Region:Global

Author(s):Rebecca

Product Code:KRAE3251

Pages:80

Published On:February 2026

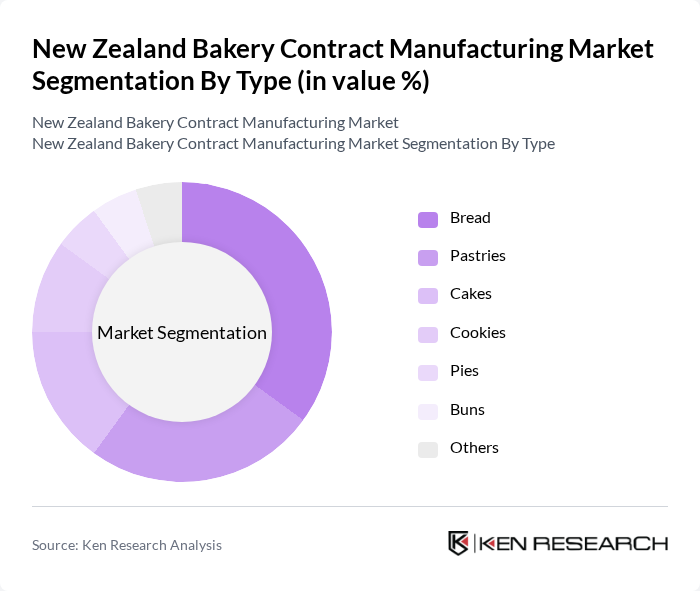

By Type:The bakery contract manufacturing market is segmented into various types, including bread, pastries, cakes, cookies, pies, buns, and others. Among these, bread and pastries are the most significant contributors to market revenue. The increasing preference for artisanal and specialty breads, along with the growing demand for convenient snack options like pastries, drives their popularity. The trend towards healthier options has also led to innovations in these segments, catering to consumer preferences for whole grain and gluten-free products.

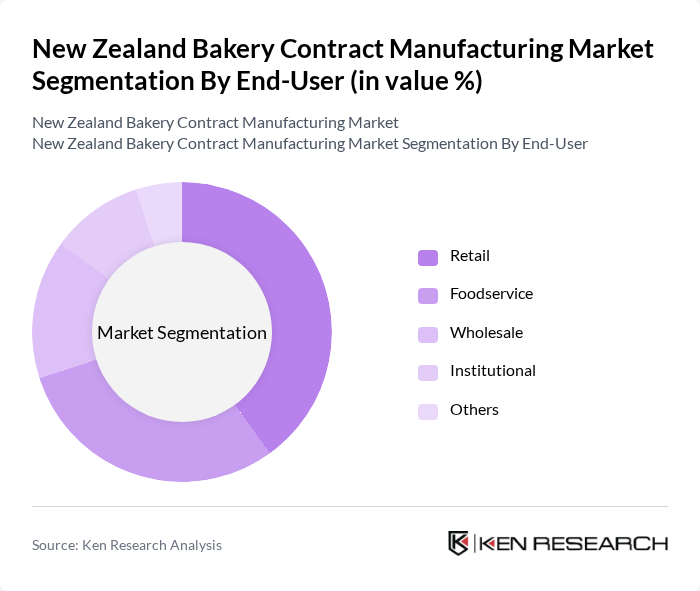

By End-User:The market is segmented by end-user into retail, foodservice, wholesale, institutional, and others. The retail segment holds the largest share, driven by the increasing availability of bakery products in supermarkets and convenience stores. The foodservice sector is also growing, fueled by the rising number of cafes and restaurants that offer baked goods as part of their menu. Consumer trends towards convenience and ready-to-eat options further bolster the retail and foodservice segments.

The New Zealand Bakery Contract Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Goodman Fielder, George Weston Foods, Silver Fern Farms, Hellers, The Food Company, Brumby's Bakeries, Bakers Delight, Pams, Countdown, New Zealand Gourmet Foods, The Bakery Company, Aoraki Bakery, Baked with Love, The Artisan Baker, Little & Friday contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand bakery contract manufacturing market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for convenience and health-oriented products continues to rise, manufacturers are likely to invest in automation and innovative baking techniques. Additionally, the focus on sustainable practices and packaging will shape product development, ensuring alignment with consumer values. This dynamic environment presents opportunities for growth and adaptation, positioning the market for resilience and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Bread Pastries Cakes Cookies Pies Buns Others |

| By End-User | Retail Foodservice Wholesale Institutional Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Direct Sales Others |

| By Packaging Type | Flexible Packaging Rigid Packaging Bulk Packaging Others |

| By Ingredient Type | Wheat Flour Sugar Yeast Fats and Oils Others |

| By Region | North Island South Island |

| By Product Innovation | Health-focused Products Ethnic and Specialty Baked Goods Seasonal Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Contract Manufacturing for Bread Products | 100 | Production Managers, Quality Assurance Leads |

| Pastry and Confectionery Manufacturing | 80 | Product Development Managers, Operations Directors |

| Specialty and Gluten-Free Bakery Products | 70 | Marketing Managers, R&D Specialists |

| Distribution and Supply Chain Management | 90 | Logistics Coordinators, Supply Chain Analysts |

| Consumer Insights on Bakery Products | 120 | End Consumers, Retail Buyers |

The New Zealand Bakery Contract Manufacturing Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by consumer demand for convenience foods and health-conscious eating habits.