Region:Asia

Author(s):Shubham

Product Code:KRAB6585

Pages:85

Published On:October 2025

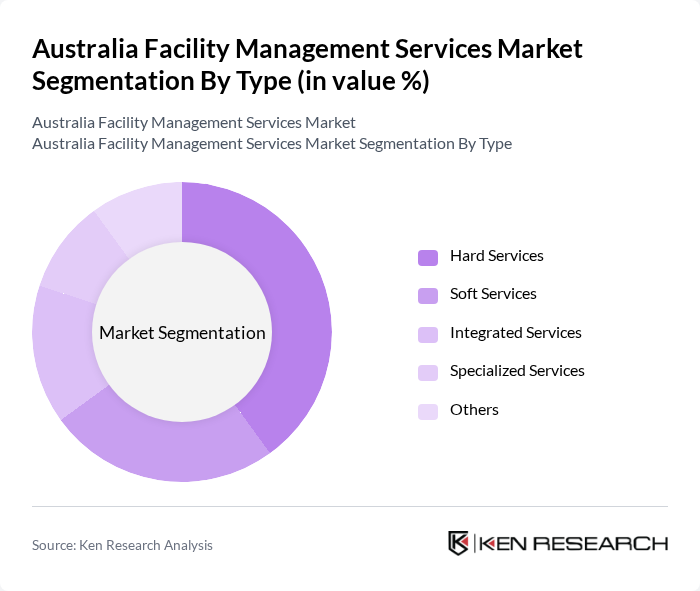

By Type:The facility management services market is segmented into various types, including Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Among these, Hard Services dominate the market due to their essential role in maintaining the physical infrastructure of buildings, such as electrical, plumbing, and HVAC systems. The increasing focus on safety and compliance with regulations drives demand for these services, as businesses prioritize maintaining operational integrity and minimizing downtime.

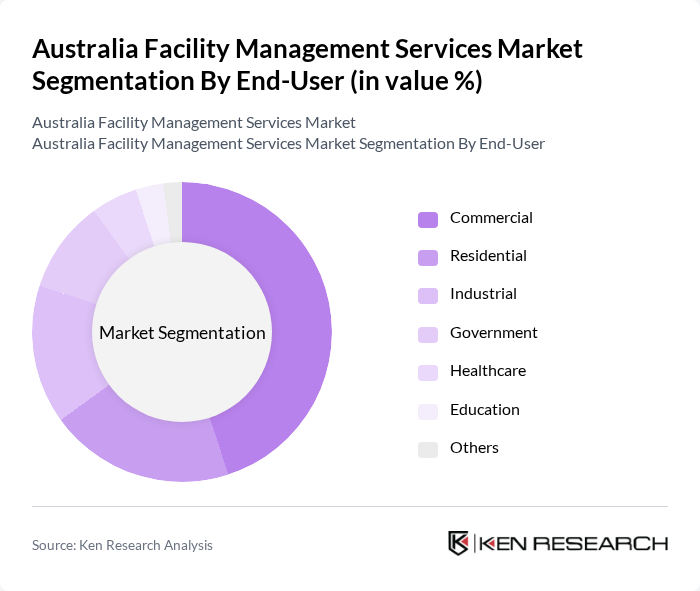

By End-User:The end-user segmentation includes Commercial, Residential, Industrial, Government, Healthcare, Education, and Others. The Commercial sector leads the market, driven by the growing number of office spaces and commercial establishments requiring comprehensive facility management services. The increasing trend of outsourcing these services to enhance operational efficiency and focus on core business activities further propels the demand in this segment.

The Australia Facility Management Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services, Spotless Group, CBRE Group, Inc., JLL (Jones Lang LaSalle), Programmed Maintenance Services, Brookfield Global Integrated Solutions, Cushman & Wakefield, Serco Group plc, G4S plc, Ventia, Downer EDI Limited, UGL Limited, Sodexo, Mitie Group plc, Aegis Facilities Management contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia facility management services market is poised for transformation, driven by technological advancements and a growing emphasis on sustainability. As businesses increasingly adopt integrated facility management solutions, the demand for digital tools and smart technologies will rise. Additionally, the focus on employee well-being and flexible workspaces will shape service offerings, encouraging providers to innovate and adapt. This evolving landscape presents opportunities for growth and differentiation in a competitive market.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Commercial Residential Industrial Government Healthcare Education Others |

| By Service Model | Outsourced In-House Hybrid |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Tasmania Others |

| By Technology | Building Management Systems Energy Management Systems Security Systems Maintenance Management Software Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing |

| By Contract Type | Short-Term Contracts Long-Term Contracts Project-Based Contracts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 100 | Facility Managers, Operations Directors |

| Healthcare Facility Services | 80 | Healthcare Administrators, Maintenance Supervisors |

| Educational Institution Management | 70 | Campus Facility Managers, Procurement Officers |

| Retail Facility Management | 60 | Store Managers, Facilities Coordinators |

| Government Facility Services | 50 | Public Sector Facility Managers, Compliance Officers |

The Australia Facility Management Services Market is valued at approximately USD 30 billion, reflecting a significant growth trend driven by urbanization, demand for efficient facility management, and investments aimed at enhancing service delivery and operational efficiency.