Region:Asia

Author(s):Geetanshi

Product Code:KRAB1528

Pages:98

Published On:October 2025

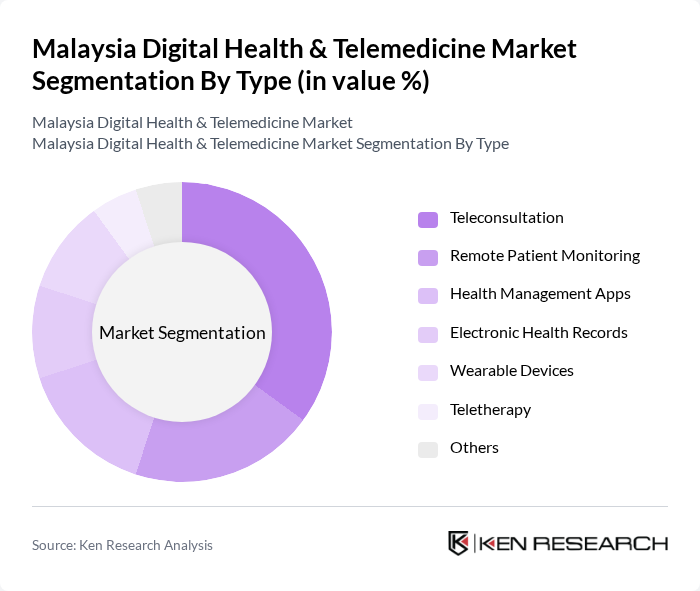

By Type:The market is segmented into various types, including Teleconsultation, Remote Patient Monitoring, Health Management Apps, Electronic Health Records, Wearable Devices, Teletherapy, and Others. Among these, Teleconsultation is currently the leading sub-segment, driven by the increasing demand for remote consultations and the convenience it offers to patients. The rise in smartphone usage and internet accessibility has further fueled the adoption of teleconsultation services, making it a preferred choice for many consumers. Digital health systems and mobile health applications are also experiencing strong growth, reflecting broader trends in Asia Pacific.

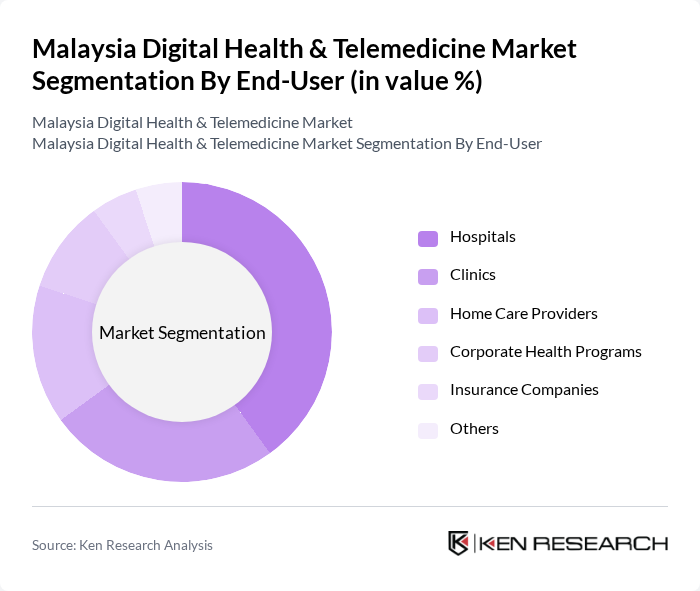

By End-User:The market is segmented by end-users, including Hospitals, Clinics, Home Care Providers, Corporate Health Programs, Insurance Companies, and Others. Hospitals are the dominant end-user segment, as they increasingly adopt digital health solutions to enhance patient care and streamline operations. The integration of telemedicine in hospitals allows for better resource management and improved patient outcomes, making it a critical component of modern healthcare delivery. Clinics and home care providers are also rapidly adopting telehealth platforms and remote monitoring tools, reflecting the broader shift toward decentralized and patient-centric care.

The Malaysia Digital Health & Telemedicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as DoctorOnCall, Doctor Anywhere, MyDoc, HealthMetrics, GetDoc, Doctor2U, MedBuddy, HealthHub, Qmed Asia, MyHealth, MClinica, RingMD, Halodoc, Healthline, Klinik Rakyat contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysia digital health and telemedicine market appears promising, driven by technological advancements and increasing consumer acceptance. As healthcare providers invest in innovative solutions, the integration of artificial intelligence and machine learning will enhance service delivery. Additionally, the government's commitment to improving digital infrastructure will facilitate broader access to telehealth services, particularly in underserved areas. This evolving landscape is expected to foster a more patient-centric approach, ultimately improving health outcomes across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Teleconsultation Remote Patient Monitoring Health Management Apps Electronic Health Records Wearable Devices Teletherapy Others |

| By End-User | Hospitals Clinics Home Care Providers Corporate Health Programs Insurance Companies Others |

| By Application | Chronic Disease Management Mental Health Services Preventive Healthcare Emergency Services Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Healthcare Providers Mobile Applications Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Models Others |

| By Customer Segment | Individual Consumers Small and Medium Enterprises Large Corporations Government Agencies Others |

| By Technology Integration | AI and Machine Learning Blockchain Technology IoT Devices Cloud Computing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers Utilizing Telemedicine | 100 | Hospital Administrators, Clinic Managers |

| Technology Vendors in Digital Health | 60 | Product Managers, Business Development Executives |

| Patients Engaging with Telehealth Services | 120 | Patients, Caregivers |

| Regulatory Bodies and Health Authorities | 40 | Policy Makers, Health Regulators |

| Healthcare IT Specialists | 50 | IT Managers, System Analysts |

The Malaysia Digital Health & Telemedicine Market is valued at approximately USD 1.1 billion, driven by the increasing adoption of digital health solutions and the need for efficient healthcare delivery systems, particularly accelerated by the COVID-19 pandemic.