Region:Asia

Author(s):Shubham

Product Code:KRAB2594

Pages:93

Published On:October 2025

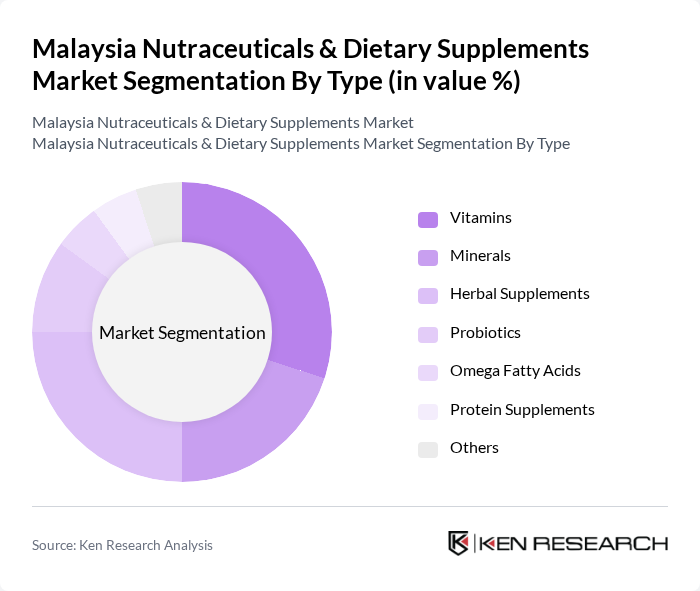

By Type:The nutraceuticals and dietary supplements market in Malaysia is segmented into vitamins, minerals, herbal supplements, probiotics, omega fatty acids, protein supplements, and others.Vitamins and herbal supplementsremain the most popular categories, reflecting strong consumer trust in traditional remedies and preventive health practices. The market is also witnessing increased demand for probiotics and plant-based supplements, driven by growing awareness of gut health, immunity, and the benefits of natural ingredients. Personalized nutrition and clean-label products are emerging as key trends, with consumers seeking supplements tailored to their specific health needs .

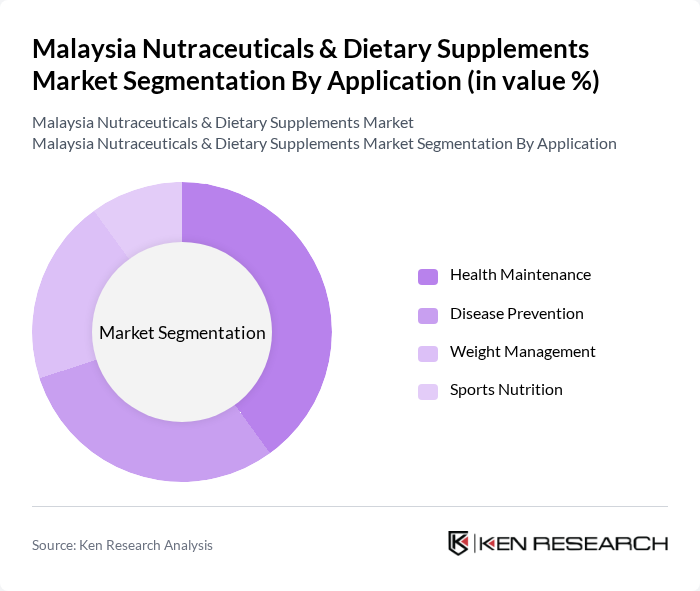

By Application:Applications for nutraceuticals and dietary supplements in Malaysia include health maintenance, disease prevention, weight management, and sports nutrition.Health maintenanceproducts continue to dominate, reflecting consumer focus on preventive care and overall well-being. There is also a notable rise in demand for supplements targeting immunity, metabolic health, and lifestyle-related conditions. Weight management and sports nutrition segments are growing, supported by increased fitness awareness and the popularity of active lifestyles .

The Malaysia Nutraceuticals & Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway (Malaysia) Sdn. Bhd., Blackmores Ltd., GNC Holdings, Inc., Nestlé Health Science, DuPont Nutrition & Biosciences, Swisse Wellness Pty Ltd., Nature's Way Products, LLC, USANA Health Sciences, Inc., Mega Lifesciences Public Company Limited, Blackmores Malaysia Sdn. Bhd., BioCare Copenhagen A/S, TCM Health Products Sdn. Bhd., YL Health Sdn. Bhd., CCM Pharmaceuticals Sdn. Bhd., Hovid Berhad, Pharmaniaga Berhad, Kotra Pharma (M) Sdn. Bhd., Xepa-Soul Pattinson (Malaysia) Sdn. Bhd., Duopharma Biotech Berhad contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysian nutraceuticals market appears promising, driven by increasing health awareness and a growing preference for preventive healthcare. As consumers continue to seek personalized and plant-based supplements, companies are likely to innovate and diversify their product offerings. Additionally, the integration of technology in product development, such as AI-driven formulations, will enhance consumer engagement and satisfaction, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Probiotics Omega Fatty Acids Protein Supplements Others |

| By Application | Health Maintenance Disease Prevention Weight Management Sports Nutrition |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Pharmacies Health Stores |

| By Consumer Demographics | Age Group (Children, Adults, Seniors, Athletes) Gender (Male, Female) |

| By Price Range | Budget Mid-Range Premium |

| By Formulation | Tablets Capsules Powders Liquids |

| By Brand Loyalty | Established Brands New Entrants Private Labels |

| By Ingredient Source | Natural Synthetic |

| By Packaging Type | Bottles Blister Packs Pouches Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Dietary Supplements | 120 | Health-conscious Consumers, Fitness Enthusiasts |

| Retail Distribution Channels Analysis | 80 | Retail Managers, Store Owners |

| Healthcare Professionals' Insights | 60 | Doctors, Nutritionists, Pharmacists |

| Market Trends in Herbal Supplements | 50 | Herbal Product Manufacturers, Distributors |

| Regulatory Impact Assessment | 40 | Regulatory Affairs Specialists, Compliance Officers |

The Malaysia Nutraceuticals & Dietary Supplements Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by increasing health consciousness, chronic diseases, and an aging population prioritizing preventive healthcare and immune support.