Region:Central and South America

Author(s):Dev

Product Code:KRAA4644

Pages:100

Published On:September 2025

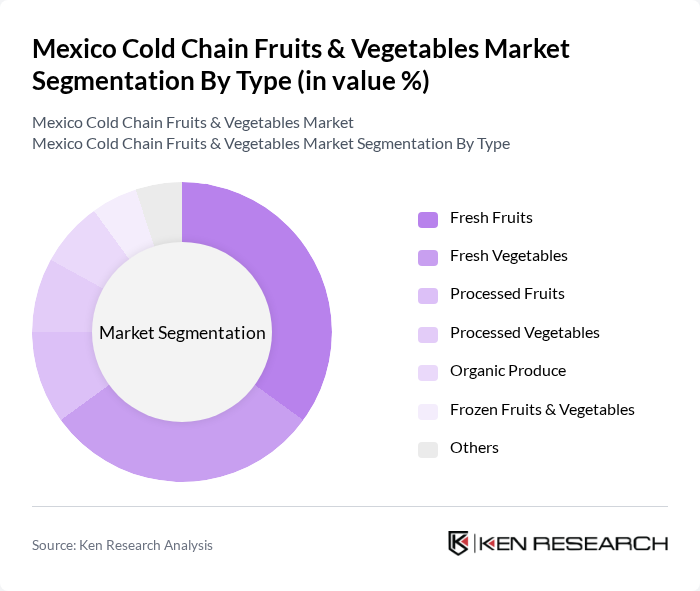

By Type:The market is segmented into various types of products, including fresh fruits, fresh vegetables, processed fruits, processed vegetables, organic produce, frozen fruits & vegetables, and others. Among these, fresh fruits and vegetables are the most dominant segments due to their high demand in both domestic and export markets. The increasing health consciousness among consumers has led to a surge in the consumption of fresh produce, driving the need for efficient cold chain solutions to maintain quality and extend shelf life.

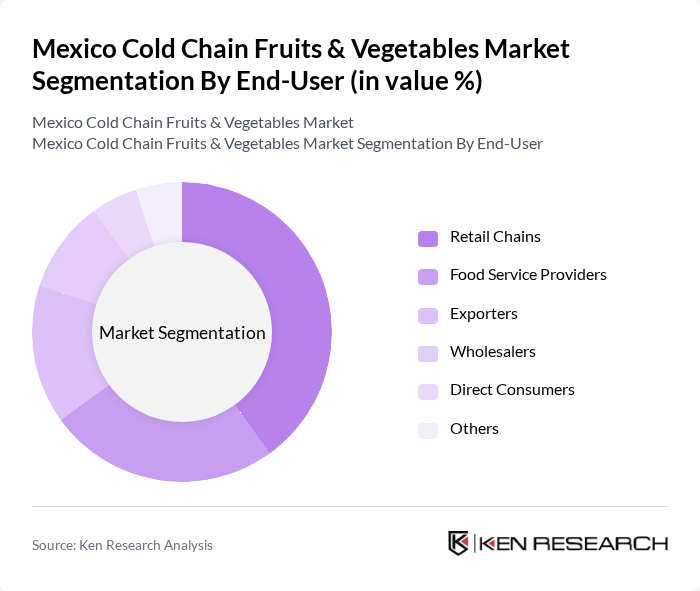

By End-User:The end-user segmentation includes retail chains, food service providers, exporters, wholesalers, direct consumers, and others. Retail chains are the leading segment, driven by the growing trend of organized retailing and the increasing number of supermarkets and hypermarkets across Mexico. The demand for fresh produce in these retail outlets necessitates robust cold chain logistics to ensure product quality and safety, thereby enhancing the overall market growth.

The Mexico Cold Chain Fruits & Vegetables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Bimbo, Sigma Alimentos, Fresh Del Monte Produce Inc., Driscoll's, Grupo Lala, Dole Food Company, Bonduelle, Cargill, Sysco Corporation, Walmart de Mexico y Centroamerica, Grupo Herdez, Agrosuper, Naturipe Farms, The Wonderful Company, Chiquita Brands International contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain fruits and vegetables market in Mexico appears promising, driven by technological advancements and increasing consumer awareness of food safety. The integration of IoT technologies is expected to enhance supply chain efficiency, allowing for real-time monitoring of temperature and humidity levels. Additionally, as sustainability becomes a priority, companies are likely to adopt eco-friendly practices, further aligning with consumer preferences and regulatory requirements, thus fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Fruits Fresh Vegetables Processed Fruits Processed Vegetables Organic Produce Frozen Fruits & Vegetables Others |

| By End-User | Retail Chains Food Service Providers Exporters Wholesalers Direct Consumers Others |

| By Distribution Channel | Direct Sales Online Sales Supermarkets and Hypermarkets Specialty Stores Farmers' Markets Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-friendly Packaging Modified Atmosphere Packaging Others |

| By Storage Type | Refrigerated Storage Frozen Storage Controlled Atmosphere Storage Others |

| By Transportation Mode | Road Transport Rail Transport Air Transport Sea Transport Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facilities | 100 | Operations Managers, Facility Supervisors |

| Fresh Produce Distributors | 80 | Supply Chain Managers, Sales Directors |

| Agricultural Cooperatives | 70 | Farm Managers, Cooperative Leaders |

| Retail Sector Cold Chain Operations | 90 | Logistics Coordinators, Store Managers |

| Transport Service Providers | 60 | Fleet Managers, Business Development Executives |

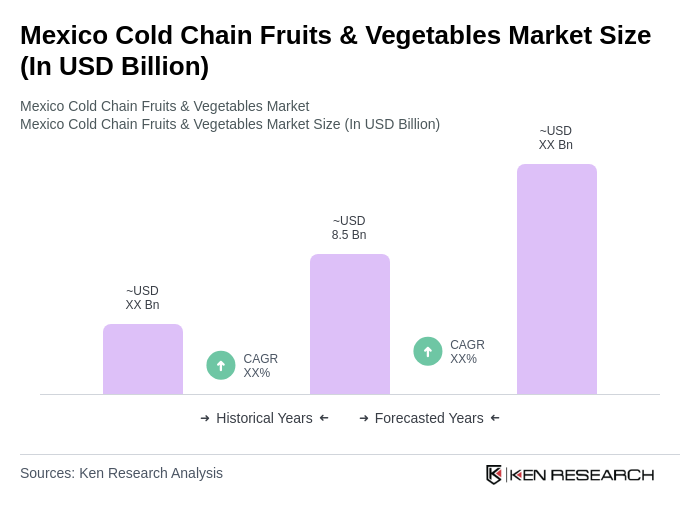

The Mexico Cold Chain Fruits & Vegetables Market is valued at approximately USD 8.5 billion, reflecting significant growth driven by increasing demand for fresh produce, advancements in cold chain logistics, and a rising consumer preference for organic and healthy food options.