60 | Store Managers, Visual Merchandisers |

The Kuwait Workwear Market is valued at approximately USD 220 million, driven by increasing demand for safety and protective clothing across various industries, including construction, oil and gas, and healthcare.