Region:Asia

Author(s):Rebecca

Product Code:KRAB6452

Pages:89

Published On:October 2025

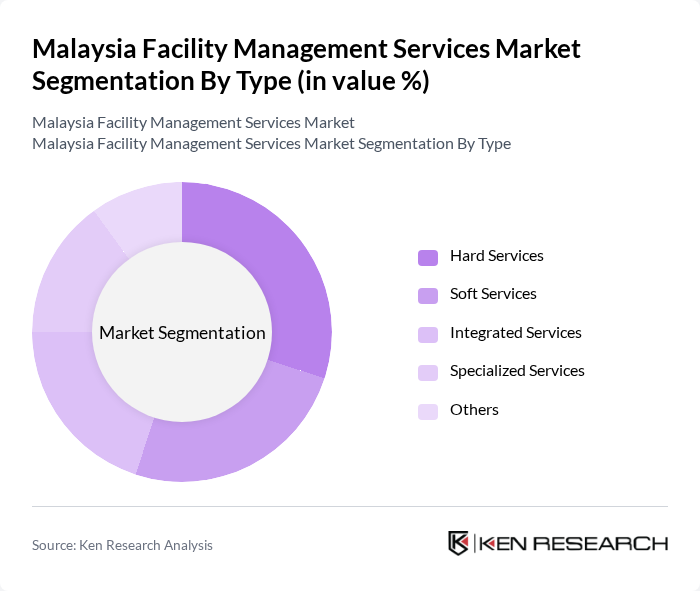

By Type:The facility management services market can be segmented into various types, including Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Hard Services encompass essential maintenance and repair tasks, while Soft Services focus on non-technical support functions. Integrated Services combine both hard and soft services for a holistic approach, and Specialized Services cater to specific needs such as security and cleaning. The Others category includes miscellaneous services that do not fit into the primary classifications.

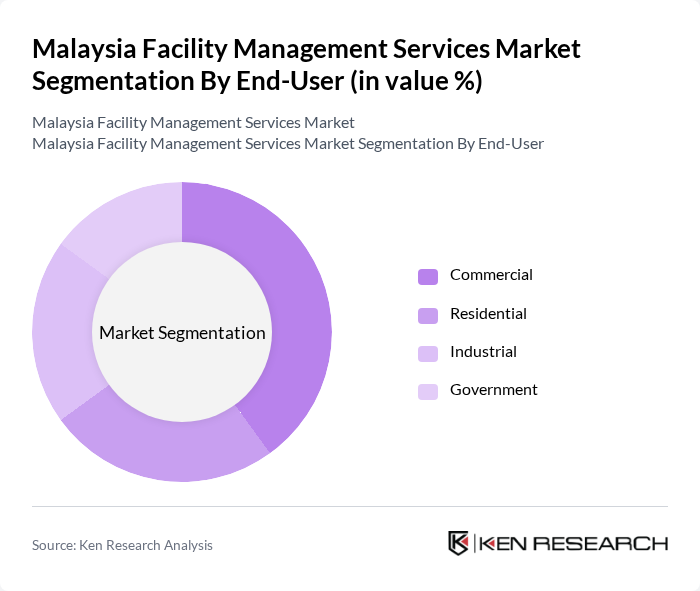

By End-User:The end-user segmentation includes Commercial, Residential, Industrial, and Government sectors. The Commercial segment is the largest, driven by the need for efficient management of office spaces and retail environments. The Residential segment is growing due to increasing urban living and property management needs. Industrial facilities require specialized services for maintenance and safety, while Government entities focus on compliance and service quality.

The Malaysia Facility Management Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as CBRE Group, Inc., JLL (Jones Lang LaSalle), ISS Facility Services, Sodexo, G4S Facilities Management, C&W Services, Knight Frank, AECOM, Cushman & Wakefield, Mitie Group plc, Serco Group plc, Bilfinger SE, Engie Services, EMCOR Group, Inc., OCS Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysia facility management services market appears promising, driven by technological advancements and a growing emphasis on sustainability. As smart building technologies gain traction, companies are expected to adopt integrated solutions that enhance operational efficiency. Additionally, the increasing focus on health and safety standards, particularly post-pandemic, will shape service offerings. These trends indicate a shift towards more innovative and sustainable practices, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Commercial Residential Industrial Government |

| By Service Model | Outsourced In-House Hybrid |

| By Sector | Healthcare Education Retail Hospitality |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Contract Type | Fixed-Price Contracts Time and Materials Contracts Cost-Plus Contracts |

| By Investment Source | Private Investment Public Funding Joint Ventures Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 100 | Facility Managers, Operations Directors |

| Healthcare Facility Services | 80 | Healthcare Administrators, Facility Coordinators |

| Educational Institution Management | 70 | Campus Facility Managers, Administrative Heads |

| Retail Facility Management | 60 | Store Managers, Regional Facility Directors |

| Industrial Facility Services | 90 | Plant Managers, Safety Officers |

The Malaysia Facility Management Services Market is valued at approximately USD 5 billion, reflecting a significant growth driven by urbanization, infrastructure development, and the increasing demand for efficient facility management across various sectors.