Region:Asia

Author(s):Dev

Product Code:KRAA6848

Pages:93

Published On:January 2026

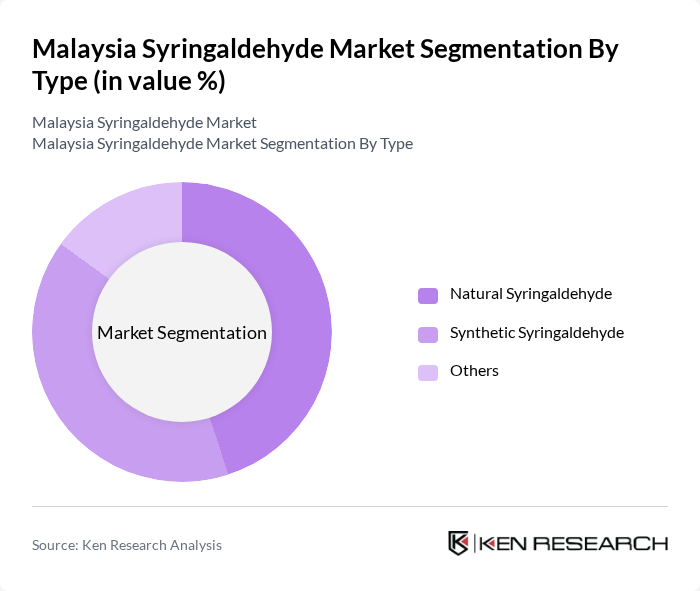

By Type:The market is segmented into Natural Syringaldehyde, Synthetic Syringaldehyde, and Others. Natural syringaldehyde is gaining traction due to the increasing consumer preference for organic and natural products, while synthetic variants are widely used for their cost-effectiveness and availability. The "Others" category includes various formulations and blends that cater to niche markets.

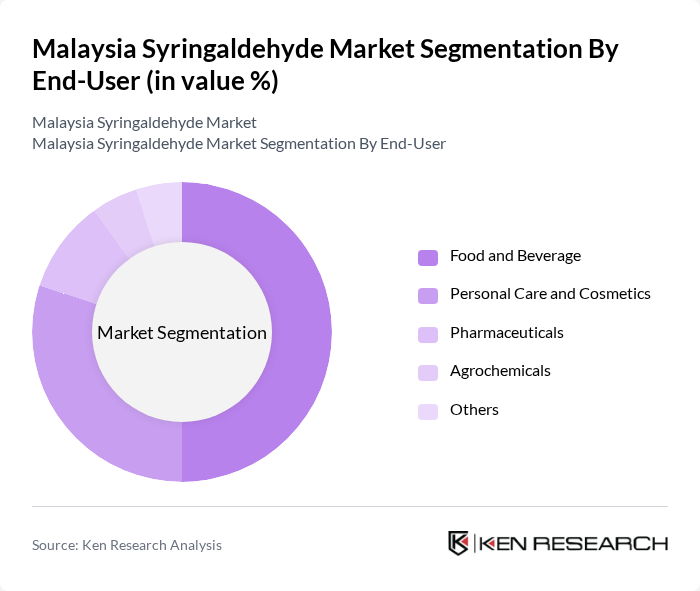

By End-User:The end-user segmentation includes Food and Beverage, Personal Care and Cosmetics, Pharmaceuticals, Agrochemicals, and Others. The Food and Beverage sector is the largest consumer of syringaldehyde, driven by its application as a flavoring agent. Personal care products also significantly contribute to the market, as consumers increasingly seek natural fragrances.

The Malaysia Syringaldehyde Market is characterized by a dynamic mix of regional and international players. Leading participants such as Merck Group, Sigma-Aldrich, TCI Chemicals, Acros Organics, Alfa Aesar, ChemSpider, Santa Cruz Biotechnology, VWR International, Thermo Fisher Scientific, Fluka Chemie, J&K Scientific, Achem Technology, Acme-Hardesty, Eastman Chemical Company, BASF SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysia syringaldehyde market appears promising, driven by increasing consumer demand for natural and sustainable products. As the fragrance and personal care industries continue to expand, the adoption of syringaldehyde is likely to rise. Additionally, ongoing research into its pharmaceutical applications may unlock new markets. With government support for eco-friendly initiatives, the market is poised for growth, although challenges related to raw material costs and regulatory compliance will need to be addressed to fully capitalize on these opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Syringaldehyde Synthetic Syringaldehyde Others |

| By End-User | Food and Beverage Personal Care and Cosmetics Pharmaceuticals Agrochemicals Others |

| By Application | Flavoring Agent Fragrance Component Chemical Intermediate Pharmaceuticals Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Region | Central Region Northern Region Southern Region Eastern Region |

| By Purity Grade | % Purity % Purity Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 45 | Product Managers, R&D Directors |

| Agrochemical Sector | 40 | Procurement Managers, Regulatory Affairs Specialists |

| Flavoring and Fragrance Industry | 35 | Flavor Chemists, Product Development Managers |

| Research Institutions | 25 | Academic Researchers, Industry Analysts |

| Environmental Agencies | 30 | Policy Makers, Environmental Scientists |

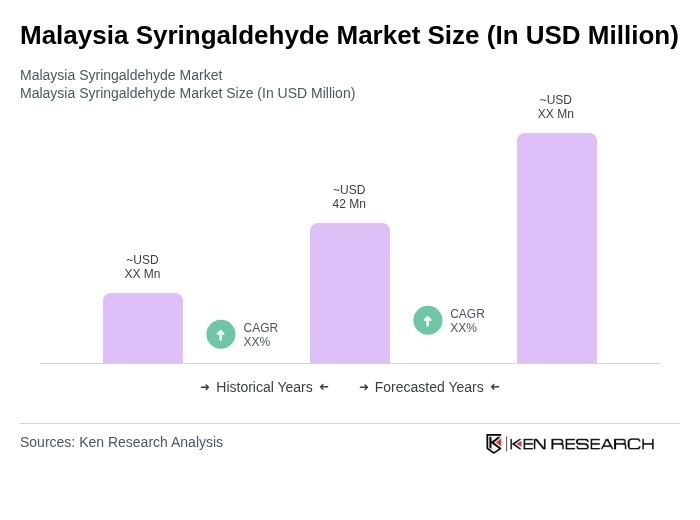

The Malaysia Syringaldehyde Market is valued at approximately USD 42 million, reflecting a five-year historical analysis. This growth is largely attributed to the increasing demand for natural flavoring agents in the food and beverage sector.