Region:Asia

Author(s):Geetanshi

Product Code:KRAB2822

Pages:93

Published On:October 2025

By Type:The facility management services market can be segmented into various types, including Hard Services, Soft Services, Integrated Facility Management, Bundled Services, and Specialized/Risk/Administrative Services. Among these,Hard Services, which encompass essential maintenance and operational functions, are currently leading the market due to their critical role in ensuring the safety and functionality of buildings. Hard Services, including MEP and asset maintenance, held the largest share of revenue in the most recent period .

By End-User:The end-user segmentation of the facility management services market includes Commercial, Residential, Industrial & Process, Government & Public Infrastructure, Healthcare, Hospitality, BFSI, and Education. TheCommercial sectoris the largest end-user, driven by the increasing number of office spaces and retail establishments requiring comprehensive facility management solutions .

The Indonesia Facility Management Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Indonesia, CBRE Indonesia, JLL Indonesia, Sodexo Indonesia, Cushman & Wakefield Indonesia, Knight Frank Indonesia, G4S Indonesia, PT Shield-On Service Tbk (SOS Indonesia), PT ISS Facility Services, OCS Group Indonesia, PT Karya Cipta Sukses Anugrah (KCS), PT Mitratama Cipta Selaras, PT Daya Cipta Mandiri Solusi, PT Bintang Sukses Energi, PT Panca Clean Property Management contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management services market in Indonesia appears promising, driven by technological advancements and a growing emphasis on sustainability. As smart building technologies gain traction, companies will increasingly adopt IoT solutions to enhance operational efficiency. Additionally, the rising awareness of environmental issues will push businesses to implement sustainable practices, creating a favorable environment for facility management services that prioritize energy efficiency and resource conservation.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services (e.g., MEP, HVAC, Fire Safety, Building Maintenance) Soft Services (e.g., Cleaning, Security, Landscaping, Waste Management) Integrated Facility Management (IFM) Bundled Services Specialized/Risk/Administrative Services |

| By End-User | Commercial (Offices, Retail, Logistics, Mixed-use) Residential Industrial & Process (Manufacturing, Warehousing, Utilities) Government & Public Infrastructure Healthcare Hospitality BFSI Education |

| By Service Model | Outsourced In-House |

| By Service Delivery | Integrated Bundled Single Services |

| By Enterprise Size | Large Enterprises Small & Medium Enterprises |

| By Geographic Coverage | Java (Jakarta, Surabaya, Bandung, etc.) Sumatra Kalimantan (including Nusantara) Sulawesi & Eastern Indonesia |

| By Contract Type | Fixed-Price Contracts Time and Materials Contracts Public-Private Partnerships |

| By Investment Source | Domestic Investment Foreign Direct Investment Government Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 60 | Facility Managers, Real Estate Directors |

| Commercial Cleaning Services | 40 | Operations Managers, Cleaning Service Supervisors |

| Maintenance and Repair Services | 40 | Maintenance Supervisors, Technical Managers |

| Security Services in Facilities | 40 | Security Managers, Risk Management Officers |

| Integrated Facility Management Solutions | 40 | Business Development Managers, Service Delivery Managers |

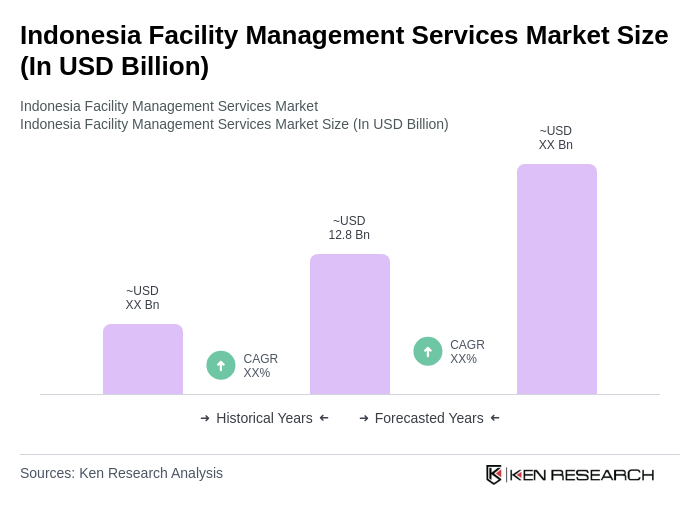

The Indonesia Facility Management Services Market is valued at approximately USD 12.8 billion, driven by urbanization, demand for efficient building management, and the expansion of commercial real estate.