Region:Asia

Author(s):Dev

Product Code:KRAB0498

Pages:95

Published On:August 2025

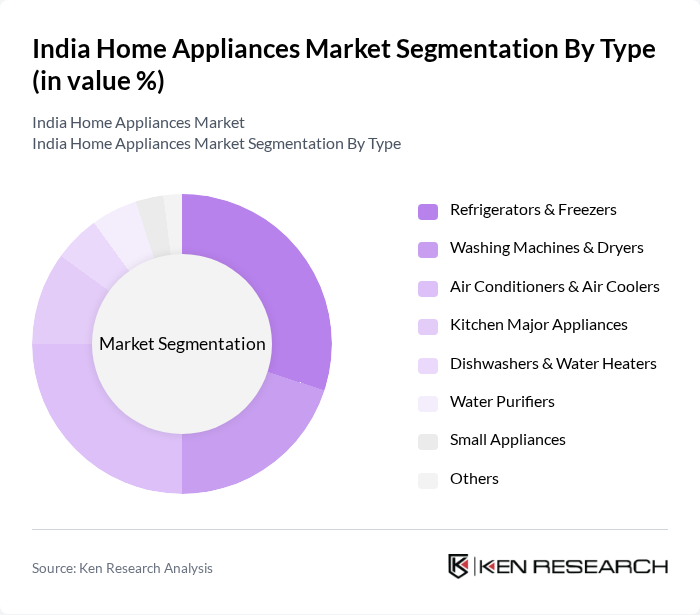

By Type:The market is segmented into various types of home appliances, including Refrigerators & Freezers, Washing Machines & Dryers, Air Conditioners & Air Coolers, Kitchen Major Appliances (Microwave Ovens, Cooktops/Hobs, Chimneys), Dishwashers & Water Heaters (Geysers), Water Purifiers, Small Appliances (Mixer-Grinders, Induction Cooktops, Electric Kettles, Irons, Vacuum Cleaners, etc.), and Others (Air Purifiers, Dehumidifiers, Built-in Appliances). Among these, Refrigerators & Freezers and Air Conditioners & Air Coolers are leading segments due to their essential role in modern households and increasing consumer preference for energy-efficient and inverter-based models.

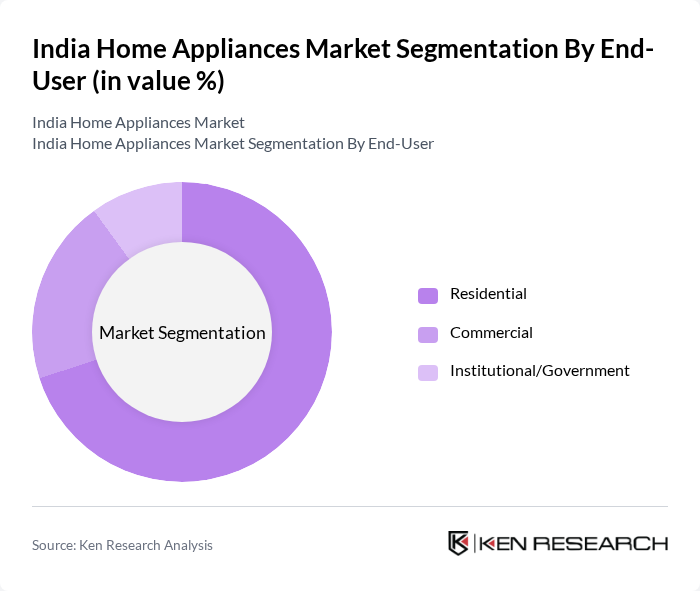

By End-User:The market is segmented by end-user into Residential, Commercial (Hospitals, Hospitality, Offices, Retail), and Institutional/Government (Public Offices, PSUs, Educational Institutions). The Residential segment dominates the market, driven by increasing urbanization, home ownership, and modernization of homes with advanced and connected appliances; demand for energy-efficient and smart models is particularly high among residential consumers as retailers and e-commerce platforms expand assortments nationwide.

The India Home Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as LG Electronics India Pvt. Ltd., Samsung India Electronics Pvt. Ltd., Whirlpool of India Ltd., Godrej Appliances (Godrej & Boyce Mfg. Co. Ltd.), BSH Home Appliances Pvt. Ltd. (Bosch & Siemens), Panasonic Life Solutions India Pvt. Ltd., Haier Appliances India Pvt. Ltd., Philips Domestic Appliances India Ltd. (Versuni), Voltas Ltd. (including Voltas Beko JV), Electrolux India Pvt. Ltd., Midea India Pvt. Ltd. (Carrier Midea India Pvt. Ltd.), IFB Industries Ltd., Bajaj Electricals Ltd. (including Morphy Richards in India), TCL India Pvt. Ltd., Havells India Ltd. (including Lloyd), Blue Star Ltd., Crompton Greaves Consumer Electricals Ltd., Hindustan Unilever Ltd. (Pureit Water Purifiers), Kent RO Systems Ltd., Eureka Forbes Ltd. (Aquaguard) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India home appliances market appears promising, driven by technological innovations and evolving consumer preferences. As urbanization accelerates, the demand for smart and energy-efficient appliances is expected to rise significantly. Additionally, the increasing penetration of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer choice. Companies that adapt to these trends and invest in sustainable practices are likely to thrive in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators & Freezers Washing Machines & Dryers Air Conditioners & Air Coolers Kitchen Major Appliances (Microwave Ovens, Cooktops/Hobs, Chimneys) Dishwashers & Water Heaters (Geysers) Water Purifiers Small Appliances (Mixer-Grinders, Induction Cooktops, Electric Kettles, Irons, Vacuum Cleaners, etc.) Others (Air Purifiers, Dehumidifiers, Built-in Appliances) |

| By End-User | Residential Commercial (Hospitals, Hospitality, Offices, Retail) Institutional/Government (Public Offices, PSUs, Educational Institutions) |

| By Region | North India South India East India West India |

| By Application | Food Preservation & Cooking Fabric Care Air Comfort & Purification Water Heating & Purification |

| By Sales Channel | Online (E-commerce Marketplaces, D2C) Offline Modern Trade (Multi-brand Large Format, Exclusive Brand Stores) General Trade (Independent Retailers, Kirana/Electrical Stores) Institutional/B2B & Project Sales |

| By Price Range | Economy Mid-range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-sensitive Customers First-time Buyers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Refrigerator Market Insights | 120 | Product Managers, Retail Buyers |

| Washing Machine Consumer Preferences | 110 | Home Appliance Users, Market Analysts |

| Microwave Oven Usage Trends | 90 | Kitchen Appliance Retailers, Consumer Behavior Researchers |

| Smart Home Appliances Adoption | 80 | Tech Enthusiasts, Early Adopters |

| Energy Efficiency in Home Appliances | 80 | Sustainability Experts, Regulatory Officials |

The India Home Appliances Market is valued at approximately USD 22 billion, driven by factors such as rising disposable incomes, urbanization, and a growing middle-class population seeking modern living standards and convenience in their households.