Region:Asia

Author(s):Geetanshi

Product Code:KRAB5205

Pages:97

Published On:October 2025

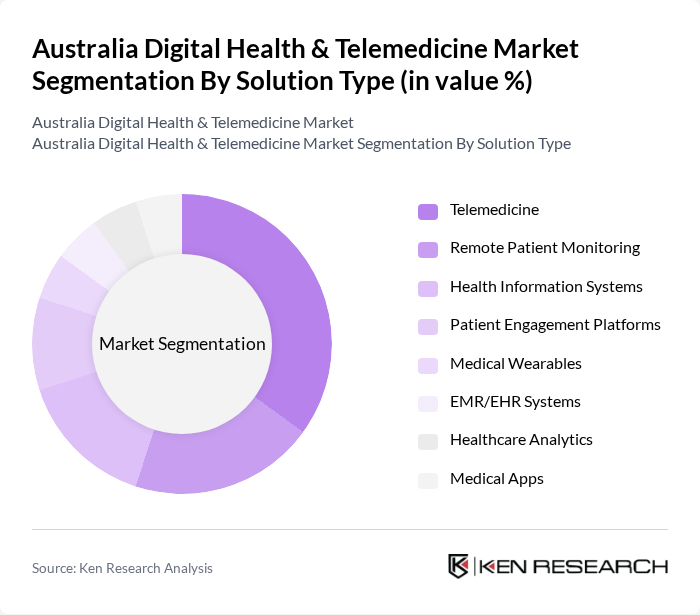

By Solution Type:The solution type segmentation includes Telemedicine, Remote Patient Monitoring, Health Information Systems, Patient Engagement Platforms, Medical Wearables, EMR/EHR Systems, Healthcare Analytics, and Medical Apps. Telemedicine remains the leading subsegment, driven by widespread acceptance and utilization during the pandemic, ongoing government support, and consumer preference for remote consultations. Remote Patient Monitoring is rapidly expanding due to increased adoption of connected devices for chronic disease management. Health Information Systems and EMR/EHR platforms are gaining traction as interoperability and data integration become critical for healthcare providers. Patient Engagement Platforms and Medical Apps are increasingly used to facilitate communication and improve patient outcomes, while Medical Wearables and Healthcare Analytics support preventive care and personalized medicine .

By Component:The component segmentation encompasses Hardware, Software, and Services. The Services subsegment is currently leading the market, driven by the increasing demand for telehealth consultations, remote patient monitoring, and digital health support services. Healthcare providers are prioritizing service-based solutions to enhance patient engagement, streamline operations, and comply with evolving regulatory standards. Hardware demand is supported by the proliferation of connected medical devices and wearables, while Software remains essential for data management, analytics, and interoperability .

The Australia Digital Health & Telemedicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Telstra Health, Teladoc Health Australia, HealthEngine, Coviu, Alcidion Corporation, ResApp Health, MedAdvisor, Koninklijke Philips NV, GE HealthCare Technologies, Siemens Healthineers, Oracle Health, Medtronic Australia, American Well Corporation, Doctor On Demand, Global Med Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital health and telemedicine market in Australia appears promising, driven by technological advancements and increasing consumer acceptance. As the healthcare landscape evolves, the integration of artificial intelligence and machine learning is expected to enhance diagnostic accuracy and patient engagement. Additionally, the ongoing emphasis on mental health services will likely lead to innovative telehealth solutions, ensuring that healthcare remains accessible and efficient for all Australians, particularly in remote areas.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Telemedicine Remote Patient Monitoring Health Information Systems Patient Engagement Platforms Medical Wearables EMR/EHR Systems Healthcare Analytics Medical Apps |

| By Component | Hardware Software Services |

| By End-User | Hospitals Clinics Home Care Providers Patients Insurance Companies Government Healthcare Agencies |

| By Application | Chronic Disease Management Mental Health Services Preventive Healthcare Emergency Care Rehabilitation Services Remote Consultation |

| By Geography | New South Wales Victoria Queensland Western Australia South Australia Tasmania Northern Territory Australian Capital Territory |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telehealth Service Providers | 60 | Healthcare Administrators, Telehealth Coordinators |

| Patients Using Telemedicine | 100 | Patients, Caregivers |

| Healthcare Professionals | 80 | Doctors, Nurses, Allied Health Professionals |

| Health Technology Developers | 50 | Product Managers, Software Engineers |

| Policy Makers in Health Sector | 40 | Government Officials, Health Policy Analysts |

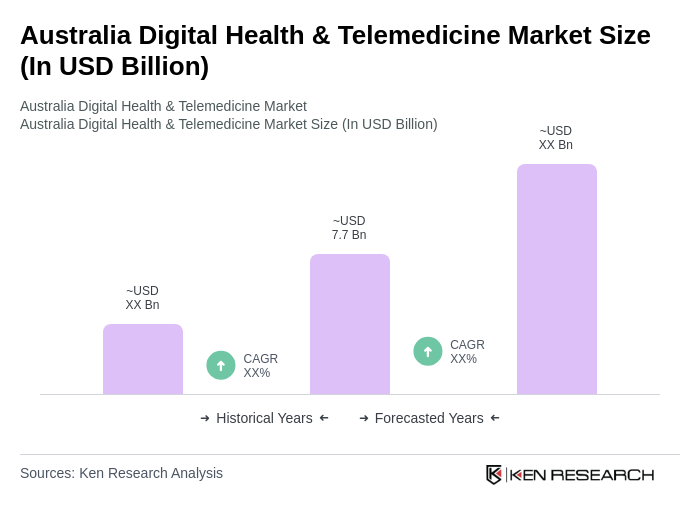

The Australia Digital Health & Telemedicine Market is valued at approximately USD 7.7 billion, reflecting significant growth driven by the adoption of digital health solutions, telemedicine usage, and government support, particularly during the COVID-19 pandemic.