Malaysia Flooring Market Overview

- The Malaysia Flooring Market is valued at USD 1.1 billion, based on a five-year historical analysis, aligning with regional flooring and construction activity levels within South East Asia. This growth is primarily driven by the increasing demand for residential and commercial spaces, coupled with a rise in construction activities across the country, supported by ongoing urban development and real estate projects. The market is also influenced by consumer preferences for aesthetic, low-maintenance, and durable flooring solutions, including luxury vinyl tiles (LVT), stone plastic composite (SPC), engineered wood, and tiles, leading to a diverse range of products being offered.

- Key cities such as Kuala Lumpur, Penang, and Johor Bahru dominate the Malaysia Flooring Market due to their rapid urbanization, strong real estate pipelines, and significant infrastructure development, including mixed-use, commercial, industrial, and hospitality projects. These urban centers are experiencing a surge in both residential and commercial projects, including high-rise apartments, shopping malls, offices, and industrial facilities, which in turn drives the demand for a wide range of flooring materials and solutions such as vinyl, tiles, carpets, and engineered wood.

- The regulatory framework influencing the flooring and broader construction materials market in Malaysia is guided, among others, by the Construction Industry Transformation Programme (CITP) 2016–2020 under the Construction Industry Development Board Malaysia (CIDB) and the Green Building Index (GBI) certification scheme, which encourage the adoption of sustainable building materials, energy-efficient designs, and low–emission products in construction projects. In addition, the CIDB Act 520 (as amended) issued by the Government of Malaysia and administered by CIDB Malaysia provides for registration, accreditation, and quality and safety requirements for construction works and materials, supporting higher standards and greater uptake of compliant and sustainable flooring products in the market.

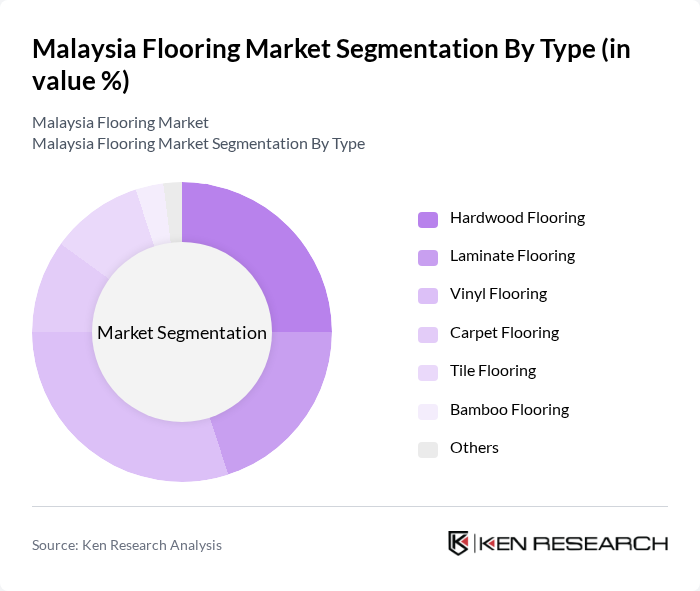

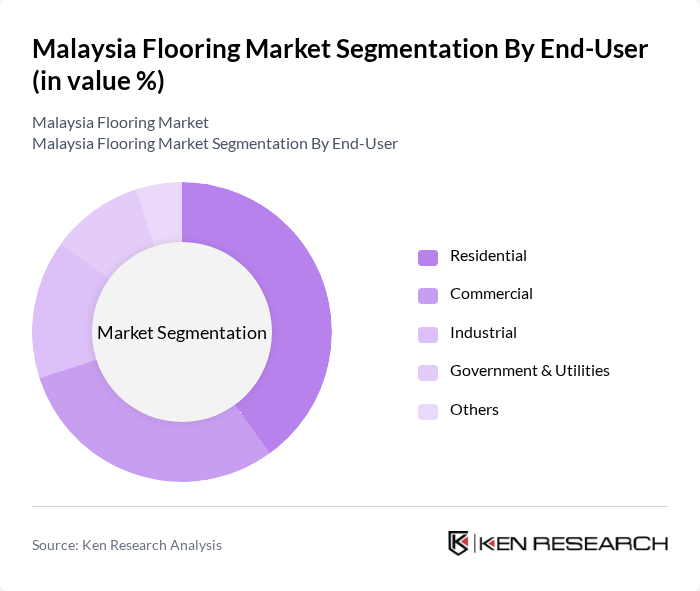

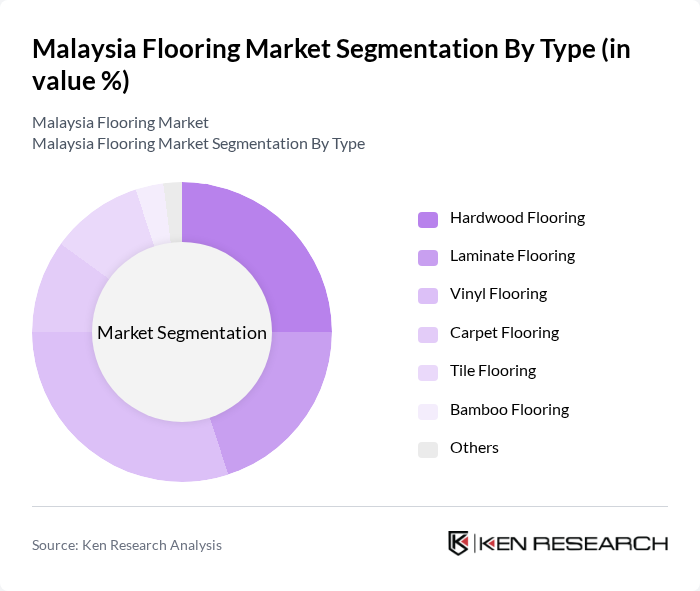

Malaysia Flooring Market Segmentation

By Type:The flooring market can be segmented into various types, including hardwood flooring, laminate flooring, vinyl flooring, carpet flooring, tile flooring, bamboo flooring, and others. Each type caters to different consumer preferences and applications, with specific characteristics that appeal to various market segments, such as the growing use of LVT and SPC in residential and commercial interiors, ceramic and porcelain tiles in high-traffic and wet areas, and engineered wood and laminates where a premium aesthetic and easier installation are desired.

By End-User:The flooring market is segmented based on end-users, which include residential, commercial, industrial, government & utilities, and others. Each segment has distinct requirements and preferences, influencing the types of flooring products that are in demand, with the residential sector increasingly favoring vinyl, laminates, and engineered wood for aesthetics and comfort, while commercial and industrial users prioritize durability, safety, and ease of maintenance through solutions such as tiles, resilient flooring, and specialized industrial coatings.

Malaysia Flooring Market Competitive Landscape

The Malaysia Flooring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mohawk Industries, Shaw Industries, Tarkett, Armstrong Flooring, Gerflor, Interface, Inc., Forbo Flooring Systems, LG Hausys, Beaulieu International Group, Boral Limited, Kronospan, Polyflor, Daltile, Quick-Step, NAFCO contribute to innovation, geographic expansion, and service delivery in this space, with a strong focus on resilient flooring, LVT/SPC, carpets, engineered wood, and solutions that meet green building and performance standards.

Malaysia Flooring Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Malaysia's urban population is projected to reach 80% in future, up from 77% in 2020, according to the World Bank. This rapid urbanization drives demand for residential and commercial flooring solutions, as new housing and infrastructure projects emerge. The construction sector is expected to contribute approximately MYR 250 billion to the economy in future, further fueling the need for diverse flooring options that cater to urban lifestyles and preferences.

- Rising Disposable Income:The average disposable income in Malaysia is anticipated to rise to MYR 4,000 per month in future, reflecting a growth trend that enhances consumer purchasing power. This increase allows consumers to invest in higher-quality flooring materials, such as hardwood and luxury vinyl tiles. As households prioritize home improvement, the flooring market is expected to benefit significantly from this trend, with consumers seeking durable and aesthetically pleasing options.

- Demand for Sustainable Flooring Solutions:With Malaysia's commitment to sustainable development, the demand for eco-friendly flooring materials is on the rise. The government aims to reduce carbon emissions by 45% in future, promoting green building initiatives. As a result, manufacturers are increasingly offering sustainable options, such as bamboo and recycled materials, which are projected to capture a significant share of the market, appealing to environmentally conscious consumers and businesses alike.

Market Challenges

- Fluctuating Raw Material Prices:The flooring industry in Malaysia faces challenges due to volatile raw material prices, particularly for timber and synthetic materials. In future, the price of timber increased by 15% due to supply chain disruptions and increased demand. This fluctuation can lead to higher production costs for manufacturers, impacting pricing strategies and profit margins, ultimately affecting market competitiveness and consumer affordability.

- Intense Competition:The Malaysian flooring market is characterized by intense competition, with over 200 registered companies vying for market share. This saturation leads to price wars and aggressive marketing strategies, which can erode profit margins. In future, the market is expected to see further consolidation as smaller players struggle to compete, potentially limiting innovation and diversity in product offerings, which could hinder overall market growth.

Malaysia Flooring Market Future Outlook

The Malaysia flooring market is poised for significant growth driven by urbanization, rising incomes, and a shift towards sustainable materials. As consumers increasingly prioritize eco-friendly options, manufacturers are likely to innovate and expand their product lines. Additionally, the integration of smart technologies in flooring solutions will enhance functionality and appeal. The market is expected to adapt to these trends, fostering a competitive landscape that encourages quality and sustainability in flooring products, ultimately benefiting consumers and businesses alike.

Market Opportunities

- Expansion of E-commerce Platforms:The growth of e-commerce in Malaysia, projected to reach MYR 60 billion in future, presents a significant opportunity for flooring companies. Online platforms enable manufacturers to reach a broader audience, streamline sales processes, and reduce overhead costs. This shift allows consumers to access a wider variety of flooring options conveniently, enhancing market penetration and sales potential.

- Government Initiatives for Green Building:The Malaysian government is actively promoting green building initiatives, with incentives for sustainable construction practices. In future, it is expected that 30% of new buildings will adhere to green certification standards. This creates opportunities for flooring manufacturers to develop and market eco-friendly products, aligning with government policies and attracting environmentally conscious consumers, thereby enhancing market growth.