Region:Asia

Author(s):Rebecca

Product Code:KRAA5717

Pages:81

Published On:January 2026

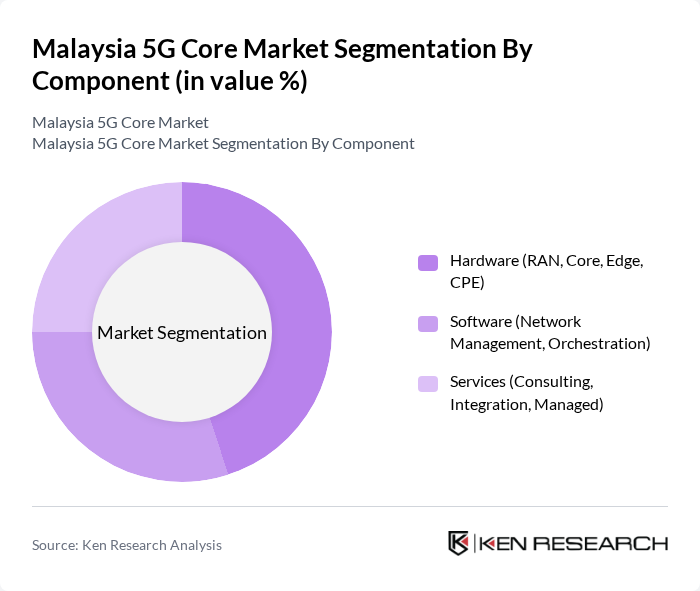

By Component:The market is segmented into Hardware, Software, and Services. Hardware includes RAN, Core, Edge, and CPE, while Software encompasses Network Management and Orchestration. Services are categorized into Consulting, Integration, and Managed services. The Hardware segment is currently leading the market due to the increasing demand for advanced network infrastructure to support 5G capabilities.

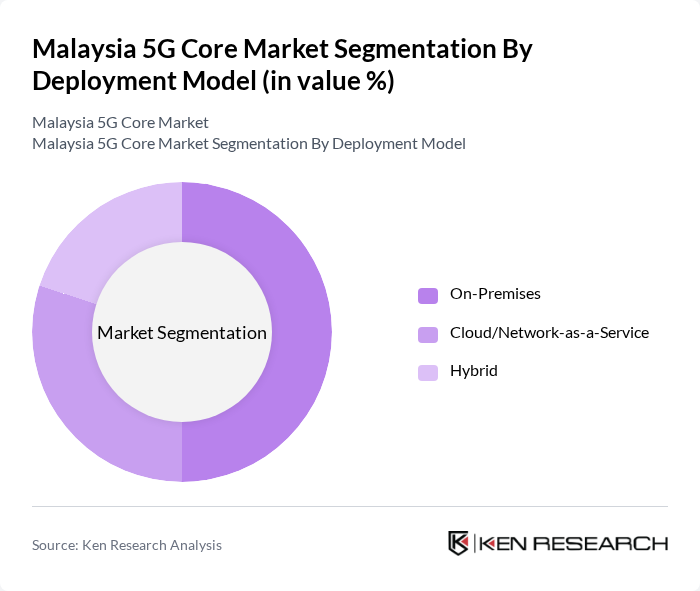

By Deployment Model:The market is divided into On-Premises, Cloud/Network-as-a-Service, and Hybrid deployment models. The On-Premises model is currently the most popular due to its reliability and control over data security, especially among large enterprises that require robust infrastructure for their operations.

The Malaysia 5G Core Market is characterized by a dynamic mix of regional and international players. Leading participants such as Telekom Malaysia Berhad, Maxis Berhad, CelcomDigi Berhad, Digi Telecommunications Sdn Bhd, U Mobile Sdn Bhd, Huawei Technologies (Malaysia) Sdn Bhd, Ericsson Malaysia Sdn Bhd, Nokia Solutions and Networks (Malaysia) Sdn Bhd, ZTE (Malaysia) Corporation Sdn Bhd, Cisco Systems (Malaysia) Sdn Bhd, Samsung Malaysia Electronics (SME) Sdn Bhd, NEC Corporation of Malaysia Sdn Bhd, Qualcomm Technologies, Inc., YTL Communications Sdn Bhd, Digital Nasional Berhad (DNB) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysia 5G core market appears promising, driven by technological advancements and increasing digitalization across sectors. As the government continues to invest in infrastructure and regulatory frameworks improve, the adoption of 5G technology is expected to accelerate. Additionally, the rise of smart cities and IoT applications will create new avenues for growth, enhancing connectivity and driving economic development. The focus on sustainability will also shape future investments in green technologies within the telecommunications sector.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (RAN, Core, Edge, CPE) Software (Network Management, Orchestration) Services (Consulting, Integration, Managed) |

| By Deployment Model | On-Premises Cloud/Network-as-a-Service Hybrid |

| By End-Use Industry | Telecom Operators Manufacturing Healthcare Energy and Utilities Transportation and Logistics Media and Entertainment |

| By Application | Smart Manufacturing and Industrial Automation Smart Energy Smart Medical Smart Transportation Media Entertainment |

| By Region | Central Region (Klang Valley, Selangor, Kuala Lumpur) Northern Region (Penang, Kedah, Perlis, Perak) Southern Region (Johor, Melaka, Negeri Sembilan) East Coast Region (Pahang, Terengganu, Kelantan) East Malaysia (Sabah, Sarawak, Labuan) |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By Spectrum/Access Model | Dedicated Licensed Spectrum Shared/Unlicensed Spectrum Operator-Sliced 5G Network |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Operators | 45 | Network Engineers, Product Managers |

| Enterprise Users | 80 | IT Directors, Operations Managers |

| Government Regulators | 40 | Policy Makers, Regulatory Affairs Specialists |

| Consumer Insights | 120 | General Consumers, Tech Enthusiasts |

| Industry Experts | 60 | Consultants, Academic Researchers |

The Malaysia 5G Core Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by high-speed internet demand, IoT proliferation, and government initiatives aimed at digital transformation across various sectors.