Region:Central and South America

Author(s):Shubham

Product Code:KRAB0556

Pages:92

Published On:August 2025

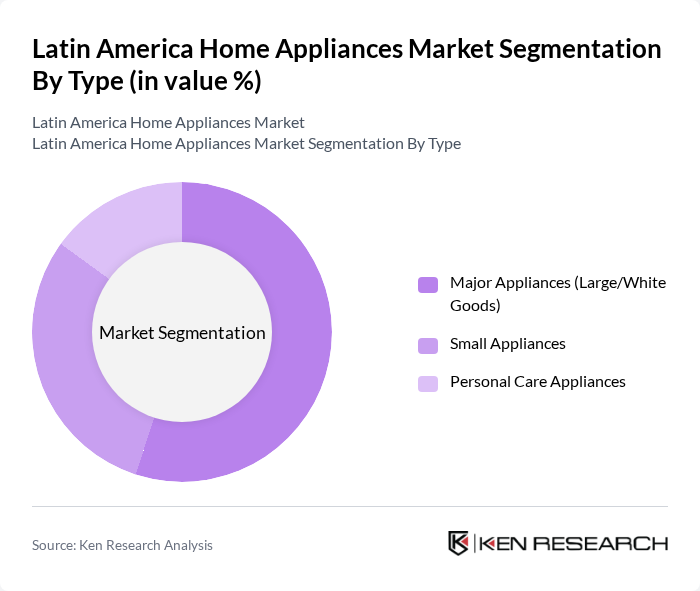

By Type:The market is segmented into Major Appliances (Large/White Goods), Small Appliances, and Personal Care Appliances. Major appliances dominate the market due to their essential role in households, while small appliances are gaining traction due to convenience and innovation. Personal care appliances are also witnessing growth as consumers prioritize personal grooming and wellness.

By Product:The product segmentation includes Refrigerators & Freezers, Washing Machines & Dryers, Cookers, Ovens & Cooktops, Dishwashers, Air Conditioners, Microwaves, Vacuum Cleaners, Coffee/Tea Makers, Blenders & Food Processors, Water & Air Purifiers, and Others. Refrigerators & Freezers lead the market due to their necessity in food preservation, while air conditioners are increasingly popular in warmer regions.

The Latin America Home Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Whirlpool Corporation, Electrolux AB, LG Electronics Inc., Samsung Electronics Co., Ltd., Mabe, S.A. de C.V., BSH Hausgeräte GmbH (Bosch & Siemens Home Appliances), Haier Group (including GE Appliances), Hisense Group (including Gorenje), Panasonic Holdings Corporation, Midea Group Co., Ltd., Gree Electric Appliances, Inc., De’Longhi S.p.A., Philips Domestic Appliances (now Versuni), Britânia Eletrodomésticos (Brazil), Mondial Eletrodomésticos (Brazil) contribute to innovation, geographic expansion, and service delivery in this space.

The Latin America home appliances market is poised for transformation, driven by technological innovations and changing consumer preferences. As urbanization continues to rise, the demand for energy-efficient and smart appliances will likely increase. Additionally, the expansion of e-commerce platforms will facilitate access to a broader range of products. Companies that adapt to these trends and invest in sustainable practices will be better positioned to capture market share and meet evolving consumer needs in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Major Appliances (Large/White Goods) Small Appliances Personal Care Appliances |

| By Product | Refrigerators & Freezers Washing Machines & Dryers Cookers, Ovens & Cooktops Dishwashers Air Conditioners Microwaves Vacuum Cleaners Coffee/Tea Makers, Blenders & Food Processors Water & Air Purifiers Others |

| By Distribution Channel | Supermarkets & Hypermarkets Specialty Stores (Electronics & Appliance Retailers) Online (Marketplaces & D2C) Others (Including Wholesale/Institutional) |

| By Price Range | Economy Mid-Economy Premium |

| By End-User | Residential Commercial (Hospitality, Laundry Services, Offices) |

| By Product Features | Energy-Efficient (Inverter, A+++ Equivalent) Smart/Connected Appliances (Wi?Fi/IoT) Multi-Functional/Compact Formats |

| By Country | Brazil Mexico Argentina Chile Colombia Peru Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Purchases | 150 | Homeowners, Renters, First-time Buyers |

| Retail Distribution Channels | 100 | Store Managers, Sales Representatives |

| Market Trends in Smart Appliances | 80 | Product Managers, Technology Analysts |

| Consumer Preferences and Brand Loyalty | 120 | Frequent Buyers, Brand Advocates |

| Impact of Economic Factors on Purchases | 90 | Financial Analysts, Economic Researchers |

The Latin America Home Appliances Market is valued at approximately USD 61 billion, reflecting a five-year historical analysis. This growth is driven by urbanization, rising disposable incomes, and a growing middle class seeking modern conveniences.