Region:Europe

Author(s):Shubham

Product Code:KRAB6589

Pages:92

Published On:October 2025

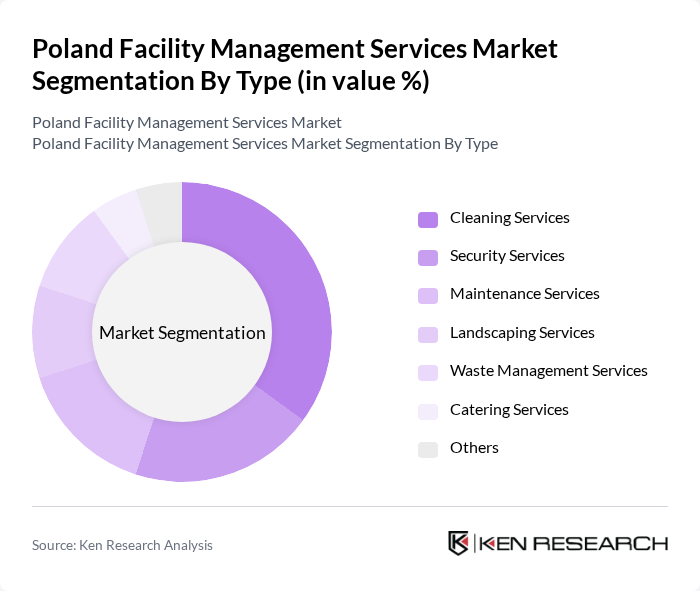

By Type:

The facility management services market is segmented into various types, including Cleaning Services, Security Services, Maintenance Services, Landscaping Services, Waste Management Services, Catering Services, and Others. Among these, Cleaning Services is the leading sub-segment, driven by the increasing emphasis on hygiene and cleanliness in commercial spaces, especially post-pandemic. The demand for professional cleaning services has surged as businesses prioritize health and safety, making it a critical component of facility management.

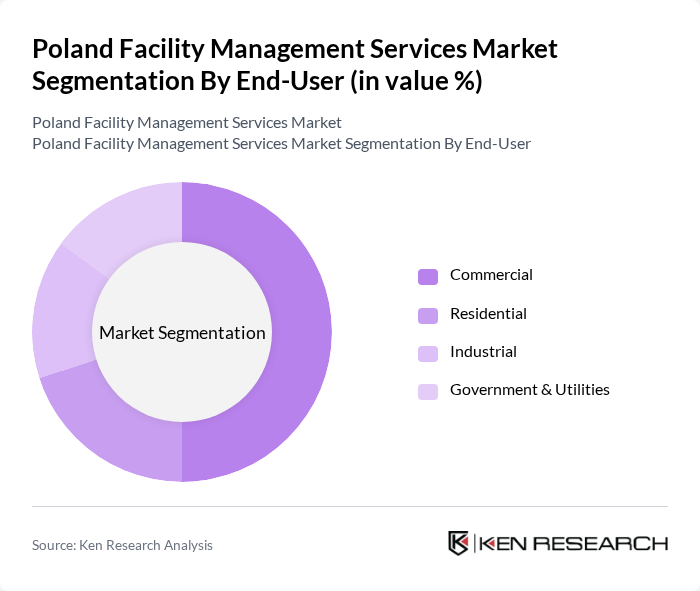

By End-User:

The market is also segmented by end-user, which includes Commercial, Residential, Industrial, and Government & Utilities. The Commercial segment holds the largest share, primarily due to the increasing number of office spaces and corporate establishments in urban areas. Businesses are increasingly outsourcing facility management to enhance operational efficiency and focus on their core activities, thus driving growth in this segment.

The Poland Facility Management Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services, Sodexo, CBRE Group, Inc., JLL (Jones Lang LaSalle), G4S Facilities Management, Compass Group PLC, Aramark, Bilfinger SE, Caverion Corporation, Seris Group, Apleona, Mitie Group PLC, Securitas AB, Dussmann Group, Veolia Environnement S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management services market in Poland appears promising, driven by technological advancements and a growing emphasis on sustainability. As businesses increasingly adopt integrated facility management solutions, the demand for services that enhance operational efficiency and employee well-being will rise. Additionally, the ongoing expansion of the real estate sector, particularly in urban areas, will create new opportunities for service providers to innovate and cater to evolving client needs, ensuring sustained market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Cleaning Services Security Services Maintenance Services Landscaping Services Waste Management Services Catering Services Others |

| By End-User | Commercial Residential Industrial Government & Utilities |

| By Service Model | Integrated Facility Management Single Service Providers Bundled Services Others |

| By Contract Type | Fixed-Term Contracts Open-Ended Contracts Project-Based Contracts Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Pricing Model | Hourly Rates Fixed Pricing Performance-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 150 | Facility Managers, Operations Directors |

| Healthcare Facility Services | 100 | Healthcare Administrators, Facility Coordinators |

| Educational Institution Management | 80 | Campus Facility Managers, Administrative Heads |

| Industrial Facility Maintenance | 70 | Maintenance Supervisors, Safety Officers |

| Commercial Real Estate Services | 90 | Property Managers, Leasing Agents |

The Poland Facility Management Services Market is valued at approximately USD 5 billion, reflecting significant growth driven by urbanization, the expansion of commercial real estate, and increasing demand for integrated services.