Region:Middle East

Author(s):Shubham

Product Code:KRAD3584

Pages:95

Published On:November 2025

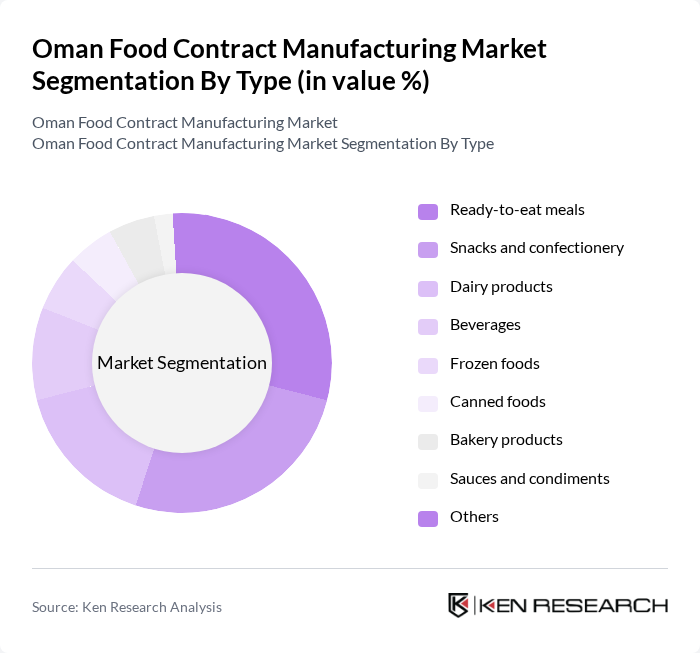

By Type:The food contract manufacturing market in Oman is segmented into ready-to-eat meals, snacks and confectionery, dairy products, beverages, frozen foods, canned foods, bakery products, sauces and condiments, and others. Ready-to-eat meals have gained significant traction, driven by the fast-paced lifestyles of urban consumers and the growing demand for convenient, time-saving meal solutions. Snacks and confectionery also hold a substantial share, supported by rising disposable incomes and a preference for on-the-go and indulgent products.

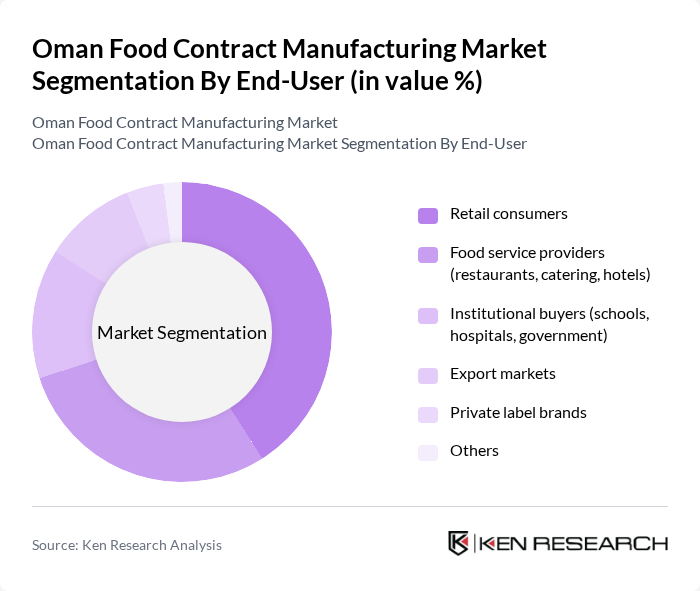

By End-User:End-user segmentation includes retail consumers, food service providers (such as restaurants, catering, and hotels), institutional buyers (schools, hospitals, government), export markets, private label brands, and others. Retail consumers represent the largest segment, fueled by the growing trend of home meal preparation and the demand for convenient, packaged food solutions. Food service providers also constitute a significant share, as they increasingly rely on contract manufacturers for consistent quality and supply.

The Oman Food Contract Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Food Investment Holding Company (OFIC), A’Safwah Dairy & Juice Products Co., Dhofar Cattle Feed Co. SAOG, Oman Flour Mills Company SAOG, Al Joud Food Industries, Al Maha Food Processing LLC, Al Mudhish (Dhofar Beverages & Food Stuff Co. SAOG), Al Bahja Group (Food Division), Al Fair Food Services LLC, Sweets of Oman SAOG, National Biscuits Industries Ltd SAOG, Modern Dairy Factory LLC, Salalah Macaroni Company SAOG, Areej Vegetable Oils & Derivatives SAOC, and Al Reef Sugar Refinery LLC contribute to innovation, geographic expansion, and service delivery in this space.

The Oman food contract manufacturing market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As manufacturers increasingly adopt automation and digital solutions, operational efficiencies are expected to improve. Additionally, the focus on sustainability will likely lead to innovations in packaging and product development, aligning with global trends. The market is also anticipated to benefit from enhanced regulatory frameworks that support food safety and quality, fostering consumer trust and market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Ready-to-eat meals Snacks and confectionery Dairy products Beverages Frozen foods Canned foods Bakery products Sauces and condiments Others |

| By End-User | Retail consumers Food service providers (restaurants, catering, hotels) Institutional buyers (schools, hospitals, government) Export markets Private label brands Others |

| By Distribution Channel | Supermarkets and hypermarkets Online retail Convenience stores Foodservice distributors Direct sales (B2B) Others |

| By Packaging Type | Flexible packaging Rigid packaging Bulk packaging Sustainable/eco-friendly packaging Others |

| By Product Shelf Life | Short shelf life (chilled, fresh) Medium shelf life Long shelf life (ambient, canned, frozen) Others |

| By Nutritional Content | High-protein products Low-calorie products Gluten-free products Organic products Plant-based/vegan products Others |

| By Price Segment | Premium products Mid-range products Economy products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Product Manufacturers | 100 | Production Managers, Quality Assurance Heads |

| Retail Food Brands | 60 | Brand Managers, Marketing Directors |

| Logistics and Supply Chain Providers | 40 | Supply Chain Managers, Operations Directors |

| Food Safety and Regulatory Experts | 50 | Compliance Officers, Regulatory Affairs Managers |

| Consumer Insights and Market Research Analysts | 50 | Market Analysts, Consumer Behavior Researchers |

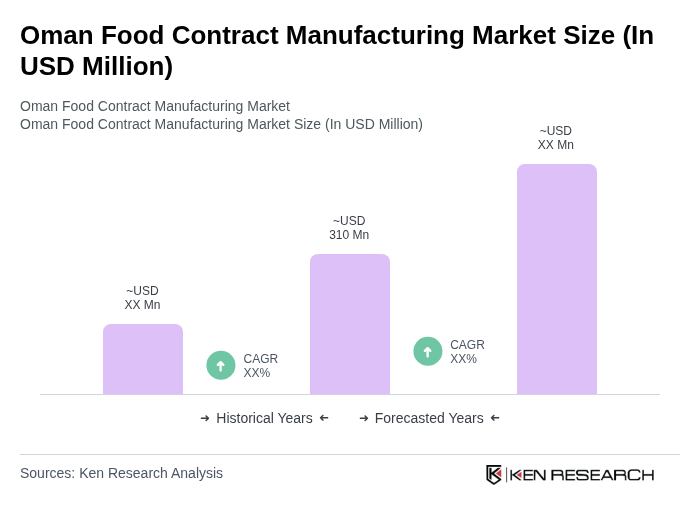

The Oman Food Contract Manufacturing Market is valued at approximately USD 310 million, reflecting a significant share of the domestic food manufacturing sector. This valuation is based on a five-year historical analysis and indicates robust growth driven by consumer demand for convenience foods.