Region:Central and South America

Author(s):Shubham

Product Code:KRAB1116

Pages:89

Published On:October 2025

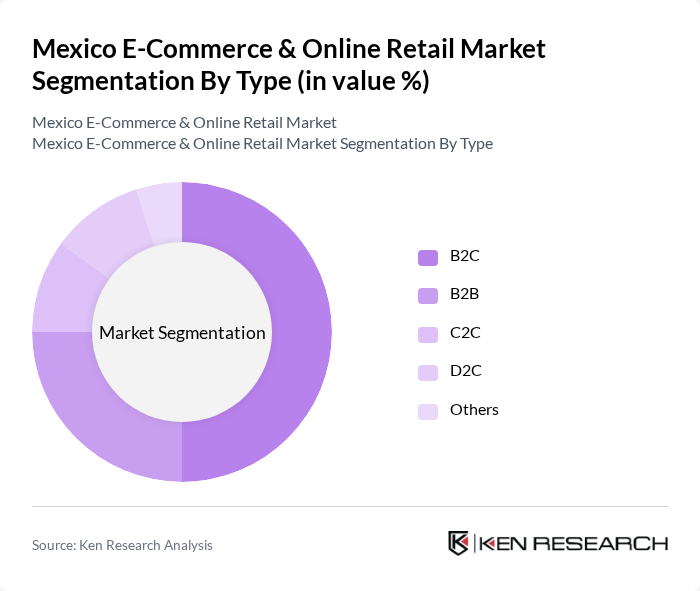

By Type:

TheB2C segmentis the dominant force in the market, driven by the increasing number of consumers shopping online for convenience and variety. The rise of mobile commerce has contributed significantly, as consumers prefer to shop via their smartphones. The availability of diverse product categories—especially food and beverage, fashion, and electronics—and competitive pricing has made B2C platforms highly attractive to consumers, leading to a substantial market share .

By Sales Channel:

Online marketplacesare the leading sales channel, accounting for a significant portion of the market. Their popularity is driven by the vast selection of products, competitive pricing, and the convenience of shopping from multiple vendors in one place. The trust established by well-known platforms such as Mercado Libre and Amazon México further encourages consumers to make purchases, solidifying the dominance of this channel .

The Mexico E-Commerce & Online Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon México, Mercado Libre, Walmart de México y Centroamérica, Linio México, Coppel, Liverpool, Sears México, Elektra, Bodega Aurrera, OXXO, Sanborns, Farmacias Similares, Chedraui, Grupo Bimbo, GAIA Design contribute to innovation, geographic expansion, and service delivery in this space.

The future of Mexico's e-commerce market appears promising, driven by technological advancements and changing consumer behaviors. As internet penetration continues to rise, more consumers are expected to engage in online shopping, particularly through mobile devices. Additionally, the integration of artificial intelligence and big data analytics will enhance personalized shopping experiences. However, businesses must address logistical challenges and cybersecurity threats to maintain consumer trust and capitalize on the growing market potential effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | B2C B2B C2C D2C Others |

| By Sales Channel | Online Marketplaces Brand Websites Social Commerce Platforms Mobile Apps Others |

| By Product Category | Beauty and Personal Care Consumer Electronics Fashion and Apparel Food and Beverage (Incl. Grocery and Alcohol) Furniture and Home Décor Toys, Baby and DIY Books, Music and Stationery Auto-parts and Industrial Tools Others |

| By Payment Method | Credit/Debit Cards Digital Wallets (PayPal, Mercado Pago, Apple Pay) Cash Vouchers (OXXO, 7-Eleven) Bank Transfer (SPEI) Buy Now Pay Later (Kueski Pay, Aplazo) Others |

| By Consumer Demographics | Age Groups Income Levels Urban vs Rural Gender Others |

| By Delivery Method | Standard Shipping Express Delivery Click and Collect Same-Day Delivery Others |

| By Customer Loyalty Programs | Membership Programs Reward Points Subscription Services Referral Discounts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer E-commerce Behavior | 150 | Online Shoppers, Frequent Buyers |

| SME Online Retail Strategies | 100 | Business Owners, Marketing Managers |

| Logistics and Fulfillment Insights | 80 | Logistics Managers, Supply Chain Analysts |

| Payment Processing Preferences | 70 | Finance Managers, Payment Solution Providers |

| Consumer Trust and Security Concerns | 90 | Cybersecurity Experts, Consumer Advocacy Groups |

The Mexico E-Commerce & Online Retail Market is valued at approximately USD 47 billion, driven by increased internet penetration, mobile device usage, and a shift in consumer behavior towards online shopping.