Region:Asia

Author(s):Rebecca

Product Code:KRAE3243

Pages:98

Published On:February 2026

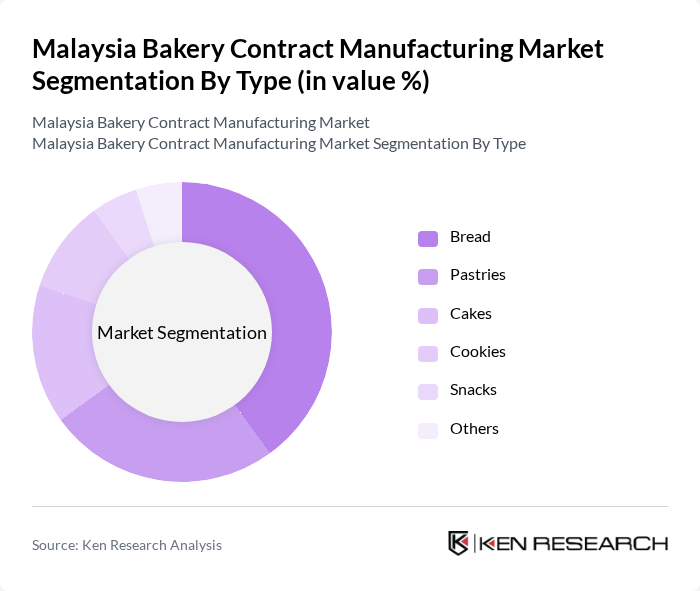

By Type:The bakery contract manufacturing market can be segmented into various types, including Bread, Pastries, Cakes, Cookies, Snacks, and Others. Among these, Bread is the leading sub-segment due to its widespread consumption and versatility in various culinary applications. The increasing trend of artisanal and specialty breads has further fueled its demand. Pastries and Cakes also hold significant market shares, driven by consumer preferences for indulgent treats and celebratory occasions.

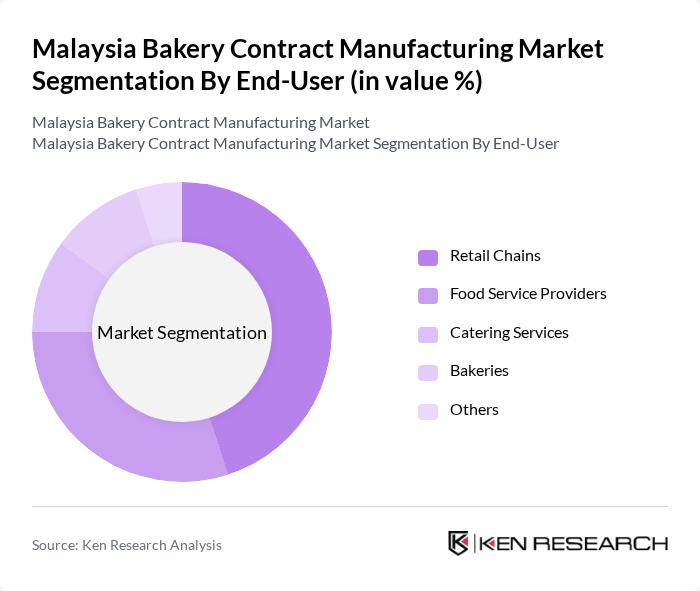

By End-User:The end-user segmentation includes Retail Chains, Food Service Providers, Catering Services, Bakeries, and Others. Retail Chains dominate the market, driven by the increasing number of supermarkets and hypermarkets that offer a wide range of bakery products. Food Service Providers also play a crucial role, as they require consistent supply for restaurants and cafes. The growing trend of online food delivery services has further enhanced the demand from these end-users.

The Malaysia Bakery Contract Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gardenia Bakeries (KL) Sdn Bhd, Hup Seng Perusahaan Makanan (M) Sdn Bhd, The Baker's Cottage, Julie's Biscuits, Munchy's, Biskut Cap Kunci, Leong Hup International Berhad, FFM Berhad, Swee San Food Industries Sdn Bhd, Syarikat Jaya Sdn Bhd, Kawan Food Berhad, Syarikat Jaya Sdn Bhd, Syarikat Makanan Hup Seng, Syarikat Makanan Kawan, Syarikat Makanan Swee San contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysian bakery contract manufacturing market appears promising, driven by evolving consumer preferences and technological advancements. As health trends continue to influence purchasing decisions, manufacturers are likely to invest in innovative product development, focusing on gluten-free and organic options. Additionally, the integration of automation in production processes will enhance efficiency and reduce costs, positioning companies to better meet the growing demand for convenience and quality in bakery products.

| Segment | Sub-Segments |

|---|---|

| By Type | Bread Pastries Cakes Cookies Snacks Others |

| By End-User | Retail Chains Food Service Providers Catering Services Bakeries Others |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Convenience Stores Direct Sales Others |

| By Packaging Type | Flexible Packaging Rigid Packaging Bulk Packaging Others |

| By Flavor Profile | Sweet Savory Spicy Others |

| By Ingredient Type | Organic Ingredients Conventional Ingredients Gluten-Free Ingredients Others |

| By Product Line | Premium Products Value Products Standard Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Bakery Operations | 100 | Bakery Owners, Production Managers |

| Retail Bakery Insights | 80 | Store Managers, Sales Executives |

| Consumer Preferences in Bakery Products | 150 | Regular Consumers, Food Bloggers |

| Raw Material Suppliers | 70 | Procurement Managers, Supply Chain Coordinators |

| Food Safety and Compliance Experts | 60 | Quality Assurance Managers, Regulatory Affairs Specialists |

The Malaysia Bakery Contract Manufacturing Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing demand for convenience foods and healthier eating options among consumers.