Region:Asia

Author(s):Geetanshi

Product Code:KRAA3273

Pages:93

Published On:September 2025

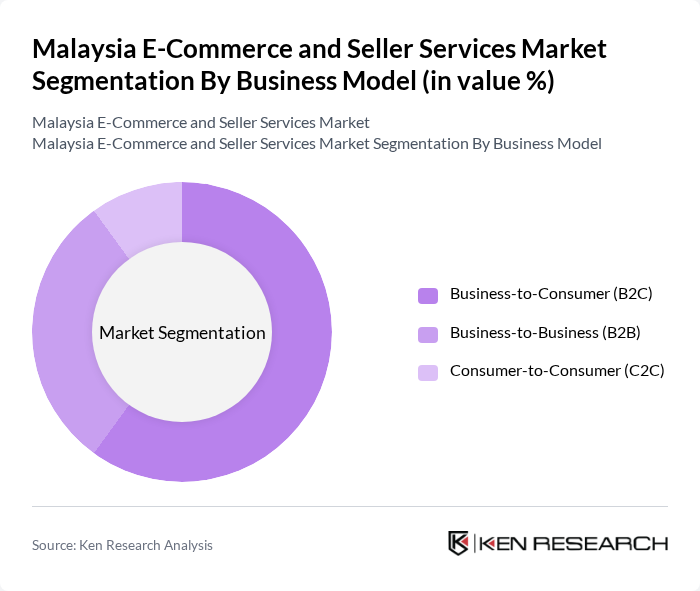

By Business Model:The e-commerce market in Malaysia is segmented into three primary business models: Business-to-Consumer (B2C), Business-to-Business (B2B), and Consumer-to-Consumer (C2C). The B2C segment is the most dominant, propelled by the rising number of online shoppers and the convenience of direct retail purchases. The B2B segment is substantial, as enterprises increasingly utilize online platforms for procurement and supply chain management. The C2C segment, while smaller, is expanding due to the popularity of peer-to-peer sales platforms and social commerce features.

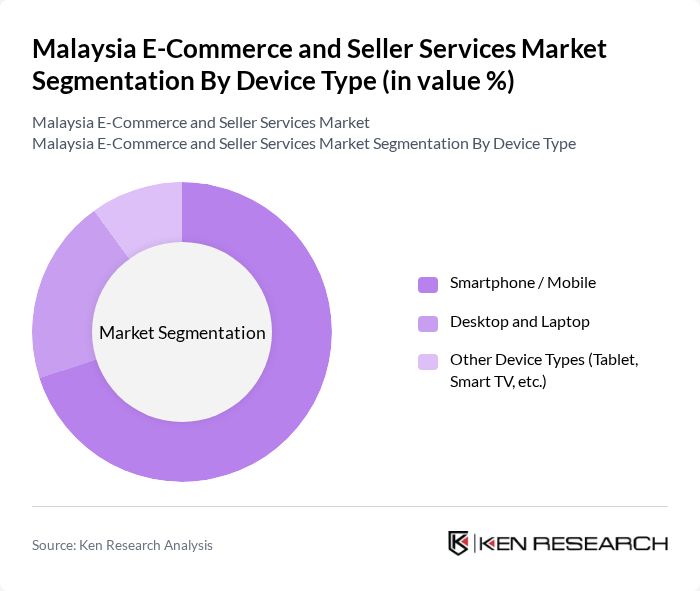

By Device Type:The market is also segmented by device type, including Smartphone/Mobile, Desktop and Laptop, and Other Device Types (Tablet, Smart TV, etc.). The Smartphone/Mobile segment leads the market, as mobile devices are the primary channel for consumers to access e-commerce platforms. The surge in mobile shopping apps, mobile-optimized websites, and high smartphone penetration (over 90%) have accelerated this trend. Desktop and Laptop usage remains relevant, especially for B2B transactions and higher-value purchases, while Other Device Types are gradually increasing in adoption due to smart home integration and multi-device shopping experiences.

The Malaysia E-Commerce and Seller Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lazada Malaysia, Shopee Malaysia, Zalora Malaysia, Lelong.my, PG Mall, Carousell Malaysia, Foodpanda Malaysia, GrabMart, Fave, Qoo10 Malaysia, Mydin, Lotus's Malaysia, Senheng, Watsons Malaysia, MR.DIY contribute to innovation, geographic expansion, and service delivery in this space.

The future of Malaysia's e-commerce market appears promising, driven by technological advancements and changing consumer behaviors. As digital payment solutions become more integrated, the market is likely to see increased transaction volumes. Additionally, the rise of AI and data analytics will enable businesses to personalize shopping experiences, enhancing customer satisfaction. With a growing focus on sustainability, e-commerce platforms are expected to adopt eco-friendly practices, aligning with consumer preferences for responsible shopping.

| Segment | Sub-Segments |

|---|---|

| By Business Model | Business-to-Consumer (B2C) Business-to-Business (B2B) Consumer-to-Consumer (C2C) |

| By Device Type | Smartphone / Mobile Desktop and Laptop Other Device Types (Tablet, Smart TV, etc.) |

| By Sales Channel | Online Marketplaces Brand Websites Social Media Platforms Mobile Apps |

| By Product Category | Fashion and Apparel Consumer Electronics Beauty and Personal Care Home and Living Food and Beverage Toys, DIY, and Media Furniture and Home Furnishing Office Equipment and Supplies Books, Music, and Video Digital Products Others |

| By Payment Method | Credit/Debit Cards Digital Wallets / E-Wallets Bank Transfers Buy Now, Pay Later (BNPL) Cash on Delivery Prepay Cryptocurrency Others |

| By Region | East Malaysia West Malaysia North Malaysia South Malaysia |

| By Customer Demographics | Age Groups (e.g., 18-24, 25-34, 35-44, 45+) Income Levels Urban vs Rural Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Retailers | 100 | E-commerce Managers, Business Owners |

| Logistics Service Providers | 60 | Operations Managers, Logistics Coordinators |

| Payment Gateway Providers | 40 | Product Managers, Technical Leads |

| Consumer Insights | 80 | Frequent Online Shoppers, Market Researchers |

| SME Seller Services | 50 | Small Business Owners, Marketing Directors |

The Malaysia E-Commerce and Seller Services Market is valued at approximately USD 80 billion, driven by high internet penetration, smartphone adoption, and a shift towards online shopping, making it a crucial component of the Malaysian economy.